Home >Technology peripherals >It Industry >Shuidi's Q2 revenue in 2023 increased by 12% quarter-on-quarter, making profits for 6 consecutive quarters

Shuidi's Q2 revenue in 2023 increased by 12% quarter-on-quarter, making profits for 6 consecutive quarters

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2023-09-15 11:13:011404browse

According to news from this site on September 7, Shuidi Company today announced its unaudited second quarter performance report for 2023 as of June 30, 2023.

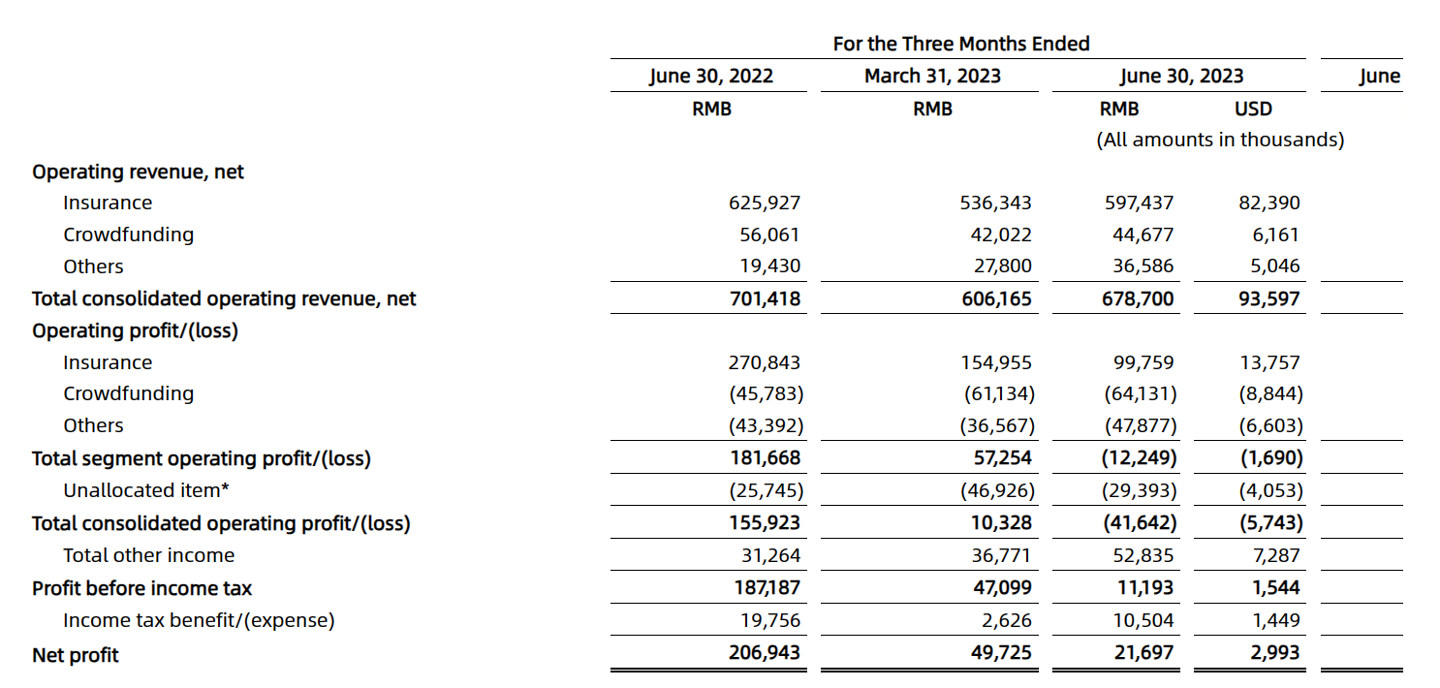

In the second quarter of 2023, Shuidi's net operating income was 679 million yuan, an increase of 12% compared with the previous quarter; net profit was 21.7 million yuan, achieving profitability for 6 consecutive quarters.

The performance report shows that in the second quarter of 2023, Shuidibao, the Internet insurance platform owned by Shuidi Company, generated first-year premiums of 2.197 billion yuan, an increase of 29.8% compared with the previous quarter. As of June 30, 2023, the Shuidi platform provided 1,050 insurance products to customers, an increase of 174 in a single quarter, and critical illness insurance products accounted for 21.8% of the first-year scale premiums generated. In the second quarter, Shuidi Company’s insurance-related income was 597 million yuan, accounting for 87.9%.

The service fee income of Shuidichiu business in the second quarter was approximately 44.68 million yuan, and the operating loss of this business was approximately 64.13 million yuan. As of June 30, 2023, a total of approximately 439 million users of Shuidichi have donated 60.1 billion yuan to more than 2.95 million patients since its launch.

It is worth noting that Shuidi Company’s new business, Yifan Pharmaceuticals, achieved revenue of 29.4 million yuan in the second quarter of 2023,compared to 11 million yuan in the same period of 2022, an increase of more than 167%. In the second quarter, Yifan Pharmaceuticals collaborated with 132 pharmaceutical companies and CROs, successfully recruited more than 900 patients and signed 80 new clinical trial projects.

The above is the detailed content of Shuidi's Q2 revenue in 2023 increased by 12% quarter-on-quarter, making profits for 6 consecutive quarters. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Meng Wanzhou talks about taking office as rotating chairman: Huawei is a collective leadership, not an individual succession

- Hydrogen production and separator development trends under the global hydrogen energy arms race

- Counterpoint Research: 2022 is a milestone year for the global eSIM ecosystem, with more than 260 operators supporting eSIM

- Google sued by publishers in UK for £3.4 billion

- Making mobile phones like making cars: Meizu has changed! Finally taking off?