Home >Technology peripherals >It Industry >XGIMI DLP projection brand is far ahead, firmly holding half of the market

XGIMI DLP projection brand is far ahead, firmly holding half of the market

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2023-08-10 23:45:01909browse

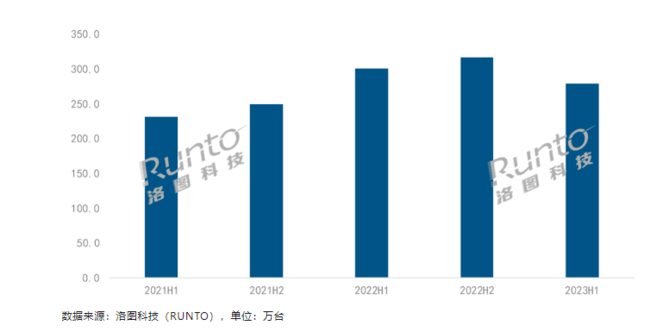

According to the latest data released by Luotu Technology, China’s smart projection market experienced a stall in the first half of this year. Sales and sales of various categories declined, and smart projectors were not immune. Specific data shows that in the first half of 2023, China's smart projection (excluding laser TV) market sales were 2.791 million units, a year-on-year decrease of 7.3%, and sales were 5.3 billion yuan, a year-on-year decrease of 15.4%.

Cause the smart projection market There are two main reasons for the "fall in both volume and volume". First of all, the macroeconomic recovery is weak and the endogenous growth momentum is insufficient. At the same time, there is a time lag in the transmission of economic recovery to corporate performance, residents' income and market confidence, resulting in the growth of service and contact demand in the consumer market, but home appliances and consumer electronics category purchasing power is weak. Secondly, after rapid growth in the past few years, the smart projection market is facing a sluggish environment this year and has begun to enter a consolidation stage. At the same time, the fading of e-commerce dividends and marketing fatigue have also weakened consumers' desire to buy

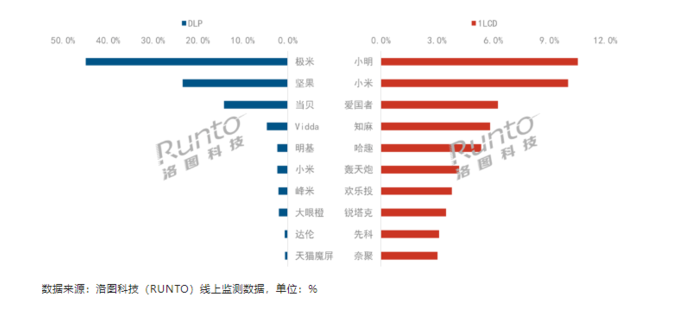

According to the author’s understanding, the brand pattern of the smart projector market was relatively stable in the first half of the year. Among brands that focus on DLP projection technology, Jimi has an absolute advantage, with a market share of nearly 50%, followed by Nuts and Dangbei. In addition, Vidda, which joined the smart projection industry early last year, ranked fourth. However, competition among 1LCD projection technology brands is more intense. 32.6% of the 96 new brands are concentrated in TOP4 brands, including Xiaoming, Xiaomi, Patriot and Zhima, an increase of 4.1 percentage points compared to the same period last year. , but no brand has a share of more than 10%

Luotu Technology predicts that under the circumstances of slowdown in the growth of the smart projection market, the sales volume of smart projections in 2023 is expected to be will drop 5.3%. In order to overcome this dilemma, in addition to increasing efforts on the product side, it is also necessary to expand on the market side. In the past few years, the development of the smart projection market has mainly relied on the rapid growth of user demand in first- and second-tier cities. However, as market demand becomes saturated, shifting focus to lower-tier markets may be the way to resume growth

INTELLIGENCE The projection industry is going through its own "structural adjustment period" and competition among brands will further intensify in the future. Subsequent brands have the opportunity to stand out from the competition by launching cost-effective products and expanding into the market

The above is the detailed content of XGIMI DLP projection brand is far ahead, firmly holding half of the market. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Meng Wanzhou talks about taking office as rotating chairman: Huawei is a collective leadership, not an individual succession

- Hydrogen production and separator development trends under the global hydrogen energy arms race

- Counterpoint Research: 2022 is a milestone year for the global eSIM ecosystem, with more than 260 operators supporting eSIM

- Google sued by publishers in UK for £3.4 billion

- Making mobile phones like making cars: Meizu has changed! Finally taking off?