Home > Article > Technology peripherals > ChatGPT boss throws money to rescue companies: One million dollars to help companies victimized by Silicon Valley Bank, no IOUs or commitments, pay back when you can

ChatGPT boss throws money to rescue companies: One million dollars to help companies victimized by Silicon Valley Bank, no IOUs or commitments, pay back when you can

- WBOYforward

- 2023-04-12 16:07:03674browse

This article is reprinted with the authorization of AI New Media Qubit (public account ID: QbitAI). Please contact the source for reprinting.

Technology companies affected by the collapse of Silicon Valley Bank can breathe a little easier.

On the one hand, wealthy people in the technology industry have stepped in to help:

Sam Altman, CEO of OpenAI, the company behind ChatGPT, was exposed that he had already paid employees who were unable to pay wages to Silicon Valley Bank. company, providing financial assistance totaling more than $1 million.

And they didn’t ask for any IOUs or documents. They just said, “You can pay me back when you have money.”

On the other hand, U.S. regulators are determined to take the bottom line.

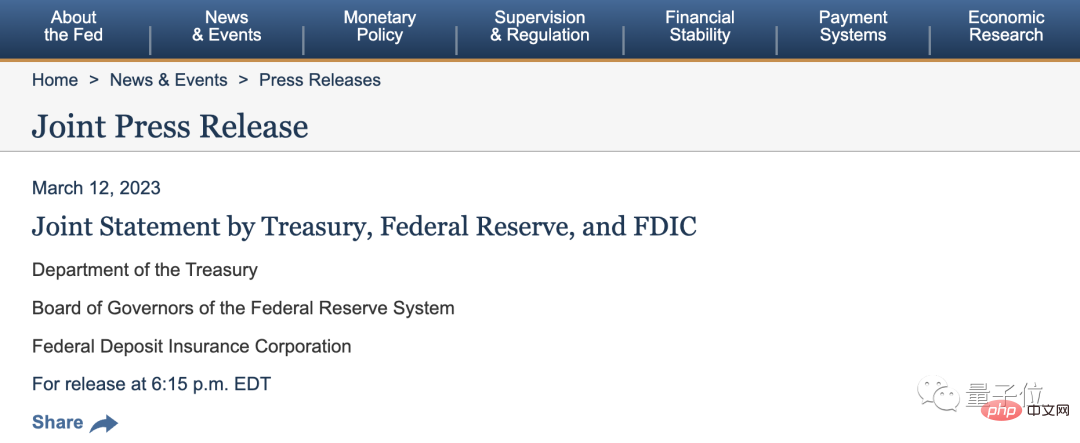

According to a joint statement issued by the U.S. Department of the Treasury, the Federal Reserve (Fed), and the Federal Deposit Insurance Corporation (FDIC), Silicon Valley Bank depositors "will be able to withdraw all funds starting on Monday, March 13."

However, "any losses related to resolving Silicon Valley Bank's problems will not be borne by taxpayers."

The boss comes to the rescue, the Fed steps in to wipe the butt

The CEO of the AI start-up Rad AI revealed that the boss of ChatGPT reached out to help To Reuters.

The CEO named Doktor Gurson claimed that he was not familiar with Altman-

Sam Altman was not an investor in this start-up. Gurson only met Altman once when he attended a Y Combinator event in 2014.

The reason why he asked Altman for help was a bit like seeking medical treatment in a hurry:

The company's money in the Silicon Valley bank account kept failing to be transferred out, and employees' wages were about to be unable to be paid. . At this time, Gurson saw Altman's tweet. The latter used his Twitter account to call on investors to help affected technology companies as soon as possible.

△Photo source: Tony Webster

He sent Altman an email. Unexpectedly, it only took 1-2 hours for the CEO of OpenAI to reply to the letter asking for help and promised to provide at least 6 figures of emergency funds, "without making any other requests."

Gurson conservatively estimates that Altman has spent more than $1 million to assist entrepreneurs like him.

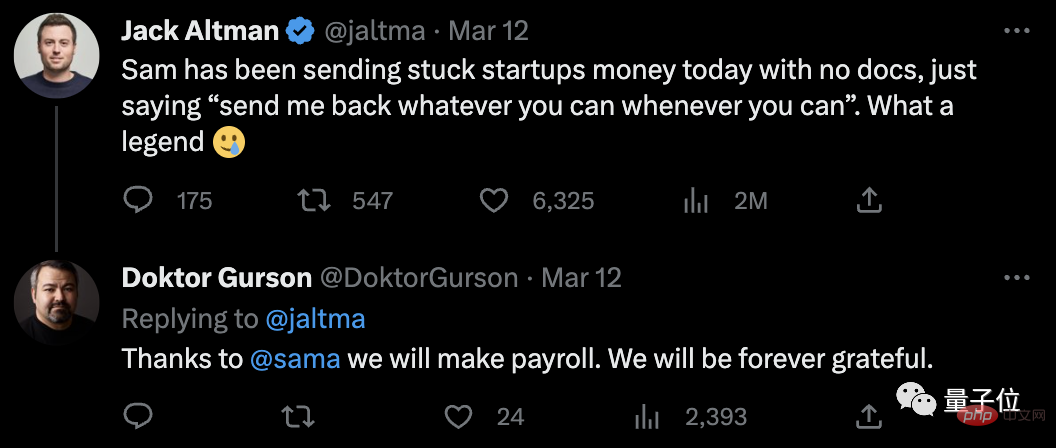

Sam Altman’s brother Jack Altman also confirmed the incident on Twitter.

Sam had been sending money to struggling startups without asking for any documentation, telling them to "pay me back when you have the money." Simply a legend.

In addition, according to Reuters, Y Combinator also invited 3500 CEOs and founders to co-sign a petition calling on U.S. Treasury Secretary Janet Yellen and others support Silicon Valley Bank depositors.

The latest news today is that the U.S. Treasury Department and the Federal Reserve are planning to launch an emergency loan program to support depositors’ withdrawal requests.

The original text of the joint statement from the U.S. Treasury Department, the Federal Reserve and the FDIC reads:

Starting Monday, March 13, Silicon Valley Bank depositors can withdraw all funds in their accounts, and resolve Any losses related to Silicon Valley Bank’s problems will not be borne by taxpayers.

…

Finally, the Federal Reserve Board announced on Sunday that it will provide additional funding to eligible depository institutions to ensure that banks have the ability to meet the needs of all depositors.

It is worth mentioning that the statement mentioned that Signature Bank in New York was also closed due to "systemic risks."

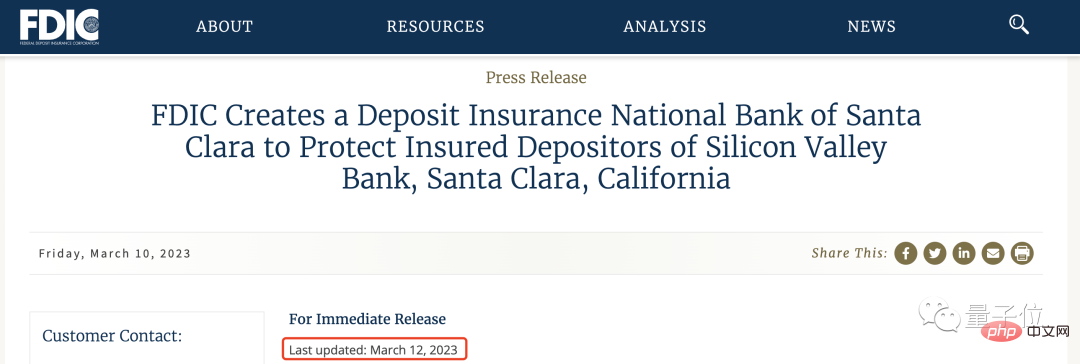

The FDIC’s takeover statement has also been updated. Previously, the FDIC mentioned that "depositors will have access to insured deposits on March 13," but the FDIC's insurance limit was only $250,000.

Now, a new line has been added to the statement: Customers with accounts over $250,000 should call the FDIC’s toll-free number.

#Rad AI CEO believes that this news has given Silicon Valley a "collective sigh of relief."

"Honestly, this weekend took years off my life."

And Sam Altman also updated his Twitter:

Now, first priority Already solved. We need more regulation of banks.

One More Thing

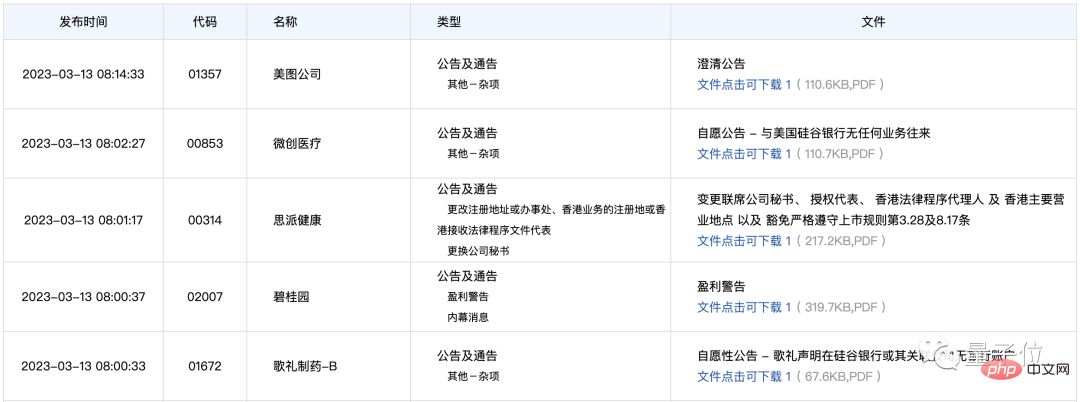

The impact of the collapse of Silicon Valley Bank has not yet subsided.

Before the market opened on March 13, many A-share and Hong Kong-listed companies issued voluntary announcements stating their business dealings with Silicon Valley Bank.

Reference link:

[1]https://www.php.cn/link/3817157c9127b4cdb7a8d690ee72d874

[2]https://www.php.cn/link/0a118184382a407bba7aef472932273e

[3]https: //www.php.cn/link/1977ab8c9f9473d8594671be4ddf9e7f

The above is the detailed content of ChatGPT boss throws money to rescue companies: One million dollars to help companies victimized by Silicon Valley Bank, no IOUs or commitments, pay back when you can. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Technology trends to watch in 2023

- How Artificial Intelligence is Bringing New Everyday Work to Data Center Teams

- Can artificial intelligence or automation solve the problem of low energy efficiency in buildings?

- OpenAI co-founder interviewed by Huang Renxun: GPT-4’s reasoning capabilities have not yet reached expectations

- Microsoft's Bing surpasses Google in search traffic thanks to OpenAI technology