Bitcoin halving will affect its future development, mainly in the following ways: pushing up the price, which reduces the supply of new Bitcoin and increases demand. Potentially lower hash rates, but this could be offset by higher Bitcoin prices. Strengthen Bitcoin’s value proposition and stimulate innovation. Provide investors with profit opportunities, but be aware of investment risks. Future impacts are uncertain, but could lead to increased scarcity, acceptance, and innovation in Bitcoin.

The impact of Bitcoin halving on the future

Bitcoin halving refers to the change of Bitcoin block rewards every four years An event that is halved once. This aims to control the supply of Bitcoin, making it more scarce. The halving will have a significant impact on the future development of Bitcoin.

Impact on Price

Historically, halvings have been the catalyst for Bitcoin’s price surge. The halving reduces the supply of new Bitcoins, leading to increased demand and pushing up the price. The past three halvings have been associated with significant price increases.

Impact on Hash Rate

Bitcoin’s hash rate, or network computing power, is closely tied to block rewards. After the halving, miners will be rewarded with fewer Bitcoins, potentially causing the hash rate to drop. However, if the price of Bitcoin increases, miners' income may remain stable, thus maintaining the hash rate.

Impact on Business

Having can impact businesses in many ways. It could increase Bitcoin’s value proposition as a store of value asset. Additionally, it could spur innovation as businesses race to develop new Bitcoin use cases and technologies.

Impact on Investors

The halving provides potential profit opportunities for Bitcoin investors. History shows that following halvings, prices tend to rise significantly. However, it is important to remember that investing in Bitcoin involves risks, and investors should only invest money they are willing to lose.

Impact on the future

Long-term predictions of the impact of halving on the future development of Bitcoin are uncertain. What is certain, however, is that it will continue to have a significant impact on prices, hashrate, businesses, and investors. Here are some potential long-term consequences:

- Bitcoin could become more scarce and valuable.

- Bitcoin’s hash rate is likely to remain stable.

- Bitcoin may become a more widely accepted store of value.

- Bitcoin innovation and adoption may accelerate.

The above is the detailed content of What will happen after Bitcoin halving?. For more information, please follow other related articles on the PHP Chinese website!

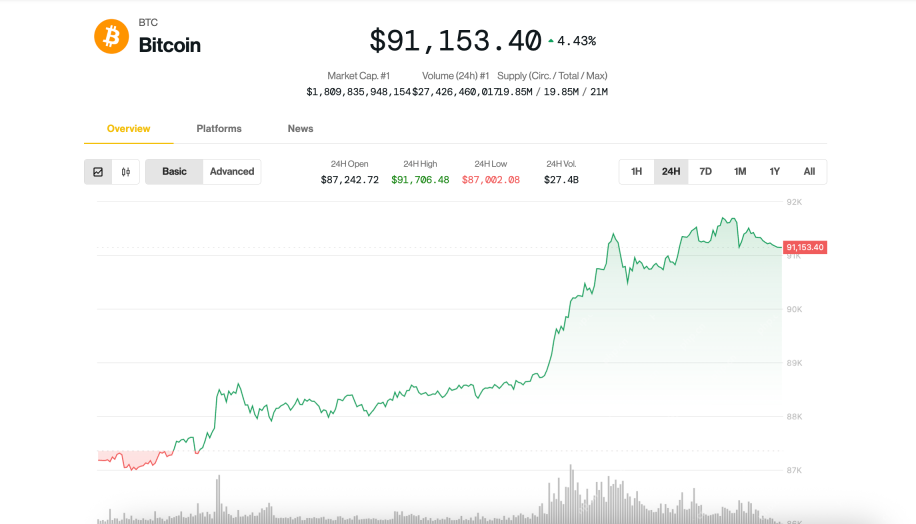

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SublimeText3 Linux new version

SublimeText3 Linux latest version

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

Dreamweaver Mac version

Visual web development tools

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software