web3.0

web3.0 BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume Today

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayBlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume Today

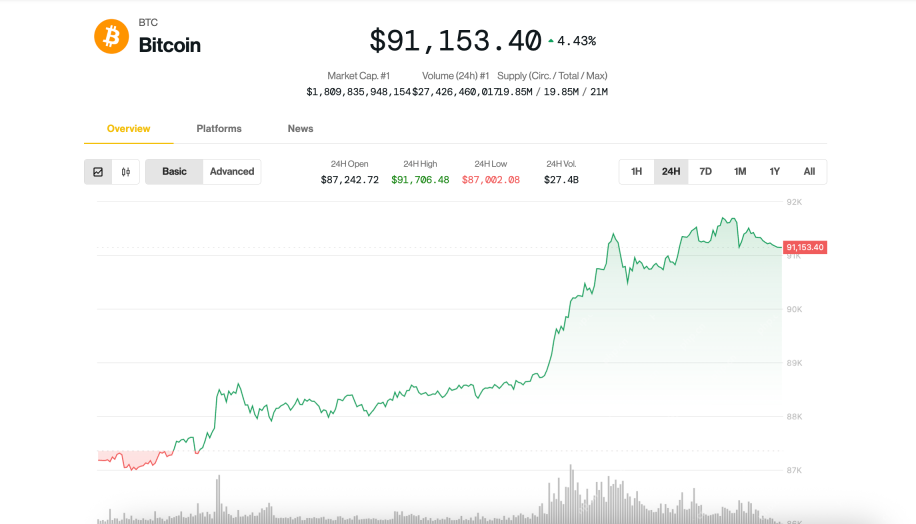

BlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

BlackRock’s spot Bitcoin ETF, IBIT, saw a massive trading volume of $4.2 billion today, as the price of Bitcoin soared above $91,000 for the first time since early March. According to data from Barchart, IBIT exchanged hands in 81,098,938 shares, closing the session at a price of $52.08.

This surge in ETF activity comes on the same day Bitcoin reached $91,739, according to Bitbo. It’s the highest price level since April 8, when Bitcoin hit a low of $75,603. The strong upward momentum signals renewed buying pressure in the market, particularly from institutional investment products like spot ETFs.

Fidelity’s spot Bitcoin ETF, FBTC, also showed significant trading activity, with $425.17 million in volume. Meanwhile, Grayscale’s GBTC posted $250.91 million, Ark Invest’s ETF recorded $170 million, and Bitwise’s fund traded $120 million over the day.

Today's trading volumes ?

$IBIT w/ $4.2 Billion?, $FBTC $425m pic.twitter.com/otcm0GkAuA

Earlier in the day, BlackRock's IBIT also reached an all-time high when measured against the Nasdaq index, a noteworthy milestone indicating the growing strength and investor confidence in the fund and Bitcoin.

Blackrock's Bitcoin ETF (IBIT) just reached an all-time high measured against the Nasdaq pic.twitter.com/5EOh7e8bgJ

High-volume trading days such as this where the price of BTC surges up often reflects strong inflows. However, the official figures for net inflows and outflows for today’s ETF activity will not be available until later this evening as the wealth managers publicize them.

As Bitcoin's price continues to trend upward and ETF products show strong trading volumes, the market is now being shaped not just by investor speculation, but also by fundamental demand from corporate and institutional buyers. The impact of regulated financial products like spot ETFs is being amplified by a growing wave of corporate adoption.

In addition to institutional interest via ETFs, public companies are increasingly turning to Bitcoin as a reserve asset. Michael Saylor's Strategy has continued to aggressively acquire BTC, most recently announcing the purchase of 6,556 more coins. Semler Scientific has also joined the trend, reaching over 1,100 BTC in holdings and recently filing to raise another $500 million to buy more. GameStop is preparing to enter the market as well, having raised $1.5 billion for a Bitcoin treasury strategy dubbed "Project Rocket." These corporate moves are injecting additional demand into the market, further contributing to upward price momentum.

Together, the surge in ETF activity and rising corporate adoption appear to be forming a powerful feedback loop, helping to push Bitcoin's price to new highs. While final inflow data for today's ETF trading will arrive later this evening, the combined impact of institutional buying and balance sheet strategies from publicly traded companies is reinforcing Bitcoin's status as both an investment asset and a long-term store of value.

News data source: kdj.com

The above is the detailed content of BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume Today. For more information, please follow other related articles on the PHP Chinese website!

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SublimeText3 Chinese version

Chinese version, very easy to use

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

Notepad++7.3.1

Easy-to-use and free code editor

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

SublimeText3 Linux new version

SublimeText3 Linux latest version