Software Tutorial

Software Tutorial Mobile Application

Mobile Application How to fill in the special additional deduction declaration for personal income tax in 2024

How to fill in the special additional deduction declaration for personal income tax in 2024How to fill in the special additional deduction declaration for personal income tax in 2024

php Xiaoxin, the editor, how to fill in the information for 2024 in the declaration of special additional deductions for personal income tax? According to the latest regulations, additional special deductions for personal income tax include special deductions for children’s education, medical treatment for serious illnesses, and housing rent. When filling out the declaration form, you need to fill in specific items and amounts, and provide corresponding supporting materials. There are many specific filling methods and precautions. In order to avoid filling errors, it is recommended to understand the relevant regulations in advance and consult a tax professional.

Steps and procedures for reporting special additional deductions for personal income tax

1. Open the personal tax APP, select [Common Business] on the homepage, and then select [Fill in special additional deductions]

2 , The scope of special deduction items: children’s education, continuing education, serious illness medical treatment, housing loan interest, housing rent, support for the elderly, and infant care. According to the relevant policies and regulations of the national tax department, the Personal Income Tax Law determines the scope of the following special deduction items: Children’s education

3. At the bottom of the page, you can select [One-click import] , so that you can fill in last year’s declaration information with one click.

4. Then verify that the information filled in is correct. If there is any information that needs to be modified, the user can also choose to fill in and declare it by himself.

5. Finally, after filling in all the information correctly, click [One-click Declaration] in the upper right corner. Submit for review and wait for the declaration to be completed.

The above is the detailed content of How to fill in the special additional deduction declaration for personal income tax in 2024. For more information, please follow other related articles on the PHP Chinese website!

You Should Try Instagram's New 'Blend' Feature for a Custom Reels FeedApr 23, 2025 am 11:35 AM

You Should Try Instagram's New 'Blend' Feature for a Custom Reels FeedApr 23, 2025 am 11:35 AMInstagram and Spotify now offer personalized "Blend" features to enhance social sharing. Instagram's Blend, accessible only through the mobile app, creates custom daily Reels feeds for individual or group chats. Spotify's Blend mirrors th

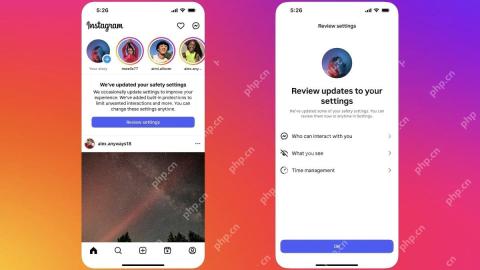

Instagram Is Using AI to Automatically Enroll Minors Into 'Teen Accounts'Apr 23, 2025 am 10:00 AM

Instagram Is Using AI to Automatically Enroll Minors Into 'Teen Accounts'Apr 23, 2025 am 10:00 AMMeta is cracking down on underage Instagram users. Following the introduction of "Teen Accounts" last year, featuring restrictions for users under 18, Meta has expanded these restrictions to Facebook and Messenger, and is now enhancing its

Should I Use an Agent for Taobao?Apr 22, 2025 pm 12:04 PM

Should I Use an Agent for Taobao?Apr 22, 2025 pm 12:04 PMNavigating Taobao: Why a Taobao Agent Like BuckyDrop Is Essential for Global Shoppers The popularity of Taobao, a massive Chinese e-commerce platform, presents a challenge for non-Chinese speakers or those outside China. Language barriers, payment c

How Can I Avoid Buying Fake Products On Taobao?Apr 22, 2025 pm 12:03 PM

How Can I Avoid Buying Fake Products On Taobao?Apr 22, 2025 pm 12:03 PMNavigating the vast marketplace of Taobao requires vigilance against counterfeit goods. This article provides practical tips to help you identify and avoid fake products, ensuring a safe and satisfying shopping experience. Scrutinize Seller Feedbac

How to Buy from Taobao in the US?Apr 22, 2025 pm 12:00 PM

How to Buy from Taobao in the US?Apr 22, 2025 pm 12:00 PMNavigating Taobao: A Guide for US B2B Buyers Taobao, China's massive eCommerce platform, offers US businesses access to a vast selection of products at competitive prices. However, language barriers, payment complexities, and shipping challenges can

5 Recommended Categories of Products for Taobao DropshippingApr 22, 2025 am 11:59 AM

5 Recommended Categories of Products for Taobao DropshippingApr 22, 2025 am 11:59 AMUnlocking Taobao Dropshipping Success: Top Product Categories Selecting the right product categories is crucial for a thriving Taobao dropshipping business. This requires understanding market trends, consumer preferences, and profit potential. Here

Taobao vs. AliExpress: Where Should I Buy My Stuff ?Apr 22, 2025 am 11:58 AM

Taobao vs. AliExpress: Where Should I Buy My Stuff ?Apr 22, 2025 am 11:58 AMTaobao vs. AliExpress: A Comparison for International Shoppers Taobao primarily serves the Chinese domestic market, while AliExpress focuses on international buyers, particularly individuals and small businesses seeking wholesale goods from Chinese s

How to Identify and Verify Reliable Suppliers on TaobaoApr 22, 2025 am 11:57 AM

How to Identify and Verify Reliable Suppliers on TaobaoApr 22, 2025 am 11:57 AMSelecting reliable Taobao suppliers is paramount for your dropshipping success. This guide outlines how to identify trustworthy vendors amidst Taobao's vast marketplace. 1. Mastering Taobao's Supplier Evaluation System Taobao's rating system uses th

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

Dreamweaver Mac version

Visual web development tools

SublimeText3 English version

Recommended: Win version, supports code prompts!

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

WebStorm Mac version

Useful JavaScript development tools