web3.0

web3.0 Keep buying, buying, buying, how many Bitcoins do U.S. listed companies and fund giants hold?

Keep buying, buying, buying, how many Bitcoins do U.S. listed companies and fund giants hold?Keep buying, buying, buying, how many Bitcoins do U.S. listed companies and fund giants hold?

Original author: Ana Paula Pereira, Sander Lutz

Original compilation: Moni, Odaily Planet Daily

Nasdaq-listed BlackRock IBIT has reached an important milestone 40 trading days after listing its spot Bitcoin ETF. The number of Bitcoins it holds already exceeds the Bitcoin holdings of Michael Saylor’s publicly traded company MicroStrategy. This achievement marks BlackRock IBIT’s strong performance in the cryptocurrency market and demonstrates its success in the field of digital asset investment. As Bitcoin holdings increase, BlackRock IBIT’s influence and status in the digital currency field is also increasing, attracting the attention of more investors

Data shows that as of March 8 , IBIT holds a total of approximately 195,985 BTC (as shown below), with a market value of more than 13.579 billion US dollars, while MicroStrategy’s Bitcoin holdings are approximately 193,000 BTC, and on the same day, Bitcoin exceeded US$70,000 for the first time in history.

In addition, spot Bitcoin ETFs have also reached a cumulative trading volume of more than $100 billion in less than two months. According to the latest data released by Yahoo Finance on March 10, as of March 8, the cumulative transaction volume of spot Bitcoin has reached 106.59 billion US dollars.

In fact, unknowingly, a battle for Bitcoin reserves has begun among U.S. listed companies.

U.S. listed companies/funds’ Bitcoin reserves have become a “three-headed force”?

As the price of Bitcoin reaches a record high, US stock listed companies/funds are also accelerating their accumulation of Bitcoin. They are "eating" Bitcoin faster than Bitcoin is mined. According to the current market trend, US listed companies have formed a "three-headed" trend, and these "three heads" are: spot Bitcoin ETF, MicroStrategy, and Tesla (and SpaceX).

First of all, let’s take a look at the spot Bitcoin ETFs listed on the US stock market. According to data compiled by BitMEX Research, in addition to Grayscale’s GBTC, the remaining nine spot Bitcoin ETFs are The ETF has been adding to its Bitcoin reserves since it received approval from the U.S. Securities and Exchange Commission to go public on January 11.

MicroStrategy, another US-listed company, can now be regarded as a "veteran" in the Bitcoin market, and every time it adds Bitcoin, it always has the right timing.

Just three days before Bitcoin exceeded $70,000 for the first time on March 8, MicroStrategy "suddenly" issued an announcement announcing plans to sell principal to qualified institutional buyers through private placements based on market conditions and other factors. A total of US$600 million of convertible senior notes due in 2030. One day later, they announced that they planned to expand the issuance of convertible senior notes to US$700 million.

At least for now, MicroStrategy’s investment strategy seems to be successful. Since August 2020, the value of Bitcoin held by MicroStrategy has increased several times, bringing generous returns to the company’s shareholders. It is reported that MicroStrategy Chairman Michael Saylor, MicroStrategy's largest investor, owns about 12% of the company's shares, has increased his personal wealth by about $700 million after consecutive gains in his company's stock and Bitcoin prices. He also revealed that he personally owned 17,732 Bitcoins in 2020, so his holdings and positions climbed to $2.96 billion from $2.27 billion at the beginning of the week.

Finally, compared to the "high-profile" spot Bitcoin ETF and MicroStrategy, Elon Musk's Tesla and SpaceX seem to be much lower-key, although no relevant data was disclosed in the recent financial report (Note: Tesla and SpaceX have not yet disclosed (Announcement of financial report for the first quarter of 2024), but according to on-chain data analysis platform Arkham monitoring, Tesla currently holds approximately 11,510 BTC (worth approximately US$780 million) in 68 addresses, and SpaceX holds approximately 8,290 BTC in 28 addresses. BTC (worth approximately $560 million), which means Tesla currently holds approximately 1,789 BTC more than the 9,720 BTC balance reported in its last financial report.

The crypto community has speculated that Tesla has started buying back Bitcoin or whether the recent change in numbers is due to an accounting error, with some users suggesting that the company may have started buying Bitcoin after its last earnings call and New purchase information may be reported on the next financial conference call.

Why do we need to pay attention to the Bitcoin reserves of listed companies/funds?

Listed companies/funds are important participants in the market economy, and their investment behavior often has benchmark significance. The holding of Bitcoin by listed companies shows that they are optimistic about the future value of Bitcoin, which may attract more investors to pay attention to Bitcoin, thereby driving up the price of Bitcoin.

Not only that, listed companies/funds holding Bitcoin can also increase the market circulation of Bitcoin and make it easier to trade, which is beneficial to the development of the Bitcoin market and can even demonstrate its support for new technologies. open attitude and enhance the company's image.

Market analysts believe that, driven by listed companies/funds increasing their Bitcoin reserves, more crypto whales may be "stimulated" to enter the market. For example, shortly after MicroStrategy announced that it would continue to purchase Bitcoin. , HODL15Capital noticed the buying action of a mysterious whale. After recently adding positions frequently, this address now holds a total of approximately 51,064 BTC, worth approximately US$3.5 billion.

From this perspective, the investment strategies of listed companies/funds also demonstrate their confidence in the long-term value of Bitcoin, which may encourage other crypto whales to continue to hold or increase their holdings of Bitcoin, plus The successful investments in spot Bitcoin ETFs, MicroStrategy, and Tesla may attract other crypto whales to follow suit and may also lead to further increases in the price of Bitcoin.

Of course, Bitcoin is still an emerging asset class and the regulatory environment is not yet complete. Investors need to pay attention to the impact of regulatory policy changes on the Bitcoin reserves of listed companies. Overall, paying attention to the Bitcoin reserves of listed companies/funds can help us understand important information such as market trends, investment risks, company financial conditions and regulatory environment, thereby allowing ordinary investors to make more informed investment decisions.

The above is the detailed content of Keep buying, buying, buying, how many Bitcoins do U.S. listed companies and fund giants hold?. For more information, please follow other related articles on the PHP Chinese website!

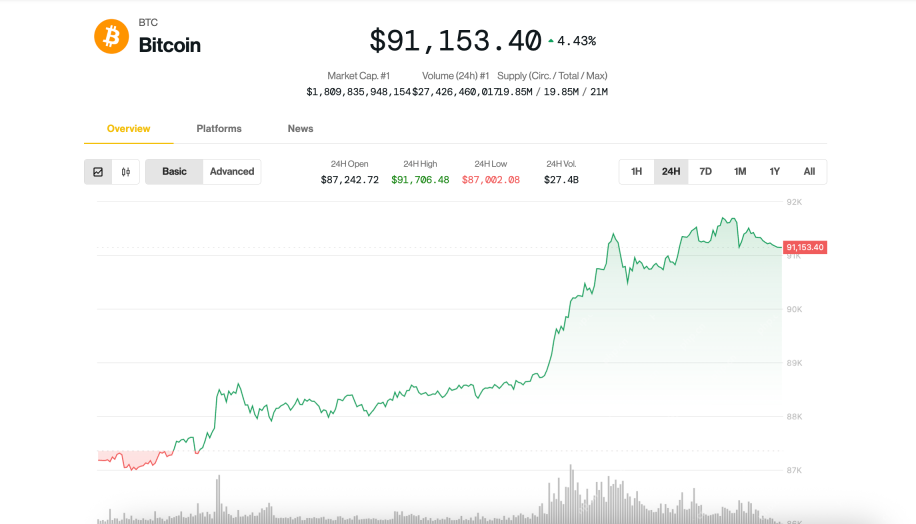

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

SublimeText3 English version

Recommended: Win version, supports code prompts!