web3.0

web3.0 Excerpt: Detailed explanation of how to buy and sell Bitcoin contracts and how to play them

Excerpt: Detailed explanation of how to buy and sell Bitcoin contracts and how to play themExcerpt: Detailed explanation of how to buy and sell Bitcoin contracts and how to play them

php editor Zimo brings you a detailed tutorial on Bitcoin contracts. Bitcoin contracts are a type of financial derivative that can be bought and sold through trading platforms. Unlike actual Bitcoin, trading in Bitcoin contracts does not require actual holding of Bitcoins, but rather earns the price difference through the price fluctuations of the contract. There is no time limit for the purchase and sale of Bitcoin contracts, and transactions can be conducted at any time. In this article, we will introduce you to the gameplay and transaction process of Bitcoin contracts to help you better understand and utilize Bitcoin contracts. Let’s explore together!

Can Bitcoin contracts be bought and sold at any time?

Bitcoin contract is a financial derivative in the Bitcoin market, which can be bought and sold at any time. Taking Eureka Exchange as an example, it provides a detailed tutorial on how to play Bitcoin contracts.

1. Open the official website of OKX Exchange (click here to register), enter your email address on the home page, and click "Register"

2. Swipe right Slide the slider to complete the puzzle for verification, then enter the verification code received by email. The verification code is valid for 10 minutes

3. Then enter your mobile phone number and click "Verify Now" ”

#4. Enter the six-digit verification code received on your mobile phone, which is also valid for 10 minutes

5. Select your country/region of residence, check the Terms of Service, "Risk and Compliance Disclosure" and Privacy Policy and Statement

#6. When creating a password, the length must be 8- 32 characters, 1 lowercase letter, 1 uppercase letter, 1 number, 1 symbol, such as: !@ # $ % and other conditions

7. Log in account Afterwards, find the "User Center" icon on the homepage and enter the identity authentication page

8. Different levels of authentication can be carried out according to different needs (note: video authentication needs to be done on the APP Operation)

#9. After completing the identity authentication, you can proceed with the transaction and find "Buy Coin" on the homepage - "C2C Buy Coin"

10. Select the "Purchase" option, pay attention to select the purchase currency, and click "All Payment Methods" to filter the payment method

11. Select After entering the merchant, operate according to the merchant's message, then enter the purchase amount, click "Buy USDT" to pay and wait for the merchant to release the currency (if you do not receive the currency after payment, you can click on the page for help after negotiating with the merchant to no avail> Others>Get help>Initiate a complaint)

12. If you want to conduct contract transactions, you need to open the account mode and set it to single-currency margin mode or cross-currency A margin model.

13. You can continue to set up the contract, personalize the trading unit and order mode.

#14. You can customize the trading mode and Kanban mode. Select the professional layout here.

15. The delivery contract is divided into USDT margin delivery contract and currency-margin delivery contract. Here we take the coin-margin weekly delivery contract as an example.

First transfer our digital assets from the capital account to the trading account. If it has been completed, no additional transfer operation is required.

16. On the trading page, click the drop-down button on the right side of the currency pair, enter the currency in the search box, select delivery in the margin trading area, and select the contract period as the current week, Coin-margined/U-margined contracts for the next week, current quarter or second quarter. Here we take the current quarter currency-based contract as an example

Is there a time limit for buying and selling Bitcoin contracts?

There are time limits for Bitcoin contract sales, but the time limits are different for different contract types. Currently, there are three main types: futures, options and CFDs. The following is a detailed introduction:

1. Futures Contract: Bitcoin futures contracts typically have a specified expiration date. The expiration date is the date when the contract ends and the trader holding the contract is required to deliver or receive the corresponding Bitcoins. The expiration date is usually a specific date in the future, such as the third Friday of each quarter.

2. Options contracts: Bitcoin options contracts usually have a specified expiration date. The expiration date is the date until which the contract is valid and the trader holding the contract must decide whether to exercise the option. The expiration date can be either a European-style option (which can only be exercised on the expiration date) or an American-style option (which can be exercised any time before the expiration date).

3. Contract for Difference (CFD): Bitcoin CFD usually does not have a clear expiration date. This means you can hold the contract for as long as you want. The opening and closing of CFD positions can be carried out according to the trader's decision, so the holding time can be controlled by the trader himself.

The above is the detailed content of Excerpt: Detailed explanation of how to buy and sell Bitcoin contracts and how to play them. For more information, please follow other related articles on the PHP Chinese website!

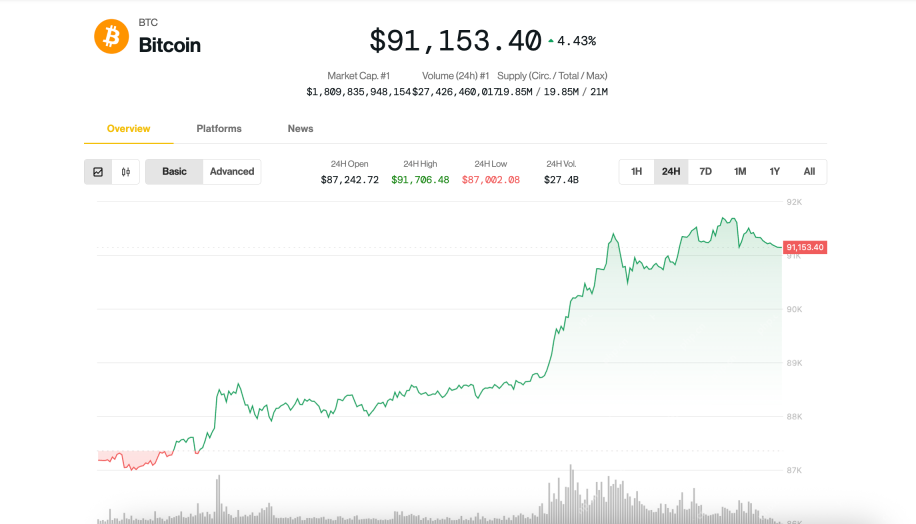

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Zend Studio 13.0.1

Powerful PHP integrated development environment

SublimeText3 Chinese version

Chinese version, very easy to use

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

SublimeText3 Mac version

God-level code editing software (SublimeText3)