Technology peripherals

Technology peripherals It Industry

It Industry Buffett reduces his holdings in BYD again, with shareholding falling to 7.98%

Buffett reduces his holdings in BYD again, with shareholding falling to 7.98%Buffett reduces his holdings in BYD again, with shareholding falling to 7.98%

News from this site on November 1. According to Hong Kong Stock Exchange documents, on October 25, Buffett’s Berkshire Hathaway completed the sale of 820,500 BYD H shares at an average price of HK$245.86 per share. The shareholding ratio dropped from 8.05% to 7.98%.

This site noticed that Berkshire Hathaway cashed out approximately HK$201.7 million this time. Currently, Berkshire Hathaway holds a total of 87.6131 million shares of BYD. According to the Hong Kong Stock Exchange's disclosure regulations, disclosure is only required when a major shareholder's increase or decrease in stock holdings exceeds a certain integer percentage.

According to statistics from the official website of the Hong Kong Stock Exchange, Berkshire Hathaway, which has held BYD shares for more than ten years, has initiated 13 consecutive reductions since it first reduced its holdings on August 24, 2022. As for holding BYD H shares, the shareholding ratio has dropped from 19.92% on August 24, 2022 to less than 8% today.

On October 30, BYD announced that in the third quarter, it achieved revenue of 162.151 billion yuan, a year-on-year increase of 38.49%; the net profit attributable to shareholders of listed companies in the third quarter was 10.413 billion yuan, a year-on-year increase of 82.16%.

Advertising statement: The external jump links (including but not limited to hyperlinks, QR codes, passwords, etc.) contained in the article are used to convey more information and save selection time. The results are for reference only. All articles on the site contain this statement.

The above is the detailed content of Buffett reduces his holdings in BYD again, with shareholding falling to 7.98%. For more information, please follow other related articles on the PHP Chinese website!

Serverless Image Processing Pipeline with AWS ECS and LambdaApr 18, 2025 am 08:28 AM

Serverless Image Processing Pipeline with AWS ECS and LambdaApr 18, 2025 am 08:28 AMThis tutorial guides you through building a serverless image processing pipeline using AWS services. We'll create a Next.js frontend deployed on an ECS Fargate cluster, interacting with an API Gateway, Lambda functions, S3 buckets, and DynamoDB. Th

CNCF Arm64 Pilot: Impact and InsightsApr 15, 2025 am 08:27 AM

CNCF Arm64 Pilot: Impact and InsightsApr 15, 2025 am 08:27 AMThis pilot program, a collaboration between the CNCF (Cloud Native Computing Foundation), Ampere Computing, Equinix Metal, and Actuated, streamlines arm64 CI/CD for CNCF GitHub projects. The initiative addresses security concerns and performance lim

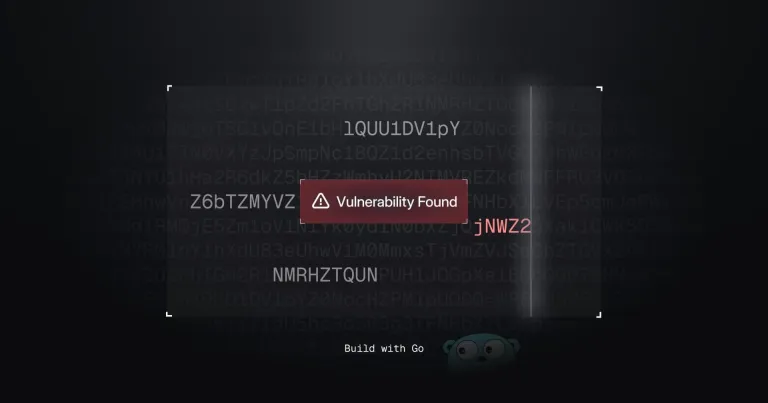

Building a Network Vulnerability Scanner with GoApr 01, 2025 am 08:27 AM

Building a Network Vulnerability Scanner with GoApr 01, 2025 am 08:27 AMThis Go-based network vulnerability scanner efficiently identifies potential security weaknesses. It leverages Go's concurrency features for speed and includes service detection and vulnerability matching. Let's explore its capabilities and ethical

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SublimeText3 English version

Recommended: Win version, supports code prompts!

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

SublimeText3 Mac version

God-level code editing software (SublimeText3)

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

Atom editor mac version download

The most popular open source editor