Home >Technology peripherals >AI >Apple MR will be released soon, taking stock of the VR industry chain

Apple MR will be released soon, taking stock of the VR industry chain

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2023-05-30 22:02:021244browse

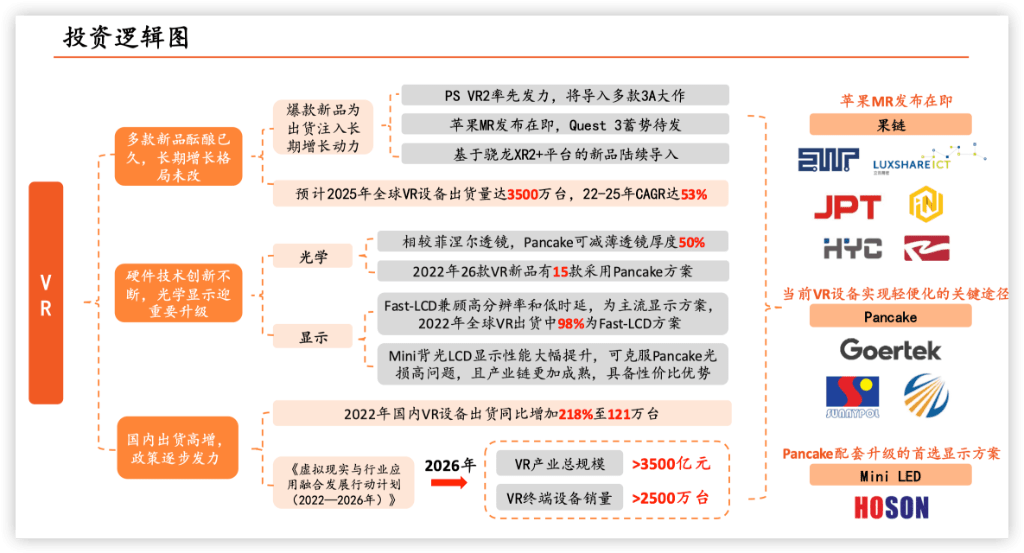

After experiencing a decline in shipments in 2022, the VR industry has finally ushered in a rare prosperity. At the WWDC conference in a week, Apple will release a blockbuster new MR headset that has been developed for seven years; just recently, the veteran giant Meta of the Metaverse has also frequently released news about its new product Quest3.

In a report released on May 26, Ping An Securities analyst Xu Yong and others pointed out that the release of a number of long-awaited new products will inject long-term growth momentum into VR equipment shipments. In the report, analysts conducted a detailed review of the entire VR industry chain.

The VR industry is in the recovery stage Meta and Pico dominate the foreign and domestic markets respectively

First of all, analysts pointed out that there are currently three categories of virtual (augmented) reality technology to which VR belongs:

1) Virtual Reality (VR) refers to computer-generated simulation of the real environment, allowing users to obtain an immersive experience;

2) Augmented Reality (AR) refers to the incorporation of computer-generated graphics on the basis of the real world to digitally enhance what we see;

3) Mixed Reality (MR), the integration of AR and VR, is to mix the real world and the virtual world together to create a new visual environment.

Due to technical limitations, most head-mounted display products currently on the market, such as Meta’s Quest and ByteDance’s Pico, are VR hardware. AR products are mainly used on the B-side and are relatively rare in the consumer market. There is almost no precedent in the market for MR headsets that combine AR and VR, and Apple is about to launch this product.

According to the degree of freedom of use, VR equipment can be divided into three types: mobile VR that needs to be connected to a mobile phone; split VR that needs to be connected to external computing power; and all-in-one VR with built-in CPU.

Since all-in-one VR is far better than the other two in terms of user experience, it currently dominates the VR hardware market. Quest 2, Pico 4, and the upcoming MR headset from Apple are all examples of all-in-one VR headsets.

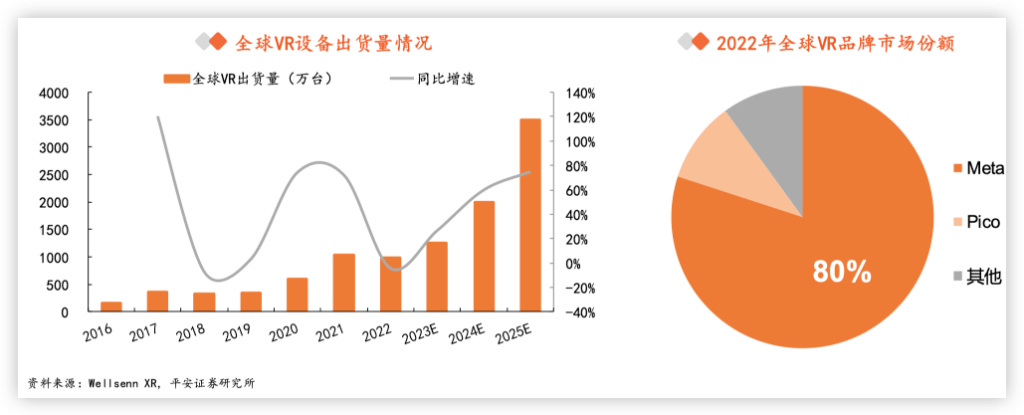

Analysts pointed out that with the improvement of VR equipment product capabilities, VR will usher in a recovery this year and is expected to experience explosive growth in 2025, with shipments reaching 35 million units by then. Meta and Pico, owned by Byte, dominate the global and domestic markets respectively:

Global VR shipments will increase to 35 million units in 2025. Global VR equipment shipments will reach 9.86 million units in 2022, -4% year-on-year, mainly due to the sluggish sales of Quest2, which increased its price by US$100, and the price of Meta's new product QuestPro, which is as high as US$1,500. Apple's two major new products, MR and Quest 3, are about to be released in 2023, but they are expected to go on sale in 23H2 and will have limited contribution to shipments in 2023. It is expected that from 2024, headsets of various brands based on Qualcomm XR2 will be launched together and once again drive the VR shipment boom.

Meta takes the lead in the global market share with a cliff-like lead. In 2022, Meta will have a global VR market share of 80% due to the excellent performance of Quest2, ranking first with an absolute lead, followed by Pico with a market share of 10%.

In 2022, domestic VR equipment shipments will reach 1.21 million units. In 2021, domestic VR equipment shipments will reach 380,000 units. In 2022, domestic VR equipment shipments will increase by 218% year-on-year, totaling 1.21 million units. Domestic VR equipment shipments are expected to increase to 8 million units by 2025. The compound annual growth rate from 2022 to 2025 is 87.7%.

Byte took over Pico, and its market share increased rapidly. Since Meta's VR products have not been sold in mainland China, the domestic market is mainly dominated by domestic brands. With ByteDance's acquisition of Pico, Pico's market share has been further increased. Pico's domestic market share will reach 66% in 2022, ranking first in the domestic market.

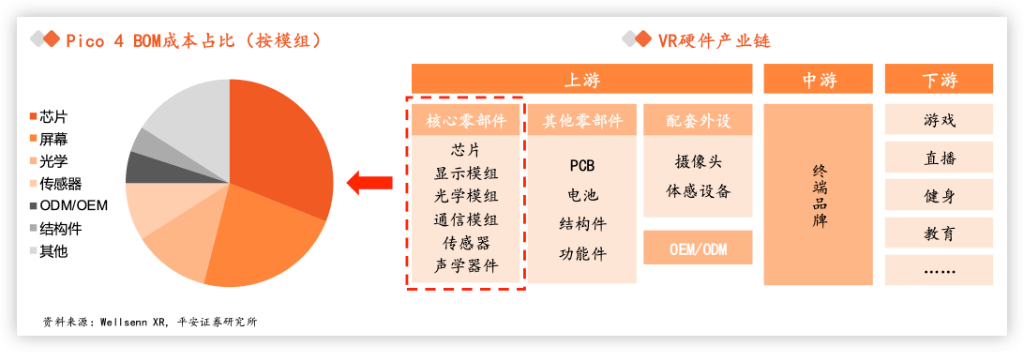

Core components account for 80% of hardware costs Pancake has gradually become a mainstream optical solution

In the VR hardware industry chain, the most critical ones are the chip, display and optical parts.

Analysts pointed out:

The core components of VR headsets are mainly divided into chips, display modules, optical modules, sensors, communication modules and acoustic devices. According to the WellsennXR disassembly Pico4 report, chips are the key cost of consumer VR equipment, accounting for About 31%, followed by display modules and optical modules, accounting for 23% and 12% respectively.

In the field of chips, there is currently a pattern in which Qualcomm dominates :

Qualcomm XR2 chip is the core XR chip at this stage. Currently, mainstream VR all-in-one machines such as Quest2 and Pico4 use Qualcomm XR2 chips. As the dominant computing chip for VR all-in-one machines in the price range of 2,000-4,000 yuan, the Qualcomm XR2 chip integrates the head 6Dof function and supports seven parallel cameras. See-through, 5G and other functions. In 2022, Qualcomm launched a new generation of XR2 chips. As an upgraded version of XR2, without sacrificing the appearance of the device, the battery life is increased by 50%, and the heat dissipation is increased by 30%. Domestic VR chips continue to be explored.

In 2017, Allwinner launched the VR9 chip, in 2020 Huawei HiSilicon laid out the XR chip, and in 2021 Rockchip released the RK3588 chip. Domestic chips have been tried, but due to multiple factors such as overseas technology restrictions and technology generation differences, , the overall effectiveness is still low, and it is still in the continuous exploration stage.

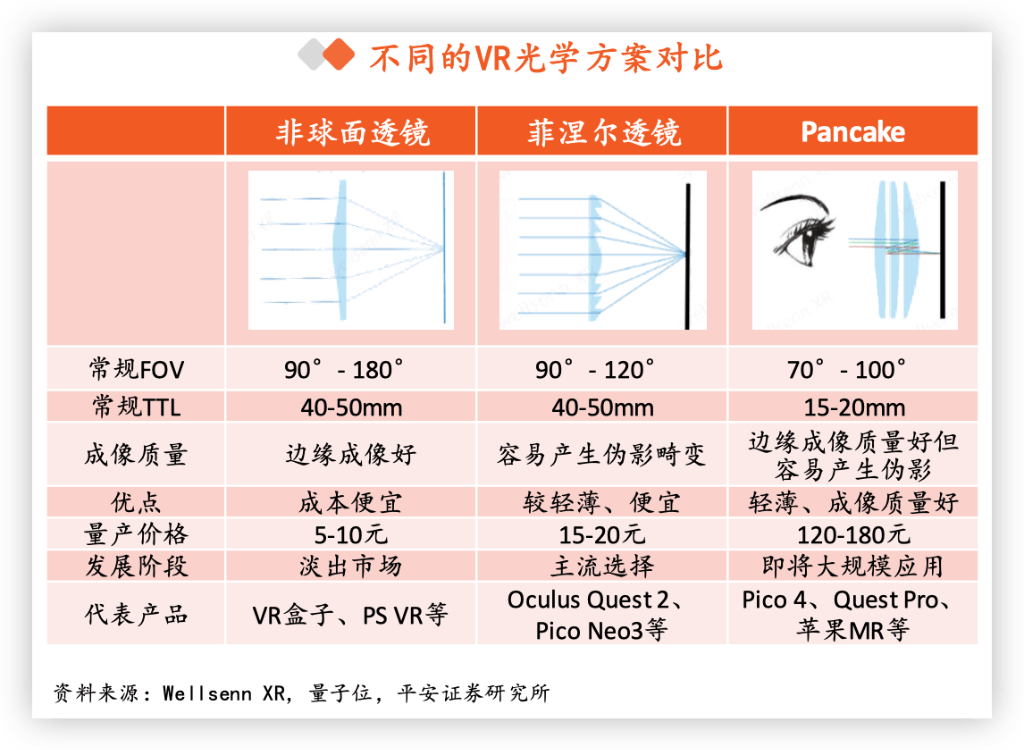

In the field of optics, in 2022, first-line products represented by Pico4 and QuestPro will all switch to the Pancake solution, and the upcoming Apple MR is also expected to adopt the Pancake solution.

Analysts pointed out that Pancake is an important solution for making VR equipment portable:

The development path of VR optics includes aspheric lenses, Fresnel lenses and Pancake lenses. The current market mainly uses Fresnel lenses as the mainstream optical solution. Although the focal length of light collection is shortened by removing the lens material, the imaging quality is low. In order to take into account both weight and image quality, Pancake, which uses a folding optical path design, was pushed to the tip. Due to its thin and light characteristics, it has gradually become the new favorite of VR manufacturers and is regarded as the first choice for the next generation of near-eye optics in VR.

Using the polarization folding mechanism, Pancake makes it possible to transmit light sources and amplify images in limited spaces. Pancake's optical solution mainly uses the principle of polarized light, using reflective polarizers and 1/4 phase delay films to adjust the shape of polarized light. After multiple reflections between the semi-transparent mirror and reflective polarized light, the light finally passes through the reflective polarizer. It is ejected and entered into the human eye to achieve focused imaging.

In the display field, Micro OLED, which has higher costs and more complex processes, is expected to dominate the market.

Looking to the future, MicroOLED has great potential. Micro OLED, also known as silicon-based OLED, is an innovative upgrade of OLED to improve the screen door effect. It combines semiconductor and OLED technology. The display uses monocrystalline silicon chips as the substrate. Not only does the display brightness achieve a significant improvement, but the pixel density also has a leapfrog upgrade, making it easy to get started. Reach 3000PPI.

In addition, MicroOLED can also make displays thinner and lighter, consume less energy, and have higher luminous efficiency. However, due to the cost of large-area silicon base and complex production processes, the cost of MicroOLED is relatively high. When MicroOLED technology becomes competitive in terms of cost and market development, it will show an explosive trend.

Apple MR is expected to accelerate the penetration of MicroOLED applications. Apple MR is expected to use two 1.4-inch, 4K-level high-resolution MicroOLEDs. The supplier is from Sony. Sony has an absolute leading position in the field of MicroOLED panels for consumer XR headsets. In addition, South Korea's Samsung, LGD and China's BOE , Shiya and other manufacturers are actively deploying MicroOLED.

The main point of this article comes from the research report "Apple MR is about to be released, pay attention to VR industry chain opportunities" published by Ping An Securities analyst Xu Yong (S1060519090004) and others, with some abridgements

The above is the detailed content of Apple MR will be released soon, taking stock of the VR industry chain. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Technology trends to watch in 2023

- How Artificial Intelligence is Bringing New Everyday Work to Data Center Teams

- Can artificial intelligence or automation solve the problem of low energy efficiency in buildings?

- OpenAI co-founder interviewed by Huang Renxun: GPT-4's reasoning capabilities have not yet reached expectations

- Microsoft's Bing surpasses Google in search traffic thanks to OpenAI technology