Home >Technology peripherals >AI >Intel plans to get one-third of the big bucks from the 'Chip Act'?

Intel plans to get one-third of the big bucks from the 'Chip Act'?

- PHPzforward

- 2023-05-07 18:10:091047browse

If nothing unexpected happens, the US "Chip Act" will be officially signed by President Biden tomorrow local time. After more than two years of deliberation, consultation, wrangling, and negotiation, the "Chip and Science Act" with a total amount of US$280 billion and aimed at stimulating the U.S. semiconductor and artificial intelligence industries is just about to take the final step.

# #This huge amount of money includes US$52 billion in subsidies for chip manufacturing and research, as well as investment tax credits for chip factories, amounting to approximately US$24 billion.

#Of the 52 billion U.S. dollars in subsidies, 39 billion will be subsidies for the construction of new wafer fabs in the next five years, with a maximum subsidy of 3 billion U.S. dollars for each project. Another US$11 billion is earmarked for subsidizing research and development.

Before the last moment arrives, the CEOs of American chip companies and automobile companies are ready to have another closed-door discussion with the government. They should discuss such a big issue. How should a sum of money be spent and to whom it should be given.

According to Reuters, leaders from chip giant GlobalFoundries, Applied Materials, which provides materials for chip manufacturing, and automakers Ford and General Motors plan to cooperate with U.S. government officials held a closed-door meeting to discuss the government's plans to invest in semiconductors.

# #The companies said the meeting will discuss with the administration "how these public investments can accelerate manufacturing of semiconductors and emerging technologies, stabilize chip supply, support the electrification of vehicles, and strengthen the U.S. economy, supply chains and national security." With Intel Thomas Caulfield, CEO of GlobalFoundries, a major chip manufacturer, said in a statement that chip legislation "protects the U.S. economy, supply chain, and national security by accelerating domestic semiconductor manufacturing."

# Also participating in the closed-door meeting with major chip manufacturers were major automobile manufacturers. As an upstream industry of intelligent manufacturing, chips are essential for the implementation of intelligent and assisted driving technologies in the automotive industry.

Previously, the chip supply shortage caused by the global epidemic that lasted for more than two years has made these major automobile manufacturers miserable. Currently, due to the lack of chips, they are still There are thousands of cars and trucks that cannot be delivered. Ford CEO Jim Farley said, "Achieving reliable domestic supply of chips, including traditional semiconductors needed by the automotive and defense industries, is key to keeping U.S. manufacturing production lines running." Intel: "The money is definitely our family's, it's just a matter of taking it."?

Intel, which is widely considered to be the biggest beneficiary of the "Chip Act", was not present at the meeting. Maybe it’s because I feel confident.

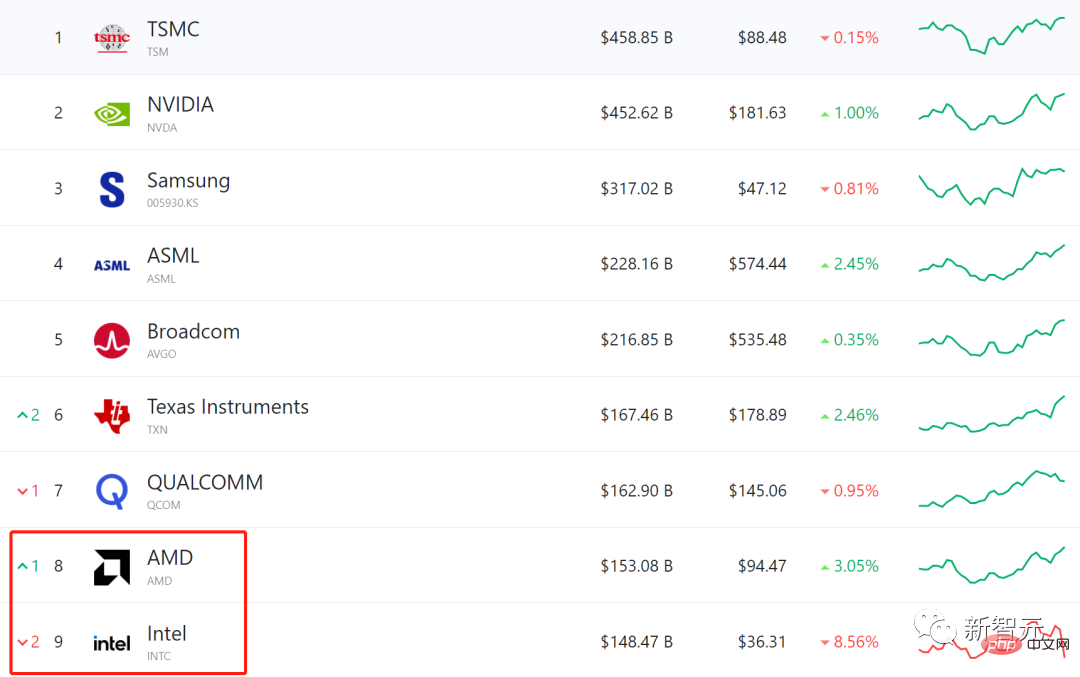

Indeed, as a large manufacturer that focuses on manufacturing with one hand and design with the other, Intel walks on two legs in terms of chip manufacturing and design. ” indeed puts it in a favorable position in this upcoming “money war.” Due to the maturity of the supply chain and international cooperation, in fact, most major chip manufacturers specialize in one field. For example, Su Ma's AMD and Lao Huang's Nvidia basically specialize in chip design, and the manufacturing is handed over to partners such as TSMC that specialize in foundry manufacturing.

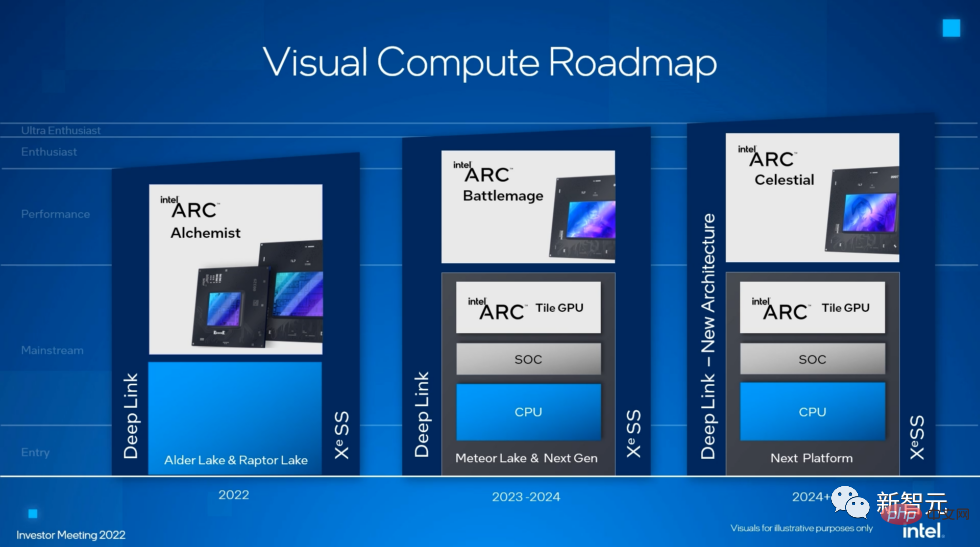

Among the huge subsidies in the "Chip Act" this time, part of them subsidizes chip manufacturing and part of them subsidizes chip design. If you want to compare, the former is the largest. Compared with subsidies and tax exemptions for chip design, subsidies for building new fabs are much greater. Intel is not left behind in manufacturing and design. According to the distribution method in the bill, it will get a lot of money. #If you have this condition, you will have a strong backbone when it comes to speaking and doing things. Previously, due to the delay in the implementation of the bill, Intel announced that it had canceled the groundbreaking ceremony for the construction of a $20 billion large-scale wafer plant in Ohio. Faced with the olive branch thrown by Europe, Intel accepted it. Previously, in order to attract Intel to build factories in Germany, a subsidy of 6.8 billion euros was already included in the local government budget. It was reported not long ago that Intel plans to spend 5 billion to build a wafer fab in Italy, with the government directly subsidying 40%. Intel CEO Pat Gelsinger said: "The chip bill may be The most important industrial policy introduced by the United States since World War II is aimed at reversing the decline in the United States' share of the global chip manufacturing industry from 38% in 1990 to 10%. "In addition, TSMC founder Zhang Zhongmou said frankly in the interview: Over the past decade, the U.S. chip market share has continued to decline, making it difficult to regain global competitiveness. This may make the chip bill money in vain. Intel hopes that this time it can get a total of 12 billion The U.S. dollar factory construction subsidy is close to "nearly one-third of the US$39 billion in factory construction subsidies" in this chip bill. My appetite is really quite big. If you have a big appetite, that is in the future after all, and the money has not been made yet No matter how many billions you can get in the future, you still have to focus on reality. # Speaking of reality, Intel has been facing a lot of problems recently. On July 29, Intel announced its second quarter 2022 financial report, with revenue of US$15.321 billion, a 22% decline compared to the same period last year. Intel's adjusted Q2 earnings per share were only 29 cents, while analysts had expected 70 cents per share. Revenue for the quarter was $15.32 billion, compared with analysts' expectations of $17.92 billion. ## Intel’s net loss this quarter was US$454 million, the first time in history suffered a quarterly loss. # As soon as the news came out, Intel’s stock price plummeted 11% that day. As for the reason for the loss, Intel attributed it to the reduced demand for data center chips and the reduced market demand for PCs. Intel CEO Pat Gelisinger predicts that revenue performance may decline in the next third quarter due to reduced customer demand, but the situation is expected to improve in the fourth quarter of this year. #Intel has fallen sharply, and its old rival AMD will not miss this good opportunity. ## AMD stock rose more than 3% that day, with the market value reaching 1530.8 One hundred million U.S. dollars. Intel fell nearly 9%. At the end of trading on Friday, Intel's market value was $148.47 billion. AMD’s market value has (again) surpassed that of its old rival Intel. In addition, Intel's aging 10nm process and power-hungry desktop CPUs have left people unable to complain. The carefully launched GPUs have only received a mediocre response in the market. They recently killed off Optane, which was called "the most promising in recent years." product line. # #A year ago, Intel announced that it would enter the dedicated graphics card business. Its launch of Intel Arc also claims to compete with Nvidia's GeForce and AMD's Radeon GPUs. However, problems ensued just one year after its release . First, Intel was unable to meet its initial launch expectations. After barely completing the launch of two low-end laptop graphics cards in the first quarter, it failed to launch a widely available desktop graphics card in the second quarter. #In addition, in terms of user experience, Arc’s performance is the worst among old games that do not support DirectX12 or Vulkan API. #This shows that Intel has publicly acknowledged a huge problem: the company is working hard to fix its GPU drivers. To make matters worse, as Intel's market performance and financial situation are both in crisis, investors have increasingly lost confidence in Intel. The performance of our own products is worrying, and the performance of the secondary market is even worse It's bleak, and competitors are chasing after it. It can only be said that Intel's life is really difficult. The government money is about to start being distributed. How much will Intel get in the end? After talking about Intel, let’s talk about the bill itself. In addition to "spending money" this time, the bill also contains an important clause as a necessary condition for obtaining U.S. government subsidies: No Locate the most advanced wafer fab in China. Whether it’s a hidden murderous intention or a very obvious one, maybe this is the ultimate goal of the United States’ repeated wrangling over this bill in the past two years. : Contain China. Due to China’s shortcomings in chip manufacturing, using chips as a breakthrough has become a tried and tested option for the United States in recent years. From more and more Chinese semiconductor and chip companies on the U.S. “Entity List” to more and more chip industry technologies and components being cut off , and at the beginning of this year, they were directly preparing to pull together China's neighboring countries and regions to organize a bureau to contain China. ##According to a report by the Korean media "Seoul Economy" in March this year It said that the U.S. government proposed to form a "Chip Quad Alliance" (Chip 4) with South Korea, Japan and Taiwan, with the intention behind using this organization to exclude mainland China from the global semiconductor supply chain. The United States' wishful thinking is that if it can unite South Korea, which has a world-class level in the chip field, TSMC, the world's largest foundry company, and Japan, which has a strong presence in semiconductor materials, components, and equipment technology, it will Build a "semiconductor barrier" surrounding China. However, reports believe that the South Korean government and companies may find it difficult to accept the US proposal. China is a very important market for Korean semiconductor companies. Samsung and SK Hynix both have factories in China, and their products occupy an important share of the global market. # #Samsung has the only overseas production base for memory chips in Xi'an, which mainly produces flash memory chips. The monthly production capacity of 12-inch wafers reaches 265,000, accounting for 42% of Samsung's overall flash memory production and 10% of the global flash memory market production. Another chip manufacturer, SK Hynix, has a negative impact on production capacity. China's reliance is even deeper, with the company's NAND factory capacity in Wuxi accounting for 47% of total capacity. #Unsurprisingly, South Korea took a cautious stance on this. The United States recently proposed to South Korea to hold a preparatory meeting on whether South Korea will participate in the "Quadruple Alliance for Chips". The South Korean government stated that it is discussing the meeting plan and decided to propose to the United States at the meeting that the "Quadrilateral Alliance for Chips" should be based on the principle that "participating countries should respect China." Emphasizing the one-China principle" and "not mentioning export restrictions to China" are the premise.

Intel's "little life" is actually not easy

The above is the detailed content of Intel plans to get one-third of the big bucks from the 'Chip Act'?. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Technology trends to watch in 2023

- How Artificial Intelligence is Bringing New Everyday Work to Data Center Teams

- Can artificial intelligence or automation solve the problem of low energy efficiency in buildings?

- OpenAI co-founder interviewed by Huang Renxun: GPT-4's reasoning capabilities have not yet reached expectations

- Microsoft's Bing surpasses Google in search traffic thanks to OpenAI technology