Technology peripherals

Technology peripherals AI

AI How are artificial intelligence and machine learning reshaping SaaS fintech?

How are artificial intelligence and machine learning reshaping SaaS fintech?How are artificial intelligence and machine learning reshaping SaaS fintech?

Translator|Cui Hao

Reviewer|Sun Shujuan

1. Opening

Like every leading industry, due to changes in market demand and technological advancement , the financial technology (FinTech) market has experienced a long-term evolution. Because many companies that rely on financial technology have transformed their operating models to participate in this feast of technological change.

This evolution has undoubtedly resulted in several exciting trends, from paper recording of daily financial transactions to building analog computing devices, from developing the first generation computers to integrating artificial intelligence (AI) and machine learning ( ML) incorporates fintech digital products, and the industry has experienced unprecedented growth.

There are more than 30,000 fintech SaaS companies around the world, and many of these brands now rely entirely or partially on AI and ML technologies.

Through this article, let’s take a deeper look at how AI and ML are reshaping today’s SaaS financial technology, and what these changes mean to us.

2. What are AI and machine learning?

Artificial intelligence and machine learning are buzzwords that are constantly making headlines right now. They may not sound familiar since most people use them interchangeably, so let's define them first.

Artificial intelligence (AI) is the abbreviation of artificial intelligence. It uses human intelligence to create self-sufficient systems or mechanisms by equipping computers with different information. It can also imitate human behavior in the physical world. action.

A simple artificial intelligence bot is Siri on the iPhone or Alexa in digital home devices. These artificial intelligence programs are designed to solve problems generated by humans and computers; their main function is to complete any given task and successfully complete the goal within a given time frame.

Machine learning is a technology that enables computers to understand new scenarios and improve their decision-making capabilities when faced with more complex situations. Machine learning uses computer algorithms and analytical methods to build predictive models that help solve different problems, especially in the financial sector.

3. The impact of AI and machine learning on SaaS financial technology

As mentioned earlier, artificial intelligence and machine learning are playing an important role in today’s SaaS financial technology by developing predictive analytics that help with decision-making. play an important role in the tool. The added value of this artificial intelligence can be felt in various fields, from professional operations to ordinary users. Here are some of the impacts of artificial intelligence and machine learning on SaaS financial technology.

1. Financial Risk Management

Banks and other financial technology organizations are always looking for models to minimize risk. The AI-based decision tree approach works by developing simple and traceable rules for complex and non-linear financial situations, thereby using these rules to impact risk management. At the same time, support vector techniques help determine the significant credit risk of a loan.

2. Revenue Forecasting

Many financial services sectors employ machine learning consultants who use deep learning and machine learning techniques to develop predictive models for their organizations.

3. Fraud detection

Fraud is a problem faced by many banks because consumer and financial security cannot be completely guaranteed. Artificial intelligence can help reduce fraud by analyzing huge amounts of transaction data to uncover hidden fraud patterns. It can detect this pattern in real time and prevent it from happening. Additionally, machine learning’s “logistic regression” algorithm can help understand fraud patterns and prevent them from happening.

PayPal is a typical example of using artificial intelligence for fraud detection. PayPal uses machine learning algorithms to analyze data from its platform and identify potentially fraudulent transactions.

The artificial intelligence system looks at various data points such as the location of the transaction, the device used to conduct the transaction, the transaction amount and the user’s history on the platform.

For example, if the transaction is made from a device not normally associated with the user's account, or if the transaction amount is much larger than usual, the system may flag the transaction for review. PayPal's artificial intelligence system has proven to be very effective at detecting fraud. According to the company, its system can detect fraudulent transactions and the fraud rate accounts for only 0.32% of the company's revenue. This helps PayPal avoid millions of dollars in fraud losses every year.

4.Customer Support

Artificial intelligence can ensure that customers get the right financial information at the right time. By studying customer data and significant analytics, AI can create customer responses based on customer preferences or requirements. Typical examples of SaaS brands using AI and ML are Zendesk and Salesforce. Their tools, AnswerBot and Einstein, understand customer intent and provide relevant responses in real time. The algorithm also learns from each interaction and gets smarter over time.

5. Asset Management

Like every other sector, artificial intelligence and machine learning have impacted the way professionals handle or manage financial assets. With AI, asset managers can automate client reporting and documentation, provide detailed account statements, and perform many more functions accurately.

4. The main benefits of AI and ML in SaaS financial technology

The integration of artificial intelligence and machine learning into SaaS financial technology has brought great benefits to the entire industry. Here are some key points for integrating artificial intelligence (AI) and machine learning (ML).

1. Improve accuracy

Before the introduction of machine learning technology, a small number of financial transactions were recorded in the ledger every day. High volumes of trading and limited understanding resulted in some errors and unbalanced accounts. Artificial intelligence and machine learning provide room for accuracy for repetitive calculation tasks including account balancing and account analysis, and ensure the correctness of these calculations. Because of these new developments, results are more accurate and losses can be reduced.

2. Increase efficiency

Another benefit of using artificial intelligence and ML in SaaS financial technology is increased efficiency, improved productivity, and reduced time required to complete tasks. Using AI chatbots to handle customer requests can help improve the overall efficiency of customer support.

3. Enhance decision-making capabilities

Artificial intelligence and machine learning provide assistance in decision-making on SaaS technology. Financial analysts can easily analyze billions of data, study patterns and trends in stocks, and use this technology to make strategic and beneficial decisions.

4. Affordability

A few years ago, only the wealthy could afford personal financial advisors who could help them manage their wealth and regulate their spending. However, in the current era of AI-based applications, bill tracking, stock price predictions, market or cryptocurrency analysis can be done for anyone, all from the comfort of their own home.

5. Challenges and Risks of Artificial Intelligence and Machine Learning in SaaS Fintech

While the benefits of incorporating artificial intelligence and machine learning into SaaS fintech are obvious, it is worth noting that at the same time It also comes with challenges.

Includes the following risks:

1. Investing in

to develop artificial intelligence financial technology applications costs money. In order to recover these costs, the developed applications must be used by the public . However, people are more likely to spend $50 on a fitness or recipe writing app than a fintech app.

2. Data Privacy

It is quite difficult to find a balance between application value, personal information and data privacy. Customers are aware of data privacy issues and want to provide as little personal information as possible when registering. If you ask too many questions or require access to too many devices, customers are likely to leave. How can you train AI to develop more personalized features if you get almost no information?

3. Bias in algorithms and data

The success of artificial intelligence and machine learning is often challenged by data bias. Most of these biases come from minority groups who do not have access to financial technology, or from humans who train artificial intelligence, and their judgments are biased. Bias is often generated by humans—and propagates into algorithms once input.

6. Conclusion

The COVID-19 incident and related government initiatives have brought about huge changes in the workplace, accelerating the adoption of cutting-edge technologies around the world. During the lockdown, AI-driven businesses not only saw an increase in productivity but also launched many new AI products, software across domains, and usage of the fusion of the two.

The SaaS financial technology space is likely to undergo a transformation in the coming years due to continued advances in artificial intelligence and machine learning. This change will allow more companies to gain a competitive advantage, improve their financial performance, and ultimately accomplish their financial management business goals.

Original link:https://www.php.cn/link/63ceea56ae1563b4477506246829b386

The above is the detailed content of How are artificial intelligence and machine learning reshaping SaaS fintech?. For more information, please follow other related articles on the PHP Chinese website!

7 Powerful AI Prompts Every Project Manager Needs To Master NowMay 08, 2025 am 11:39 AM

7 Powerful AI Prompts Every Project Manager Needs To Master NowMay 08, 2025 am 11:39 AMGenerative AI, exemplified by chatbots like ChatGPT, offers project managers powerful tools to streamline workflows and ensure projects stay on schedule and within budget. However, effective use hinges on crafting the right prompts. Precise, detail

Defining The Ill-Defined Meaning Of Elusive AGI Via The Helpful Assistance Of AI ItselfMay 08, 2025 am 11:37 AM

Defining The Ill-Defined Meaning Of Elusive AGI Via The Helpful Assistance Of AI ItselfMay 08, 2025 am 11:37 AMThe challenge of defining Artificial General Intelligence (AGI) is significant. Claims of AGI progress often lack a clear benchmark, with definitions tailored to fit pre-determined research directions. This article explores a novel approach to defin

IBM Think 2025 Showcases Watsonx.data's Role In Generative AIMay 08, 2025 am 11:32 AM

IBM Think 2025 Showcases Watsonx.data's Role In Generative AIMay 08, 2025 am 11:32 AMIBM Watsonx.data: Streamlining the Enterprise AI Data Stack IBM positions watsonx.data as a pivotal platform for enterprises aiming to accelerate the delivery of precise and scalable generative AI solutions. This is achieved by simplifying the compl

The Rise of the Humanoid Robotic Machines Is Nearing.May 08, 2025 am 11:29 AM

The Rise of the Humanoid Robotic Machines Is Nearing.May 08, 2025 am 11:29 AMThe rapid advancements in robotics, fueled by breakthroughs in AI and materials science, are poised to usher in a new era of humanoid robots. For years, industrial automation has been the primary focus, but the capabilities of robots are rapidly exp

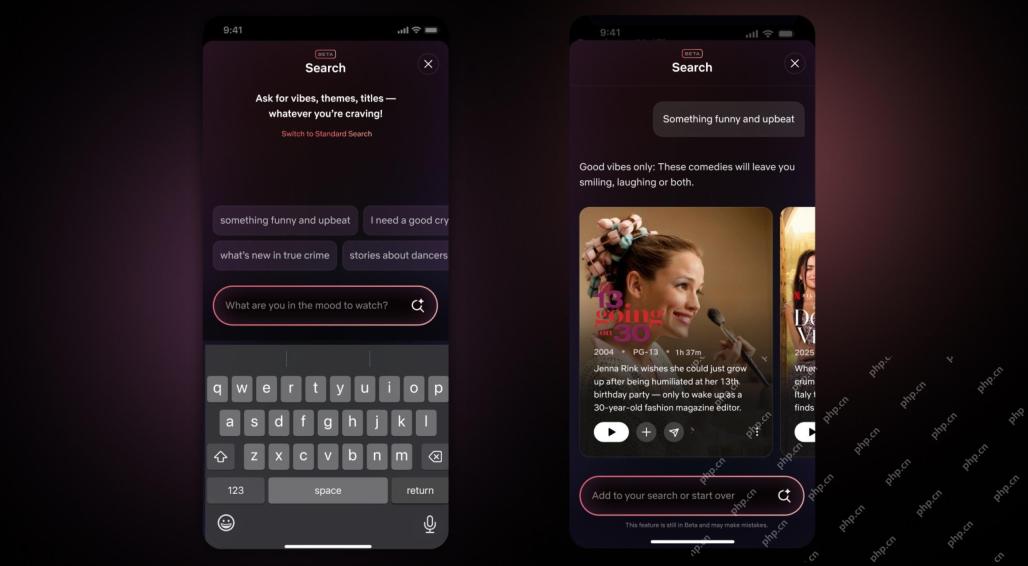

Netflix Revamps Interface — Debuting AI Search Tools And TikTok-Like DesignMay 08, 2025 am 11:25 AM

Netflix Revamps Interface — Debuting AI Search Tools And TikTok-Like DesignMay 08, 2025 am 11:25 AMThe biggest update of Netflix interface in a decade: smarter, more personalized, embracing diverse content Netflix announced its largest revamp of its user interface in a decade, not only a new look, but also adds more information about each show, and introduces smarter AI search tools that can understand vague concepts such as "ambient" and more flexible structures to better demonstrate the company's interest in emerging video games, live events, sports events and other new types of content. To keep up with the trend, the new vertical video component on mobile will make it easier for fans to scroll through trailers and clips, watch the full show or share content with others. This reminds you of the infinite scrolling and very successful short video website Ti

Long Before AGI: Three AI Milestones That Will Challenge YouMay 08, 2025 am 11:24 AM

Long Before AGI: Three AI Milestones That Will Challenge YouMay 08, 2025 am 11:24 AMThe growing discussion of general intelligence (AGI) in artificial intelligence has prompted many to think about what happens when artificial intelligence surpasses human intelligence. Whether this moment is close or far away depends on who you ask, but I don’t think it’s the most important milestone we should focus on. Which earlier AI milestones will affect everyone? What milestones have been achieved? Here are three things I think have happened. Artificial intelligence surpasses human weaknesses In the 2022 movie "Social Dilemma", Tristan Harris of the Center for Humane Technology pointed out that artificial intelligence has surpassed human weaknesses. What does this mean? This means that artificial intelligence has been able to use humans

Venkat Achanta On TransUnion's Platform Transformation And AI AmbitionMay 08, 2025 am 11:23 AM

Venkat Achanta On TransUnion's Platform Transformation And AI AmbitionMay 08, 2025 am 11:23 AMTransUnion's CTO, Ranganath Achanta, spearheaded a significant technological transformation since joining the company following its Neustar acquisition in late 2021. His leadership of over 7,000 associates across various departments has focused on u

When Trust In AI Leaps Up, Productivity FollowsMay 08, 2025 am 11:11 AM

When Trust In AI Leaps Up, Productivity FollowsMay 08, 2025 am 11:11 AMBuilding trust is paramount for successful AI adoption in business. This is especially true given the human element within business processes. Employees, like anyone else, harbor concerns about AI and its implementation. Deloitte researchers are sc

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SublimeText3 Linux new version

SublimeText3 Linux latest version

Dreamweaver Mac version

Visual web development tools

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.