web3.0

web3.0 The impact of capital inflows and outflows on the currency market: Analysis of key factors

The impact of capital inflows and outflows on the currency market: Analysis of key factorsThe impact of capital inflows and outflows on the currency market: Analysis of key factors

The impact of capital inflows and outflows on the currency market is multifaceted, and understanding the key factors of these impacts is crucial for investors and market participants. This article will analyze in detail the different aspects of capital inflows and outflows and their impact on the currency market.

The impact of capital inflow on currency market

Funding inflows usually refer to investors putting their funds into the cryptocurrency market. This inflow can come from the entry of new investors or existing investors increase their investment in cryptocurrencies. The impact of capital inflows on the market is mainly reflected in the following aspects:

- Price rise : When a large amount of capital flows into the market, demand increases, which usually drives the price of cryptocurrencies to rise. For example, if demand for Bitcoin suddenly increases, its price may rise rapidly.

- Increased market sentiment : Inflow of funds often increases the overall market sentiment, and investors are more optimistic about the future performance of the market, which may further attract more funds to enter.

- Increase in trading volume : Inflows of funds are usually accompanied by an increase in trading volume, because more investors participate in market transactions, and the liquidity of the market will also increase.

The impact of capital outflow on currency market

Fund outflow refers to investors withdrawing funds from the cryptocurrency market. This outflow may be due to investors' concerns about the market outlook or to transfer funds to other investment areas. The impact of capital outflows mainly includes:

- Price drops : When a large amount of funds are withdrawn from the market, supply increases and demand decreases, which usually leads to a drop in the price of cryptocurrencies. For example, if a large number of investors sell Bitcoin at the same time, its price may drop rapidly.

- Decline in market sentiment : capital outflows often lead to a decline in market sentiment, and investors are more pessimistic about the future performance of the market, which may further intensify the outflow of funds.

- Decreased trading volume : The outflow of funds is usually accompanied by a decrease in trading volume because the market liquidity decreases and investors' enthusiasm for participating in trading decreases.

Key factors for capital inflows

There are many key factors that affect capital inflows and outflows. Here are a few of the important factors:

- Macroeconomic environment : Changes in the global economy, such as interest rate adjustments, inflation changes, etc., will affect investors' investment decisions. For example, rising interest rates may cause funds to flow out of the cryptocurrency market, as investors may turn to traditional investment vehicles with higher returns.

- Regulatory Policy : Governments and regulators’ attitudes and policies towards cryptocurrencies can also have a significant impact on inflows and outflows. For example, if a country announces heavy taxes on cryptocurrency transactions, it may cause funds to flow out of the country's market.

- Market sentiment : Market sentiment is an important factor affecting capital inflows and outflows. Positive market sentiment may attract more capital in, while negative market sentiment may lead to capital outflows.

- Technical factors : cryptocurrency technological development and innovation will also affect capital inflows and outflows. For example, if a cryptocurrency launches a new technology upgrade, it may attract more money.

The impact of capital inflows and outflows on different types of cryptocurrencies

The impact of capital inflows on different types of cryptocurrencies may vary. Here are the specific impacts of several common types of cryptocurrencies:

- Mainstream cryptocurrencies : such as Bitcoin and Ethereum, these cryptocurrencies are often directly affected by inflows and outflows. Due to its large market size, capital inflows and outflows may lead to significant price fluctuations.

- Small-Cash Cryptocurrencies : These cryptocurrencies have a smaller market size, and the impact of capital inflows may be more significant. The price of small-cap cryptocurrencies may fluctuate greatly due to the inflow of small amounts of funds.

- Stablecoins : Stablecoins are usually pegged to fiat currencies, and their prices are relatively stable, so the impact of capital inflows is relatively small. However, the liquidity of stablecoins may be affected by inflows and outflows.

How to deal with the impact of capital inflows

Investors and market participants can deal with the impact of capital inflows in the following ways:

- Diversified Investment : By diversifying investments in different cryptocurrencies and asset classes, investors can reduce the impact of inflows and outflows on their portfolios. For example, investors can hold Bitcoin, Ethereum, and other small-cap cryptocurrencies at the same time.

- Pay attention to market sentiment : Pay close attention to market sentiment and investor behavior can help investors better predict the trend of capital inflows and outflows. For example, investors can obtain information about market sentiment through social media and market analysis reports.

- Develop risk management strategies : Develop effective risk management strategies that can help investors better protect their investments when funds flow in and out. For example, investors can set a stop loss point to automatically sell part of their assets when the price falls.

- Long-term investment : Adopting a long-term investment strategy can help investors reduce their attention to short-term capital inflows. For example, investors can choose to hold cryptocurrencies as long-term investment rather than frequent short-term trading.

The impact of capital inflows and outflows on market liquidity

The impact of capital inflows and outflows on market liquidity is also an important aspect. Market liquidity refers to the convenience of asset trading in the market, and capital inflows and outflows will directly affect market liquidity.

- Capital inflows increase liquidity : When a large amount of capital flows into the market, the liquidity of the market usually increases because more investors participate in the market transactions, and the transactions between buyers and sellers are more active. For example, if a large amount of capital flows into the Bitcoin market, it becomes easier to buy and sell Bitcoin and the liquidity of the market increases.

- Fund outflows reduce liquidity : When a large amount of funds are withdrawn from the market, the liquidity of the market is usually reduced because the transaction volume of the market decreases and the transaction between buyers and sellers becomes less active. For example, if a large amount of funds are withdrawn from the Ethereum market, buying and selling of Ethereum becomes more difficult and the market liquidity is reduced.

Data analysis of capital inflows and outflows

To better understand the impact of inflows and outflows, investors and market participants can use a variety of data analysis tools to monitor and analyze inflows and outflows. Here are some commonly used data analysis methods:

- Trading volume analysis : By analyzing the market's trading volume data, investors can understand the inflow of funds. For example, if the transaction volume of a cryptocurrency suddenly increases, it may be due to inflows of funds.

- Price trend analysis : By analyzing the price trend of cryptocurrencies, investors can judge the impact of capital inflows and outflows. For example, if the price of a cryptocurrency suddenly rises, it may be caused by inflows of funds.

- Capital flow analysis : By analyzing the flow of funds between different markets and assets, investors can understand the trend of capital inflows and outflows. For example, if funds flow from the Bitcoin market to the Ethereum market, it may be due to the increased demand for Ethereum by investors.

The above is the detailed content of The impact of capital inflows and outflows on the currency market: Analysis of key factors. For more information, please follow other related articles on the PHP Chinese website!

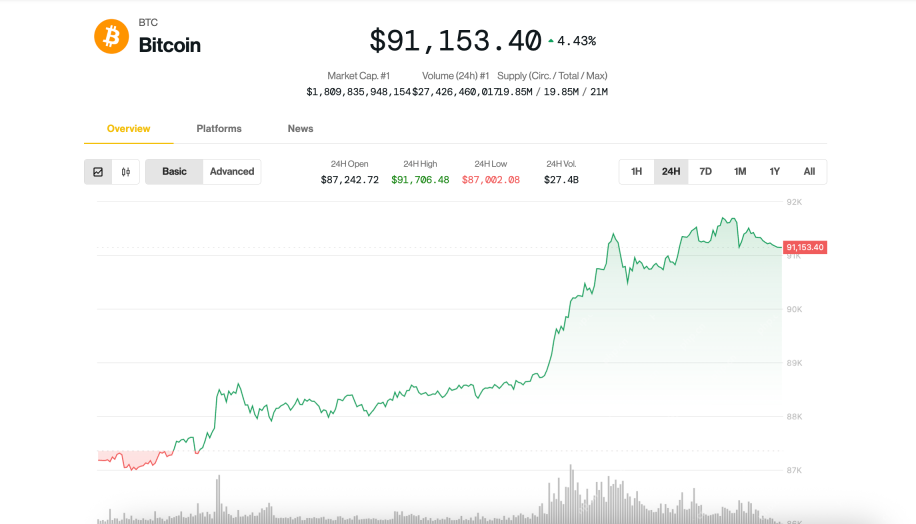

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

Dreamweaver Mac version

Visual web development tools

SublimeText3 English version

Recommended: Win version, supports code prompts!

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

WebStorm Mac version

Useful JavaScript development tools