The Intricate Web of Rumors and Data Points Propelling the Binance Coin (BNB) Rally

The cryptocurrency market, a realm perpetually susceptible to the currents of speculation and rumor, has recently witnessed a captivating narrative

The cryptocurrency market, a realm perpetually susceptible to the currents of speculation and rumor, has recently witnessed a captivating narrative unfold, centered around Binance Coin (BNB) and its ecosystem. A potent cocktail of unsubstantiated claims, commonly known as rumors, and tangible data points has propelled BNB’s price and the value of its associated tokens to significant heights, igniting a flurry of activity and analysis within the crypto community.

This article delves into the intricacies of this phenomenon, dissecting the contributing factors, analyzing the technical indicators, and examining the broader implications for Binance and the cryptocurrency landscape.

The rumor mill has been churning out a tale of the Trump family engaging in negotiations to acquire a portion of Binance.US, a claim that emerged on March 13th and was swiftly dispelled by Changpeng Zhao (CZ), Binance’s former CEO. Despite the lack of evidence to support this assertion, it has sparked a wave of speculation and trading activity, demonstrating the enduring power of rumors to influence market sentiment and price movements.

In the ensuing 24 hours, BNB has experienced a remarkable 10% rally, accompanied by a 40% surge in daily trading volumes, reaching a substantial $2 billion. This surge underscores the market’s sensitivity to even unsubstantiated claims, highlighting the need for investors to exercise caution and conduct thorough due diligence.

However, the impact of this rumor extends beyond BNB itself, permeating the entire Binance ecosystem. Tokens such as Pancakeswap (CAKE) have witnessed extraordinary gains, experiencing a 40% increase in value within 24 hours and a 60% surge over the past week. This surge is further amplified by a 300% increase in Pancakeswap’s daily trading volume, reaching $640 million.

This phenomenon underscores the interconnectedness of the cryptocurrency market, where rumors and speculation can have a cascading effect, influencing the prices of multiple assets within a shared ecosystem.

While the Trump family rumor has undoubtedly contributed to the BNB rally, it is crucial to acknowledge the presence of tangible data points that have also played a significant role. The news that the Binance Chain network has surpassed Solana in decentralized exchange (DEX) volumes provides a fundamental basis for BNB’s bullish trend.

The Binance Chain network has now emerged as the leading blockchain network in terms of DEX volume, processing $1.64 billion in the last 24 hours, compared to Solana’s $1.07 billion and Ethereum’s $1.012 billion. This achievement underscores the growing adoption and utilization of the Binance Chain network, reinforcing its position as a major player in the DeFi space.

This data point provides a crucial counterpoint to the rumor-driven narrative, demonstrating that BNB’s rally is not soley predicated on speculation. The tangible growth of the Binance Chain network, as evidenced by its DEX volume dominance, provides a fundamental basis for investor confidence and price appreciation.

To gain a deeper understanding of BNB’s price trajectory, it is essential to analyze the technical indicators that are currently shaping its market behavior. From a technical analysis perspective, BNB is exhibiting a mildly bullish trend, but it requires a decisive break above the key resistance level of $640 and a sustained price above $650 to confirm a strong bullish outlook.

On the daily timeframe, BNB is currently in an uptrend, recovering from a recent dip to around $560. This upward momentum is further supported by the bullish crossover of the Moving Average Convergence Divergence (MACD) line, which has crossed above the signal line.

While the MACD is still in negative territory, this crossover signifies growing bullish momentum, suggesting that the trend is poised to continue its upward trajectory. This bullish momentum is further confirmed by the Relative Strength Index (RSI), which is currently at 55, having rebounded from the oversold region of 30 a week ago.

These technical indicators collectively paint a picture of growing bullish momentum, suggesting that BNB is well-positioned to continue its upward trajectory. However, it is crucial to acknowledge the inherent volatility of the cryptocurrency market and the potential for unforeseen events to disrupt the current trend.

The impact of the Trump family rumor and the Binance Chain network’s DEX volume dominance extends beyond BNB itself, permeating the entire Binance ecosystem. Tokens such as Pancakeswap (CAKE) have witnessed extraordinary gains, demonstrating the interconnectedness of the cryptocurrency market.

The 40% surge in Pancakeswap’s value within 24 hours and the 60% increase over the past week highlight the potential for significant gains within a thriving ecosystem. This surge is further amplified by a 300% increase in Pancakeswap’s daily trading volume, reaching $640 million, indicating a surge in investor interest and trading activity.

This phenomenon underscores the importance of considering the broader ecosystem when analyzing the price movements of individual tokens. Rumors and data points that impact the core token of an ecosystem, such as BNB, can

The above is the detailed content of The Intricate Web of Rumors and Data Points Propelling the Binance Coin (BNB) Rally. For more information, please follow other related articles on the PHP Chinese website!

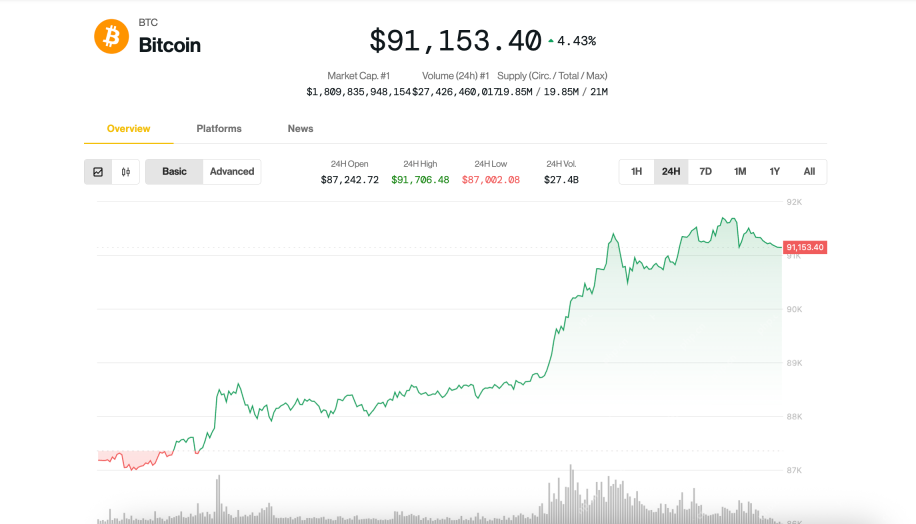

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

SublimeText3 Chinese version

Chinese version, very easy to use

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),