Bitcoin (BTC) Shows Signs of Renewed Optimism as Several Key Indicators Turn Positive

Bitcoin (BTC) menunjukkan tanda-tanda keyakinan yang diperbaharui kerana beberapa petunjuk utama telah bertukar positif, menurut seorang penganalisis dalam rantaian yang terkenal.

Penganalisis crypto samaran Checkmate, yang terkenal dengan cerapan pasarannya, telah berkongsi pemerhatian positif mengenai Bitcoin (BTC) dalam analisis baru-baru ini. Dengan lebih 98,000 pengikut di platform media sosial X (dahulunya Twitter), analisis Checkmate memberikan perspektif berharga tentang dinamik pasaran Bitcoin.

Menurut Checkmate, beberapa petunjuk utama bertukar positif untuk Bitcoin, mencadangkan peralihan dalam momentum pasaran. Salah satu penunjuk utama ialah nisbah Active-Value-to-Investor-Value (AVIV), yang baru-baru ini beralih daripada arah aliran menurun kepada isyarat neutral.

“Bitcoin market momentum is back to neutral across multiple timeframes. Not strictly bullish, but no longer bearish (which is kinda bullish…relatively speaking),” stated Checkmate.

This change in momentum is significant as it may indicate an easing of the extreme bearish sentiment that has dominated the market recently, potentially creating a more favorable environment for price recovery.

Another encouraging indicator highlighted by Checkmate is the short-term holder (STH) supply metric, which tracks the number of coins held for less than 155 days. According to the analyst, this metric is beginning to show bullish signs.

“When the market is ‘top-heavy,’ it usually means that a large portion of recent buyers (less than 155 days) are still at a loss (unrealized) and are thus applying selling pressure to get out of the red. This metric is beginning to show bullish signs from a STH perspective,” explained Checkmate.

Furthermore, Checkmate noted Bitcoin's increasing correlation with traditional assets like gold and equities. Over the past 30 days, Bitcoin has been moving in tandem with these markets, both of which have experienced upward trends.

“Bitcoin is currently very correlated with Gold and equities over the last 30 days. Which I suppose is kinda good, considering those assets are all hitting new ATHs (all-time highs),” observed Checkmate.

This correlation is particularly important as it suggests that Bitcoin could benefit from the positive momentum in traditional markets. When Bitcoin aligns with assets traditionally considered safe havens, such as gold, it may attract a different class of investors.

Despite these positive indicators, Bitcoin is currently trading down 4% in the last 24 hours at $60,994. This drop comes amid a broader market reaction to geopolitical tensions, particularly in the Middle East, which have created volatility across various asset classes, including cryptocurrencies.

“The recent drop in BTC price is likely due to the uptick in geopolitical tensions, particularly in the Middle East. This has caused a broader market reaction, with many asset classes (including crypto) showing some volatility as a result of the news,” stated Checkmate.

While the short-term outlook may seem shaky with this recent dip, the positive trends in key indicators, such as the AVIV ratio and short-term holder supply, could provide a foundation for a recovery if market sentiment shifts favorably.

The above is the detailed content of Bitcoin (BTC) Shows Signs of Renewed Optimism as Several Key Indicators Turn Positive. For more information, please follow other related articles on the PHP Chinese website!

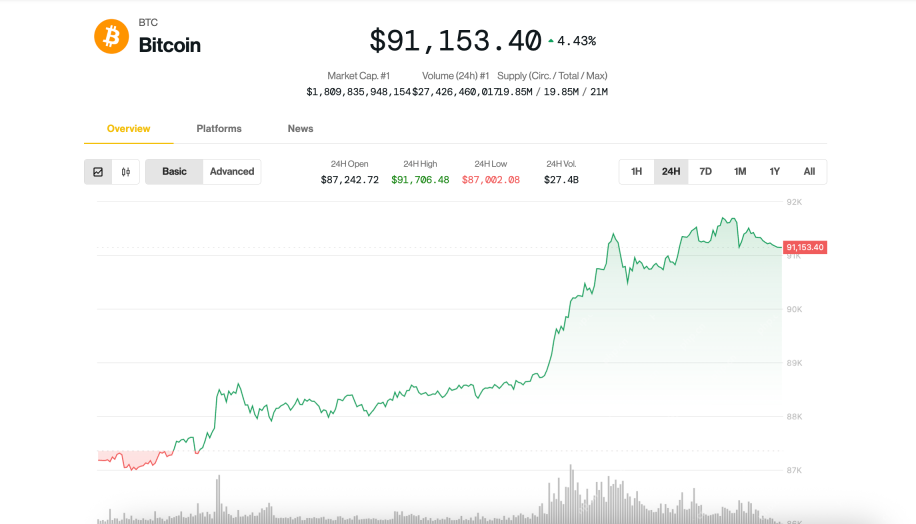

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

SublimeText3 English version

Recommended: Win version, supports code prompts!