web3.0

web3.0 TFL May Burn 1 Billion USTC and 275 Billion LUNC Tokens as Part of Chapter 11 Bankruptcy Proceedings

TFL May Burn 1 Billion USTC and 275 Billion LUNC Tokens as Part of Chapter 11 Bankruptcy ProceedingsTFL May Burn 1 Billion USTC and 275 Billion LUNC Tokens as Part of Chapter 11 Bankruptcy Proceedings

According to validator HappyCatKripto, Terraform Labs (TFL) could burn 1 billion USTC and 275 billion Terra Luna Classic (LUNC) tokens as part of its Chapter 11 bankruptcy proceedings.

Terraform Labs (TFL) could burn 1 billion USTC and 275 billion Terra Luna Classic (LUNC) tokens as part of its Chapter 11 bankruptcy proceedings, according to validator HappyCatKripto.

The amount of tokens to be burned remains uncertain, but the Terra Luna Classic Community is now questioning the ecosystem’s next move.

1 Billion USTC & 275 Billion LUNC Could Burn ?

Upcoming burns, timeline and what’s next ????

Drop a like if you want the #LUNC & #USTC to burn?? pic.twitter.com/alf1SuRdzk

— HC Crypto (@HappyCatKripto) September 8, 2024

Preparation for 1 Billion USTC and 275 Billion LUNC Burn

As block explorer Galaxy Finder revealed, 264 billion LUNC and 177 million USTC tokens have been claimed from the shuttle bridge Terraform Labs reopened. Additionally, the validator urged the community to migrate Mirror Protocol and Anchor Protocol contracts to a new code using governance similar to Risk Harbors.

Terraform Labs owns Mirror Protocol, which has been inactive since the May 2022 crash. The funds related to the Mirror Protocol and Anchor Protocol are Columbus-5 native assets USTC and LUNC. Per a Commonwealth post, the total LUNC burn from Mirror Protocol would be 480,404,166.

Additionally, 729,976,293 USTC can be burnt from the Anchor Protocol and 46,556,271 USTC from the Mirror Protocol.

According to TFL’s CEO Chris Armani, the court judgment ordered all Terra Luna Classic assets to be burned. After October 31, TFL will stop interacting with Columbus-5 or Phoenix-1 chains. Any token burn or transfer will be difficult after the court-approved deadline. Per Terra Money, TFL will no longer be able to support future chain upgrades.

As highlighted in our previous article, TFL began winding down its operations with Proposal 4818 upgrade. Changes implemented by the upgrade include a 5% minimum commission rate for validators and the removal of blacklist functionality. Terraform Labs said the winding down of its operations aligns with its settlement with the US SEC.

Meanwhile, as noted in our earlier post, the company settled with the Securities and Exchange Commission. Notably, the regulator sought the forfeiture of $5.3 billion from stablecoin sales and fines totaling $520 million for Terraform Labs and Do Kwon.

Price Reaction from Terra Luna Classic and USTC

Recent positive developments in the crypto community have fueled a price rebound for USTC and LUNC tokens. The upward momentum was boosted by Genuine Labs’ announcement that it will shortly proceed with the Tax2Gas chain update following a few tests.

LUNC has experienced a 3% surge in the past 24 hours, setting its price at $0.00007872. The trading volume increased by 26% to $9.27 million, with the market cap settling at $449 million.

In a similar move, USTC’s value increased by 2% to trade at $0.01584 in the past day. However, the trading volume declined by 2.7% to $3.5 million, indicating subdued investor interest. If the ecosystem’s positive switch is sustained, this bearish metric may also be reversed in the near future.

The above is the detailed content of TFL May Burn 1 Billion USTC and 275 Billion LUNC Tokens as Part of Chapter 11 Bankruptcy Proceedings. For more information, please follow other related articles on the PHP Chinese website!

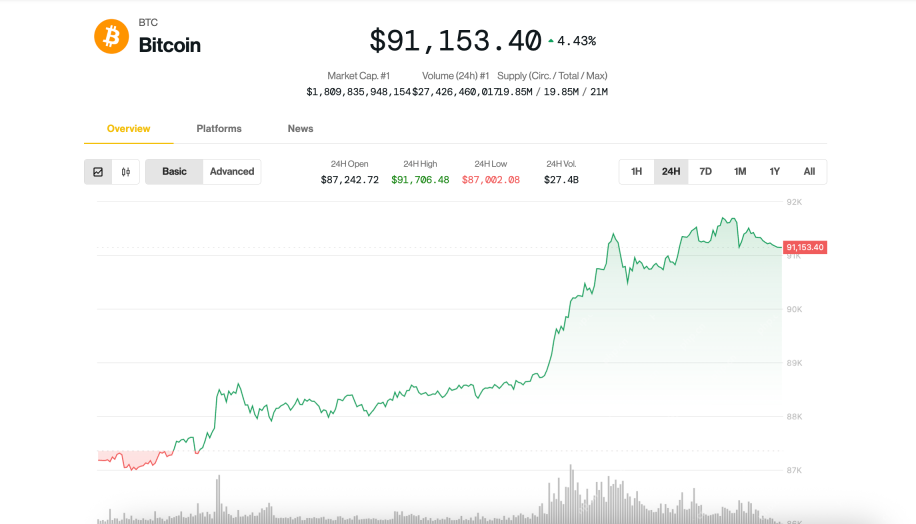

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Dreamweaver CS6

Visual web development tools

WebStorm Mac version

Useful JavaScript development tools

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

SublimeText3 Mac version

God-level code editing software (SublimeText3)