Bitcoin (BTC) Market Cycle Indicator is Again in BEAR Phase (Light Blue Area)

Bitcoin [BTC], the world's largest cryptocurrency by market capitalization, has seen considerable depreciation over the past week.

Bitcoin [BTC] has had an interesting month. After dropping to as low as $49,500 on the charts earlier in August, the world’s largest cryptocurrency recovered quickly. Later, it hit a local high of over $65k, before losing its gains again to drop below $60k. Now, as the month nears its end, BTC was seen trading at a value of $59,129, down by over 7%.

Now, while BTC dropped significantly earlier this month, many are still uncertain about the scale of the next wave of corrections. In fact, several analysts have differing opinions on the matter. However, one analysis suggested that Bitcoin may register a strong decline if the price declines below $56k.

Bitcoin’s bear phase

In his analysis, Cryptoquant analyst Julio Moreno highlighted the market cycle indicator, which showed $56k to be the crucial support level. According to the analyst, if the price falls below this level, the crypto will seen significant weakness.

Since the Bitcoin market cycle indicator has turned bearish again, the crypto risks further correction below the demand zone.

Moreno shared the analysis on X, noting that,

“#Bitcoin market cycle indicator is again in BEAR phase (light blue area). From a valuation perspective, if the price pierces $56K to the downside, risks of a larger correction increase.”

If the bulls don’t reclaim the market, the Bear phase is bound to persist.

Other market indicators

While these metrics highlighted by Moreno suggest possible future price movements, it’s essential to see what other market indicators have to say about the matter at hand.

To begin with, Bitcoin’s NUPL has declined over the past 7 days. In fact, the metric shifted from a value of 0.5 to 0.4. This highlighted a movement from investors’ realized unrealized profit to a realized unrealized loss.

This is a sign that the market may be leaning bearish. By extension, this means investors are worrying about the sustainability of the current prices, which may result in selling pressure.

Furthermore, BTC is reporting a negative adjusted price DAA divergence of -44.31.

This suggests a decline in on-chain activity based on current prices. Such market conditions result in correction as prices adjust to the lower level of on-chain activity.

Finally, the MVRV ratio for BTC has remained at 1.8 over the past week. This shows that participants are in profit, which could lead to selling pressure as they aim to realize those gains. Therefore, if BTC holders decide to sell at this rate to realize their profits, it would lead to further price correction.

If selling pressure increases, the market will experience a pullback.

Therefore, as the Cryptoquant analyst suggests, BTC is in the bear phase. If the current market conditions hold, Bitcoin may be positioned for a bigger correction. A pullback below the $56 level will see BTC fall below $50k to the critical support of $49k.

The above is the detailed content of Bitcoin (BTC) Market Cycle Indicator is Again in BEAR Phase (Light Blue Area). For more information, please follow other related articles on the PHP Chinese website!

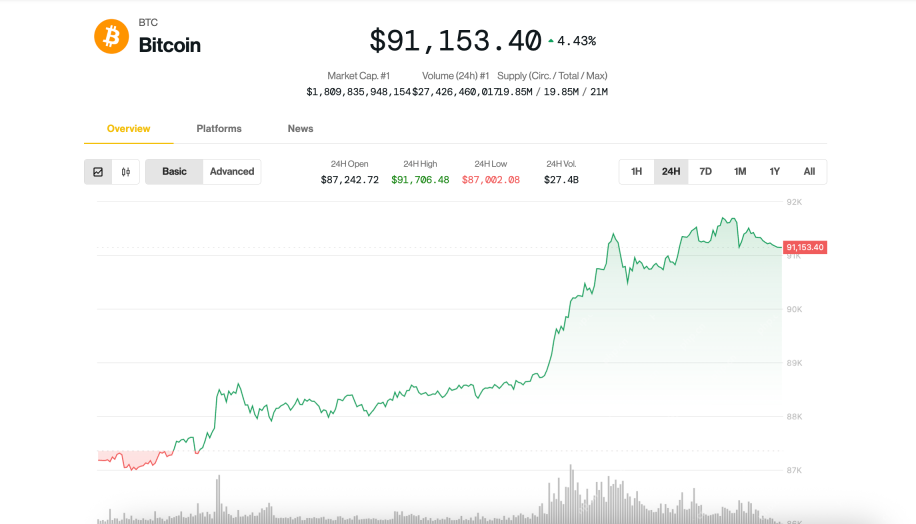

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

Atom editor mac version download

The most popular open source editor

Dreamweaver Mac version

Visual web development tools

SublimeText3 Linux new version

SublimeText3 Linux latest version