Exploring the Competitive Edge of ETFSwap (ETFS) over Chainlink (LINK) and Uniswap (UNI)

ETFSwap (ETFS), with its DeFi platform, is known for hosting tokenized exchange-traded funds (ETFs) leveraging the Ethereum network.

In the ever-evolving world of cryptocurrency, crypto enthusiasts are always searching for promising new projects to keep an eye on. In this article, we will be exploring three prominent projects, ETFSwap (ETFS), Chainlink (LINK), and Uniswap (UNI), from the perspective of their growth potential.

ETFSwap (ETFS): A Platform for Tokenized ETFs

ETFSwap (ETFS) is a DeFi platform that hosts tokenized exchange-traded funds (ETFs) on the Ethereum network. It offers investors a wide range of real-world assets through ETFs, including leveraged ETFs, cryptocurrency ETFs, real estate ETFs, fixed income ETFs, commodity ETFs, and more.

One key aspect of ETFSwap (ETFS) is its integration of AI-powered tools, which gives it an edge over Chainlink (LINK) and Uniswap (UNI). These tools, such as the ETF Screener, ETF Filter, and ETF Tracker, help investors in selecting ETF investment options based on past trends and present market conditions.

Furthermore, ETFSwap (ETFS) has completed its KYC verification with SolidProof, a renowned cybersecurity and blockchain audit firm, to protect its users from fraudulent activities. Another interesting feature is the zero-knowledge approach, which allows investors to join the platform without revealing their personal information.

Chainlink (LINK): Secure Oracle Solutions

Chainlink is a decentralized blockchain network that connects decentralized and centralized networks through oracles. As the demand for secure and reliable oracle solutions continues to rise, Chainlink's price is expected to surge in the coming days.

Chainlink has enabled over $12 trillion in transaction value for blockchain applications. Its enterprise-grade infrastructure helps financial services providers automate workflows to achieve cost efficiencies and reduce settlement times.

According to CoinGecko, Chainlink has a market cap of over $6 billion and a daily trading volume of $193,000. Over the past year, Chainlink has seen an increase of only 67% and is trading within the range of $10.07 and $10.45.

Uniswap (UNI): A Decentralized Exchange

Uniswap is a leading decentralized exchange (DEX) in the DeFi space, having gained significant attention globally since its launch. By enabling seamless token swaps and providing liquidity pools, Uniswap's position as one of the best crypto projects could lead to substantial growth potential for the UNI token.

Recently, digital assets firm Prometheum announced its plan to offer Uniswap custody for US clients alongside Ethereum and Arbitrum, although the firm had previously launched Ether custody as a security offering earlier this year. Following the announcement, UNI's price surged about 10%.

Uniswap boasts a market cap of $5 billion and a total supply of 1 billion UNI tokens. As of writing time, according to CoinGecko, Uniswap is trading at $6.75 each.

ETFSwap (ETFS) Presale Shows Good Potential

Barely a few weeks into its presale, ETFSwap (ETFS) has already raised over $3.2 million with 112 million tokens sold. This indicates a strong initial response from investors, boding well for the project's future growth and development.

For more information about the ETFS Presale:

Visit ETFSwap Presale

Join The ETFSwap Community

This article contains a press release from an external source. The opinions and information presented may differ from those of DailyCoin. Readers are encouraged to independently verify the details and consult with experts before acting on any information provided. Please note that our Terms and Conditions, Privacy Policy, and Risk Warning have been recently updated.

The above is the detailed content of Exploring the Competitive Edge of ETFSwap (ETFS) over Chainlink (LINK) and Uniswap (UNI). For more information, please follow other related articles on the PHP Chinese website!

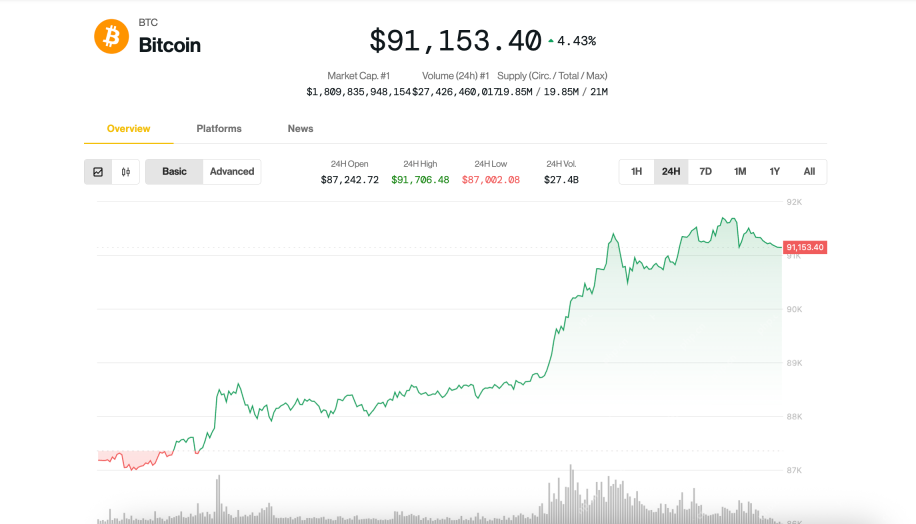

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

SublimeText3 Chinese version

Chinese version, very easy to use

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),