The Crypto Fear & Greed Index Remains in Fear Territory After Days of Sideways Action

But CryptoQuant reminds traders and investors alike that the bull market is still on. The fact that BTC is moving from spot to future exchanges shows that investors are engaging in more risk taking, similar to past cycles, the analysts wrote.

Crypto Fear & Greed Index Shows More Pain to Come Before BTC Surges Again

The crypto Fear & Greed Index remains in Fear territory after days of sideways action as Bitcoin (BTC) struggles to break above US$60K (AU$89.2K).

The index, which measures the level of fear or greed among crypto traders and investors, has been hovering around 20 for the past week. This indicates that traders are still largely pessimistic about the market, despite the recent recovery from June lows.

However, analysts at CryptoQuant believe that the bull market is still on. They point to the fact that BTC is moving from spot to future exchanges, which shows that investors are engaging in more risk taking, similar to past cycles.

“Investors are starting to take risks and bet as they have in past #bitcoin bull markets,” the analysts wrote. They added that “reckless use of leverage by risk-taking investors” is going to bring bulls back.

Analysts from Bitfinex agree with that sentiment, writing in their latest report that they believe “Bitcoin is still on track to follow previous halving year trajectories”. They expect that the last quarter of 2024 will be “extremely bullish”, adding:

“If the Bitcoin price action follows the previous halving year trajectories, then the last quarter of 2024 will be extremely bullish. This is because the last quarter of a halving year has always seen a significant increase in Bitcoin’s price.”

They also point to the overarching macroeconomic picture and the upcoming US Federal Reserve meeting on 17-18 September.

Most analysts, roughly 75% as per a Reuters report, now expect a 0.25% rate cut at the Fed meeting. This is down from the 0.5% cut that was widely anticipated following the August inflation report.

The change in expectations comes as the Fed has signaled its commitment to fighting inflation and as data has shown that price pressures are easing, albeit slowly.

“The Fed is pivoting slower than the market anticipated. This is because the market is pricing in a 0.25% rate cut at the September meeting, while the Fed officials are still discussing a 0.5% cut,” the Bitfinex analysts wrote.

“However, if inflation continues to ease and the labor market remains strong, then the Fed may ultimately decide to cut rates by 0.25% at the September meeting.”

VanEck: We’re Buyers Here

Investment mammoth and crypto enthusiast VanEck is also bullish, attributing the current mediocre price movement largely to the reversal of the Japanese carry trades, the US and German Governments’ BTC selling spree, as well as the Mt. Gox and Genesis bankruptcy creditor payouts.

“When you look at the Bitcoin price action over the past six months, it’s really been hit by a lot of forced selling,” VanEck’s Head of Digital Assets, Matthew Sigel, told CNBC.

“The Japanese carry trades started reversing in June, and then we had the US and German governments selling a lot of Bitcoin in July. And then, of course, there were the Genesis and Mt. Gox bankruptcy creditor payouts.”

Sigel added that these events have largely contributed to Bitcoin’s failure to break above US$60K (AU$89.2K), despite strong fundamentals.

“But with all of that behind us, we’re now in a typical seasonable pattern where Bitcoin tends to struggle in the 1-3 months after the halving, which was in April.”

“So, when you combine that seasonality with the fact that everyone is expecting a 0.25% rate cut at the Fed meeting, it’s really setting up for Bitcoin to have a strong recovery no matter what.”

This, according to Sigel, makes VanEck buyers of Bitcoin at current levels.

“This is because we believe that the worst of the crypto bear market is behind us and that Bitcoin is now poised to resume its bull market,” he said.

“We’re also bullish on crypto in general, as we believe that the technology has the potential to revolutionize the global financial system.”

The above is the detailed content of The Crypto Fear & Greed Index Remains in Fear Territory After Days of Sideways Action. For more information, please follow other related articles on the PHP Chinese website!

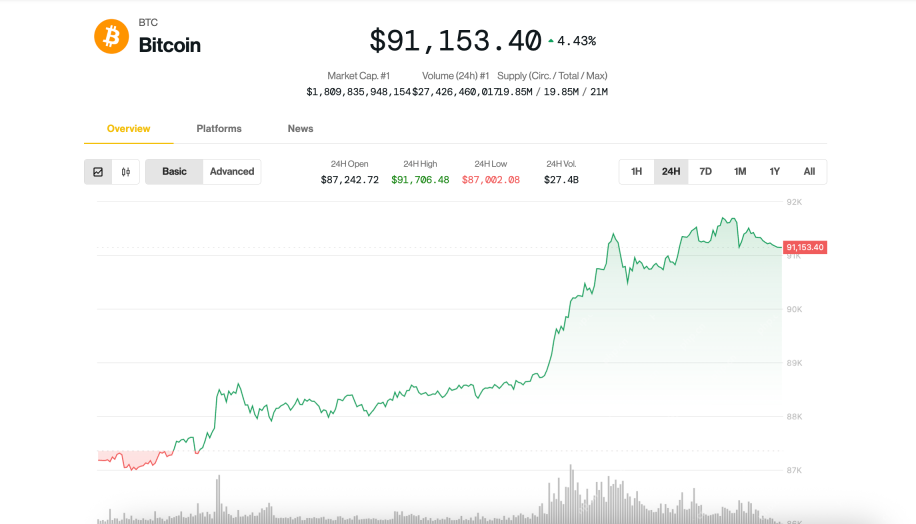

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

SublimeText3 Mac version

God-level code editing software (SublimeText3)