Coinbase CFO Alesia J. Haas Sells $1 Million Worth of COIN Stock

Coinbase (NASDAQ:COIN) Global, Inc. (NASDAQ:COIN) Chief Financial Officer Alesia J. Haas has sold a significant portion of her stock in the company

Coinbase (NASDAQ:COIN) Chief Financial Officer Alesia J. Haas has sold a significant portion of her stock in the company, according to a recent filing. The transactions, which took place on August 15, 2024, involved the sale of 5,250 shares of the company's Class A Common Stock, resulting in a total value of approximately $1,035,195.

The sales were conducted at varying prices, with individual shares sold at prices ranging from $196.89 to $198.26. The filing indicated that these sales were executed in accordance with a pre-established trading plan, known as a Rule 10b5-1 plan, which Haas had adopted on December 1, 2023.

Following the transactions, Haas still holds a substantial number of shares in Coinbase. The remaining direct ownership stands at 177,653 shares of Class A Common Stock. Additionally, it was noted in the filing that Haas disclaims beneficial ownership of shares held by ACB 2021, LLC, of which she is the sole member, except to the extent of her pecuniary interest therein.

Investors often monitor insider sales as they may provide insights into an executive's view of the company's current valuation and future prospects. However, it is also common for executives to sell shares for personal financial management reasons, such as diversification or liquidity needs, which are not necessarily indicative of their outlook on the company's future performance.

The filing with the Securities and Exchange Commission provides full details of the transactions, including the number of shares sold at each price point within the reported ranges. As is customary, the executive has offered to provide additional information regarding the sales upon request by the SEC, the issuer, or its shareholders.

In other recent news, Coinbase Global Inc. has announced a strong Q2 performance for 2024, reporting a total revenue of $1.4 billion and an adjusted EBITDA of $596 million. Despite a decrease in transaction revenue, the firm achieved an all-time high in subscription and services revenue. CEO Brian Armstrong underscored the importance of regulatory clarity and the growth of utility in the crypto market.

Coinbase, which currently holds $7.8 billion in USD resources, is anticipating modest headwinds in Q3 but maintains a positive outlook for future growth and the incorporation of crypto into the global financial system. The company is also making strides toward bringing 1 billion people on-chain and has launched Smart Wallets to facilitate easier crypto use.

These recent developments also include plans to escalate headcount and marketing spend to bolster product and international expansion. The company views the MiCA legislation in Europe as a significant catalyst for USDC adoption. Notably, Coinbase's Q2 report did not include specific revenue projections. Despite this, the firm's Q2 performance indicates its resilience in a dynamic market and commitment to innovation and regulatory engagement.

Coinbase's stock price, which experienced a 149.52% increase over the last year, is currently trading at $196.56 on August 16, 2024. The company, which is listed on the NASDAQ exchange, has seen its shares fluctuate within a price range of $30.44 to $429.44 over the past 52 weeks.

InvestingPro Insights

Coinbase Global, Inc. (NASDAQ:COIN) has been under the investor's microscope following the disclosure of CFO Alesia J. Haas's stock sale. To provide a more comprehensive picture of the company's financial health and market performance, let's consider some key metrics and insights from InvestingPro.

InvestingPro Data shows that Coinbase's market capitalization stands at $51.11 billion, reflecting the company's substantial size in the digital currency exchange market. The company's P/E ratio, a measure of its current share price relative to its per-share earnings, is 32.8. This valuation metric suggests that investors are willing to pay higher for earnings today, with expectations of future growth.

In terms of profitability, Coinbase has demonstrated impressive gross profit margins, with a figure of 86.1% over the last twelve months as of Q2 2024. This high margin indicates efficient operations and a strong market position for their services. Additionally, the company's revenue growth has been striking, posting a 74.22% increase over the same period, which is further bolstered by quarterly revenue growth of 108.29%.

InvestingPro Tip は、アナリストが同社の堅調な収益実績と一致して、今年の Coinbase の売上増加を予想していることを強調しています。この予想される成長は、投資家にとって同社の将来見通しを評価する重要な要素となる可能性があります。さらに、InvestingPro の別のヒントでは、Coinbase が今年利益を上げることが期待されていることが明らかになりました

The above is the detailed content of Coinbase CFO Alesia J. Haas Sells $1 Million Worth of COIN Stock. For more information, please follow other related articles on the PHP Chinese website!

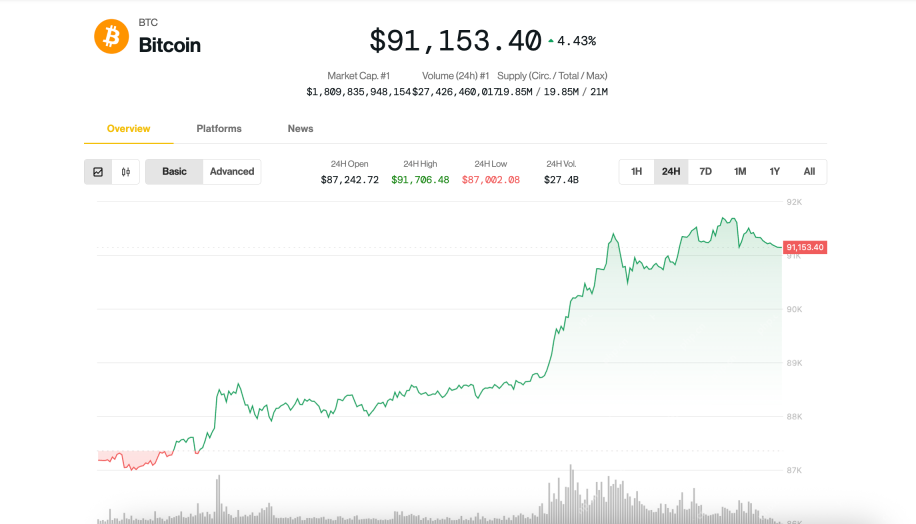

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

SublimeText3 Chinese version

Chinese version, very easy to use

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),