web3.0

web3.0 BlackRock Inc. Outpaces Grayscale Investments as the Largest Crypto Exchange-Traded Fund (ETF) Issuer

BlackRock Inc. Outpaces Grayscale Investments as the Largest Crypto Exchange-Traded Fund (ETF) IssuerBlackRock Inc. Outpaces Grayscale Investments as the Largest Crypto Exchange-Traded Fund (ETF) Issuer

Leading asset management firm BlackRock Inc. has outpaced Grayscale Investments as the largest crypto Exchange-Traded Fund (ETF) issuer.

Leading asset management firm BlackRock Inc. (NYSE:BLK) has overtaken Grayscale Investments as the largest crypto Exchange-Traded Fund (ETF) issuer. This marks a massive milestone for BlackRock as it is the first time it has taken the top crypto ETF issuer position from Grayscale.

Popular data analytics platform Arkham Intelligence posted the update on social media. According to the details, BlackRock’s ETF holdings amount to $21,217,107,987, flipping Grayscale’s $21,202,480,698. This move demonstrates BlackRock’s strong push to become a reputable force in the ETF market.

BlackRock Shines in Bitcoin and ETF Market

Arkham noted that BlackRock’s move to the top spot in the ETF sector was triggered by increased adoption of its iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust ETF (ETHA). Together, holdings from these ETFs surpassed Grayscale’s ETFs, which include GBTC, BTC Mini, ETHE, and ETH Mini.

Data from FarSide Invest shows IBIT is leading other spot Bitcoin ETFs, with total inflows reaching $20.3 billion. BlackRock’s Bitcoin ETF has been quite a huge success since it commenced trading in general, recording maximum single-day inflows above $849 million.

On the other hand, Grayscale Bitcoin Trust (GBTC) has experienced huge outflows since it launched. According to FarSide, total outflows from GBTC now amount to $19.5 billion. This suggests investors are moving their money away from GBTC to other ETFs that appear favorable to them.

The high outflows from GBTC can be attributed to its high sponsor fees, among other reasons. Unlike other spot Bitcoin ETF issuers, Grayscale has the highest fee, at 1.5%.

Meanwhile, a similar scenario exists in the spot Ethereum ETF ecosystem. BlackRock’s ETHA clinched the top spot, with total inflows reaching $967.1 million, according to FarSide. ETHA recorded the highest single-day inflow of $109.9 million on August 6, placing it among the best six-performing ETFs launched this year.

For Grayscale, its Ethereum ETF, ETHE, is experiencing outflows like its Bitcoin counterpart. Total outflows from ETHE come in around $2,386 billion. Upon launching on July 23, ETHE recorded outflows of $180 million in the same week, reducing the total net asset value for all funds with a net outflow of $406.4 million.

Despite these outflows, the other eight Ethereum ETFs have had positive overall inflows. For instance, Fidelity’s FETH has amassed inflows of $360.3 million, and Bitwise’s ETHW boasts of $305.2 million.

Impact of BlackRock’s ETF Milestone on Bitcoin and Ethereum’s Price

Bitcoin and Ethereum have had their fair share of market volatility in recent weeks. This resulted in a massive drain from exchanges, leading to losses in the value of both coins.

With BlackRock’s recent ETF milestone reached, analysts and investors anticipate a recovery in the price of Bitcoin and Ethereum. This is based on the premise that more crypto investors will begin to flood the market, strengthened by BlackRock’s commitment to Bitcoin and Ethereum via its ETFs.

Moreover, BlackRock’s CEO, Larry Fink, has expressed bullishness on Bitcoin’s long-term viability, potentially endorsing the coin for peers to invest in.

The above is the detailed content of BlackRock Inc. Outpaces Grayscale Investments as the Largest Crypto Exchange-Traded Fund (ETF) Issuer. For more information, please follow other related articles on the PHP Chinese website!

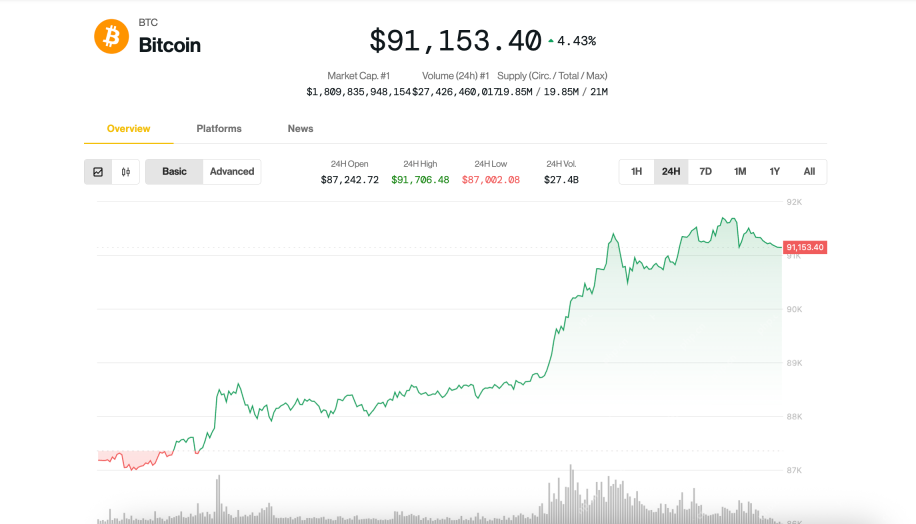

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

Notepad++7.3.1

Easy-to-use and free code editor

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment