Options Features Likely to Be Added to Spot Bitcoin (BTC) ETFs in Q4: Bloomberg

Options features are likely to be added to spot Bitcoin (BTC) exchange-traded funds (ETF) in the US in the fourth quarter, according to Bloomberg ETF analyst James Seyffart.

Options features are set to be added to spot Bitcoin (BTC) exchange-traded funds (ETFs) in the US by the fourth quarter, according to Bloomberg ETF analyst James Seyffart.

However, in another post, Seyffart highlighted that the offering could begin as early as the third quarter, as the final deadline for a decision from the US Securities and Exchange Commission (SEC) is around Sep. 21.

“Technically in our note I said second half of 2024 because the SEC deadline is in 3rd quarter (sept 21) and there’s nothing stopping things from moving even faster than that other than: ‘It normally takes longer than that,'” Seyffart added.

The analyst also noted that the inclusion must be approved by the Office of the Comptroller of the Currency (OCC) and the Commodity Futures Trading Commission (CFTC).

For reference, the Bloomberg analyst listed 20 ETFs linked to Bitcoin and Ethereum (ETH) that already have options, including leveraged products.

Coincidentally, less than an hour after Seyffart posted this prediction, three exchanges — BOX Exchange, MIAX Pearl, and Miami International Securities Exchange — withdrew their applications to list spot Bitcoin ETF options.

However, senior Bloomberg ETF analyst Eric Balchunas noted that those are three “tiny exchanges,” while major entities like the New York Stock Exchange (NYSE), Nasdaq, and Chicago Board Options Exchange (CBOE) still have active applications.

Options for Ethereum ETFsNasdaq and BlackRock filed on Aug. 7 to add options to the asset manager’s spot Ethereum ETF iShares Ethereum Trust (ETHA). The SEC has 21 days to comment on the matter, though the final deadline is “likely to be around” April 9, 2025, Seyffart said.

In the filing, Nasdaq mentioned other commodity ETFs that have listed options on its platform, including BlackRock's iShares COMEX Gold Trust and the iShares Silver Trust.

Bitcoin ETF flowsAfter two consecutive days of outflows, Bitcoin ETFs saw $45 million in inflows on Aug. 7. Despite Grayscale’s GBTC seeing outflows of $30.7 million, BlackRock's IBIT received $52.5 million in cash.

Balchunas said he was surprised by the inflows as he expected outflows to continue until Bitcoin ETFs saw a reduction in AUM of around 2% to 3%. However, only 0.5% was seen despite BTC dropping 21% on the weekly time frame.

Mentioned in this articleGino MatosGino Matos is a law school graduate and a seasoned journalist with six years of experience in the crypto industry. His expertise primarily focuses on the Brazilian blockchain ecosystem and developments in decentralized finance (DeFi).Assad JafriAJ, a passionate journalist since Yemen's 2011 Arab Spring, has honed his skills worldwide for over a decade. Specializing in financial journalism, he now focuses on crypto reporting.Messari and CryptoRank Research Highlight TRON’s Surging Onchain ActivityLatest Alpha Market ReportWhere are all the stablecoins?CryptoSlate's latest market report dives deep into stablecoin distribution across various metrics to see where the $164 billion market cap is located.Latest Press ReleasesYAWN Token Launches with Ambitious Ecosystem and E-Commerce IntegrationArche Capital to Back Early Stage Blockchain and AI Innovations in Financial ServicesHaven1 and Amazon Web Services (AWS) Announce Partnership for Node Validator

The above is the detailed content of Options Features Likely to Be Added to Spot Bitcoin (BTC) ETFs in Q4: Bloomberg. For more information, please follow other related articles on the PHP Chinese website!

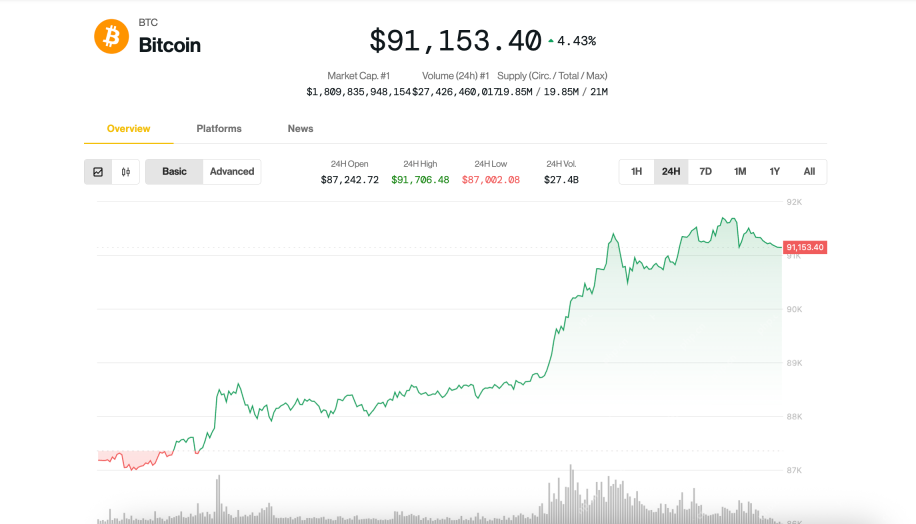

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

SublimeText3 Mac version

God-level code editing software (SublimeText3)