Grayscale GBTC fell more than 11%! Bloomberg James Seyffart: split into mini trusts

This site (120BtC.coM): Grayscale Bitcoin Trust GBTC fell more than 11% yesterday, which once caused market panic. Even Bloomberg analyst James Seyffart jumped out to explain that it was because GBTC split 10% into mini Trusted by BTC.

GBTC split 10% into Mini Trust BTC

Grayscale applied to the SEC for the Grayscale Bitcoin Spot ETF (Grayscale Bitcoin Mini Trust, BTC) in March, but it was only approved recently. Yesterday was the record day for the GBTC split. With the creation of the Grayscale Bitcoin Mini Trust (BTC), 10% of the underlying Bitcoins of the Grayscale Bitcoin Trust (GBTCTrust) were split. As a result, the net asset value of GBTC stock fell by 10% from the previous day (without taking into account the rise and fall of Bitcoin prices).

As explained in the figure below, if GBTC originally cost 10 yuan per share, Mr. A bought 10 shares, and the total investment amount was US$100. After the split, he will hold GBTC of 9 yuan per share and BTC of 1 yuan per share, and the total investment amount will still be US$100 (regardless of the rise and fall of the Bitcoin price). Mr. A does not need to do anything in this process, and the new BTC shares will enter his trust account within a few days.

BTC fee dropped to 0.15%

The time-honored Grayscale Bitcoin Trust GBTC fee is 1.5%, which is much higher than the 0.25% fee of most competitors. Therefore, it faces continued capital outflows after the listing of the Bitcoin spot ETF. Dilemma. This time, with the launch of the mini-version Bitcoin spot ETF BTC, the fee was significantly reduced to 0.15% in an attempt to regain the favor of investors.

GBTC’s current asset size is US$16 billion. Since the listing of the Bitcoin spot ETF in January, US$18.9 billion has flowed out, and more than half of the funds have been lost. Will the listing of the mini version of BTC, coupled with price reduction promotions, help Grayscale Trust’s assets recover?

The above is the detailed content of Grayscale GBTC fell more than 11%! Bloomberg James Seyffart: split into mini trusts. For more information, please follow other related articles on the PHP Chinese website!

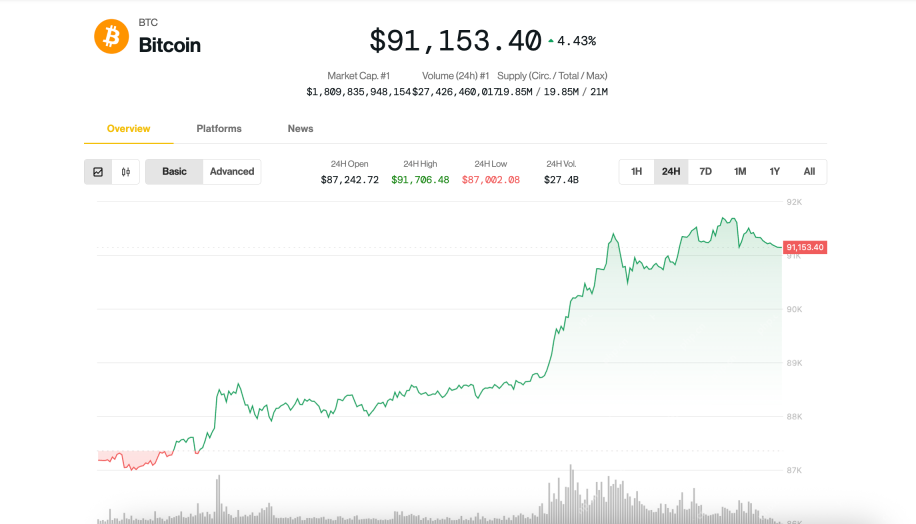

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

SublimeText3 Mac version

God-level code editing software (SublimeText3)