web3.0

web3.0 Bitcoin (BTC) Network Value-to-Transaction (NVT) Ratio Reaches All-Time High, Indicating the Cryptocurrency Could Be Overvalued

Bitcoin (BTC) Network Value-to-Transaction (NVT) Ratio Reaches All-Time High, Indicating the Cryptocurrency Could Be OvervaluedBitcoin (BTC) retrieved a four-month price range above $60,000 after a two-week deviation, trading at $64,000.

Bitcoin (BTC) price hit a four-month high of above $64,000 on July 19; however, a key network value indicator reaching an all-time high suggests that Bitcoin might be overvalued at its current level.

Crucially, data retrieved by Finbold from Santiment showed Bitcoin's Network Value-to-Transaction (NVT) ratio reached an all-time high on Monday. The NVT indicator is often likened to the price-to-earnings (P/E) indicator used in fundamental analysis for stocks.

As a result, Bitcoin's seven-day NVT ratio stands at 151, considering a transaction volume of $19.43 billion at a price of $64,100. In 2021, the Network Value-to-Transaction peaked at 58 as BTC traded at $44,800 and $106.92 billion was transacted on the chain.

At the time, Bitcoin was heading to the top of the last bull cycle, preluding the inevitable correction that followed.

How does Network Value-to-Transaction (NVT) indicate an overvalued Bitcoin?

This indicator is derived by dividing the market capitalization of an asset by its transaction volume. As such, a high NVT ratio is indicative of a high relative valuation, suggesting that an asset is overvalued. Conversely, a low NVT ratio indicates a low relative valuation, suggesting that an asset might be undervalued.

In summary, a high NVT ratio suggests that an asset's price is rising disproportionately to its network activity. This could indicate a speculative demand for the asset without a proportional organic demand, hinting at an impending correction if the network activity does not pick up.

Hence, the high NVT ratio for Bitcoin is mainly caused by an aggressive increase in the BTC price, which was not followed by network activity.

On the other hand, speculative demand remains strong, signaled by high open interest (OI) values and significant inflow to institutional products like the Bitcoin spot ETF. If new buyers continue to surge despite the low network usage, this could help BTC's price sustain the current level.

On June 16, Finbold reported a similar alert for an overvalued Ethereum (ETH) above $3,500, with a 134 NVT. Interestingly, ETH went on to hit a local bottom two weeks later at $3,090, shedding over 11% of its value.

Finbold also covered a concern about the centralization of the Bitcoin network recently, bringing uncertainty to its security.

In a contrasting development, bullish bias is evident among crypto analysts, with different technical analyses pegging BTC at $180,000, according to a chart pattern, or tracing a roadmap directly to $200,000.

As usual, investors should remain cautious and consider different analyses and indicators to improve decision-making in such a volatile market.

The above is the detailed content of Bitcoin (BTC) Network Value-to-Transaction (NVT) Ratio Reaches All-Time High, Indicating the Cryptocurrency Could Be Overvalued. For more information, please follow other related articles on the PHP Chinese website!

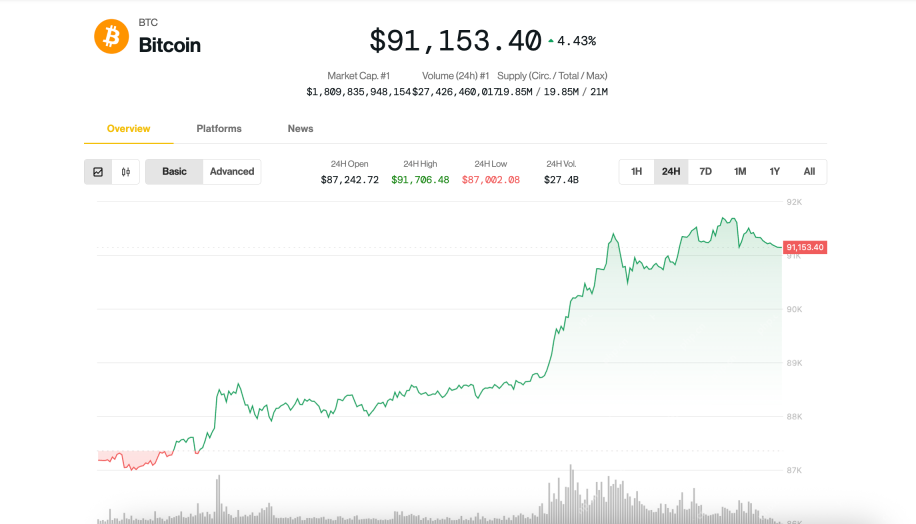

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

SublimeText3 Mac version

God-level code editing software (SublimeText3)