web3.0

web3.0 Bitcoin (BTC) Price Correction Nears the End as Key Metrics Signal a Bullish Reversal in Q3 2024

Bitcoin (BTC) Price Correction Nears the End as Key Metrics Signal a Bullish Reversal in Q3 2024Bitcoin (BTC) Price Correction Nears the End as Key Metrics Signal a Bullish Reversal in Q3 2024

Bitcoin (BTC) price volatility has sparked investor attention, but the price has rebounded to $57,500, indicating resilience in on-chain metrics.

Bitcoin’s recent price volatility has sparked investor attention, dipping to $53,500 amid significant sell-offs by the German government and Mt. Gox creditors. However, the price has since rebounded to $57,500, indicating resilience in on-chain metrics.

Major US institutions like BlackRock and Fidelity are also buying Bitcoin ETFs despite the price drop, while one analysis predicts the market will turn bullish by Q3. Let's examine the key metrics in detail.

Bitcoin Puell Multiple predicts bullish momentum

This bullish analysis comes as a breeze in the current market downturn for investors eyeing an entry in Q3. CryptoQuant’s analysis using the Bitcoin Puell Multiple suggests a potential end to the current correction phase within the ongoing bull market.

Historically, this data reveals that significant drops in the Puell Multiple often indicate strong price rallies, as observed during previous bull cycles in 2016 and 2020.

Bitcoin miner profitability drops 7.8% post halving event

June 2024 saw substantial miner capitulation, with profitability dropping 7.8% since the April halving event. Daily miner revenue fell sharply from $78 million to $26 million, highlighting market stress among miners.

However, it's not over yet…

Many quickly declare the end of this bull market, selling their long-term holdings in capitulation. But a deep dive into on-chain data, compared with previous cycles, indicates that we are still in the early stages of this new bull cycle. Technically, crypto cycles begin post-halving, with an average duration of over 500 days. We’re currently 79 days post the 2024 BTC halving. If we zoom out on the charts, there’s still a long way to go in this bull cycle.

A buying opportunity?

Adding to the bullish sentiment, Santiment’s data shows a decline of 566,000 non-empty Bitcoin wallets since mid-June, reflecting sell-offs by short-term holders amid market uncertainty.

This reduction, often seen at market bottoms, historically presents buying opportunities for patient investors.

Both the 30-day and 365-day Bitcoin MVRV indicators are also currently in the negative zone, indicating the best time to buy Bitcoin. This perfect match in the past has led to substantial returns for investors who entered the market during such periods.

Wait for Q3!

With multiple indicators suggesting a bullish sentiment, including the anticipated start of a bull run in Q3 2024 based on the Puell Multiple, Bitcoin appears poised for a potential price recovery.

However, investor caution is still advised amid ongoing market volatility and regulatory developments. So far the Puell Multiple indicator has perfectly predicted the bottom, bear trap, and peak of BTC in the past three cycles. Based on the Puell Multiple indicators, we are currently in a bear trap and can expect a bullish move from this level.

The above is the detailed content of Bitcoin (BTC) Price Correction Nears the End as Key Metrics Signal a Bullish Reversal in Q3 2024. For more information, please follow other related articles on the PHP Chinese website!

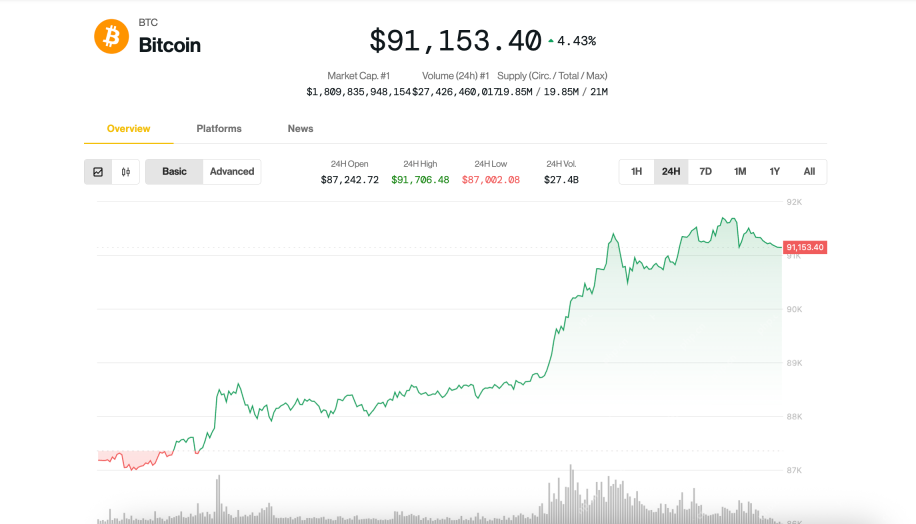

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),