The MiCA regulation had barely come into force via its sections relating to the issuance of stablecoins when Circle, the company issuing USDC, announced that it had become the first issuer of stablecoins in the world to have complied with these new rules imposed on a European scale.

Stablecoin issuer Circle has become the first company in the world to align its stablecoins with the European Union’s MiCA regulation.

The MiCA regulation, which came into force on June 30, 2024, sets out a comprehensive framework for the regulation of crypto-assets in the EU. Among other things, the regulation includes specific provisions for the issuance and circulation of stablecoins.

To comply with MiCA, Circle has obtained approval from the French Prudential Control and Resolution Authority (ACPR) to operate as an electronic money institution (EMI). This approval allows Circle to issue and redeem its USDC and EURC stablecoins in the EU.

According to a press release from Circle, the company’s Circle Mint solution, which is designed for businesses that want to integrate USDC and EURC into their operations, is now available to Circle’s European customers.

“As digital assets become increasingly integrated into traditional finance, it is essential that we establish strong and transparent structures to promote trust and adoption,” said Dante Disparte, Circle’s chief strategy officer and head of global policy, in a statement.

“Today’s announcement reinforces our commitment to building a more inclusive and compliant future for internet finance.”

What does this mean for USDC in Europe?

As of today, all USDC and EURC stablecoins circulating in the EU are compliant with the MiCA regulation.

To align with MiCA, Circle has agreed to certain requirements, including a mandate to fully insure its euro stablecoin at parity. As such, 100% of the reserves used to back the EURC are hosted through Circle France.

USDC will continue to be minted from the United States, but it will now also be minted simultaneously from France to service the European market.

With respect to major European market institutions, whether exchanges, market makers, brokers or institutions, banks, companies and individuals, Circle directly mints and redeems USDC and EURC through Circle Mint France.

These stablecoins are now under the direct supervision of the ACPR, which is responsible for ensuring the proper application of the rules induced by the arrival of MiCA, “the world’s first and most comprehensive crypto-asset regulatory regime,” according to Allaire.

As Allaire noted, European citizens who hold USDC can continue to use it as they wish, whether to exchange it, transact with it or use it in decentralized finance (DeFi).

“For the vast majority of European users who buy, hold or sell USDC or EURC on an exchange or other crypto asset service provider product, nothing changes,” he said.

A complex but necessary process for Circle

Circle’s alignment with the MiCA regulation was made possible with the support of the law firm De Gaulle Fleurance.

Anne Maréchal and Julie Bader, who contributed as associate lawyers for this purpose, told Cryptoast that the compliance process proved to be complex due to the still-nascent aspect of MiCA, requiring a period of adaptation for both the companies wishing to align with MiCA and the committed regulators.

However, these efforts should pay off, as Circle benefits from the status of being the first stablecoin issuer to be regulated on a European scale thanks to the MiCA regulation. In this regard, Maréchal told us that it is the players who understand the importance of regulation who will succeed in the European Union.

“Finance needs leaders to ensure investor safety. Regulation is inevitable. The future of finance will be regulation,” she said.

With the race now open for stablecoin issuers wishing to benefit from the European market, it remains to be seen which company will follow in the footsteps of the giant Circle and its USDC stablecoin.

Its first rival in this segment of the market will not be Tether and its USDT, however, as its CEO Paolo Ardoino pointed out “serious risks for stablecoins regulated in the EU.”

The above is the detailed content of Circle Inaugurates MiCA Regulation with its USDC and EURC. For more information, please follow other related articles on the PHP Chinese website!

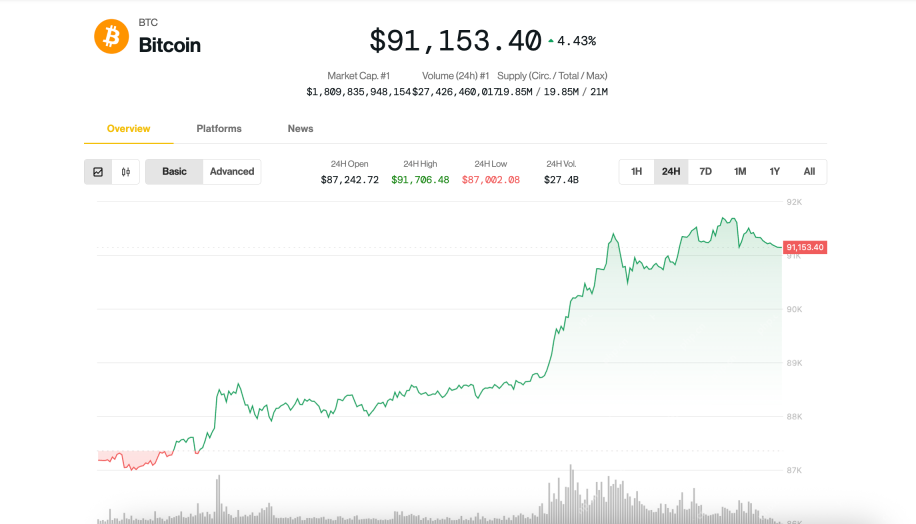

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SublimeText3 Linux new version

SublimeText3 Linux latest version

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

Dreamweaver Mac version

Visual web development tools

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software