What are Bitcoin options? How to calculate the income of Bitcoin options?

In addition to common Bitcoin contracts and currency transactions, Bitcoin options have also become a new investment tool, providing investors with higher-yield but also higher-risk trading tools. It is a derivative product based on Bitcoin contracts that allows investors to speculate or hedge in markets with volatile prices. But the most important thing to know when playing Bitcoin options is to understand how to calculate the income of Bitcoin options? According to the data, its income is mainly divided into buying options, selling options and option closing. Different options have different algorithms. The editor below will tell you in detail.

How to calculate Bitcoin option income?

Bitcoin option income can be divided into three types: buying options, selling options and option closing. It should be noted that early closing is based on the average opening price and the average closing price to calculate the closing price for you. The profit of the position is calculated for you based on the underlying price you purchased and the settlement price on the expiration date.

The profit calculation formula is as follows:

Buy option position profit=(mark price-average opening price)*contract multiplier*number of pieces

Sell option Position profit = (average opening price - mark price) * contract multiplier * number of contracts

option closing profit income = (average closing price - average opening price) * position * contract multiplier

Example:

①A buys 100 BTC options, the buying price is 0.01BTC, the current option mark price is 0.02BTC, income = (0.02-0.01)*0.01*100=0.01BTC

②B sells 100 ETH options. The selling price is 0.2ETH. The current option mark price is 0.1. Profit = (0.2-0.1)*0.1*100=1ETH

Exercise income :

Call option exercise income = (Underlying price - Exercise price) / Underlying price * Contract multiplier * Number of contracts

Put option exercise income = (Exercise price - Underlying price )/Underlying price*Contract multiplier*Number of contracts

In fact, after including the option premium, the buyer’s income is calculated as:

The exercise income of buying a call option=(Underlying price-Exercise price)/underlying price*contract multiplier*number of contracts-option fee

The exercise income of buying a put option=(exercise price-underlying price)/underlying price*contract multiplier*number of contracts-option fee

The seller's income is calculated as:

The exercise income of selling a call option = option fee-(exercise price-underlying price)/underlying price*contract multiplier*number of contracts

Selling put option exercise income = option fee - (underlying price - exercise price)/underlying price * contract multiplier * number of contracts

For example: Xiao Ming bought 20 contracts on the platform The call option on BTCUSD-20200925-7000-C costs an option premium of 0.01 BTC. By 16:00 on September 25, 2020, the final BTC price was US$10,000, and Xiao Ming earned a total of (10,000-7,000)/10,000*0.01*20=0.06 BTC. Subtract the 0.01 BTC option fee spent. Xiao Ming finally got 0.05 BTC

What does the Bitcoin option mean?

Bitcoin options are a type of financial derivative that allow investors to buy or sell Bitcoin at a specific price at a certain time in the future. An options contract gives its holder the right, but not the obligation, to buy (call option) or sell (put option) a certain number of bits at a certain time in the future (expiration date) at an agreed price (strike price) currency.

A call option gives the holder the right to purchase a certain amount of Bitcoin at a predetermined price on the expiration date. If the market price of Bitcoin is higher than the exercise price at expiration, the holder can make a profit by exercising the option to purchase Bitcoin at a price below the market price.

A put option gives the holder the right to sell a certain amount of Bitcoin at a predetermined price on the expiration date. If the market price of Bitcoin is lower than the exercise price at expiration, the holder can make a profit by exercising the option to sell the Bitcoin at a price higher than the market price.

The above is the detailed content of What are Bitcoin options? How to calculate the income of Bitcoin options?. For more information, please follow other related articles on the PHP Chinese website!

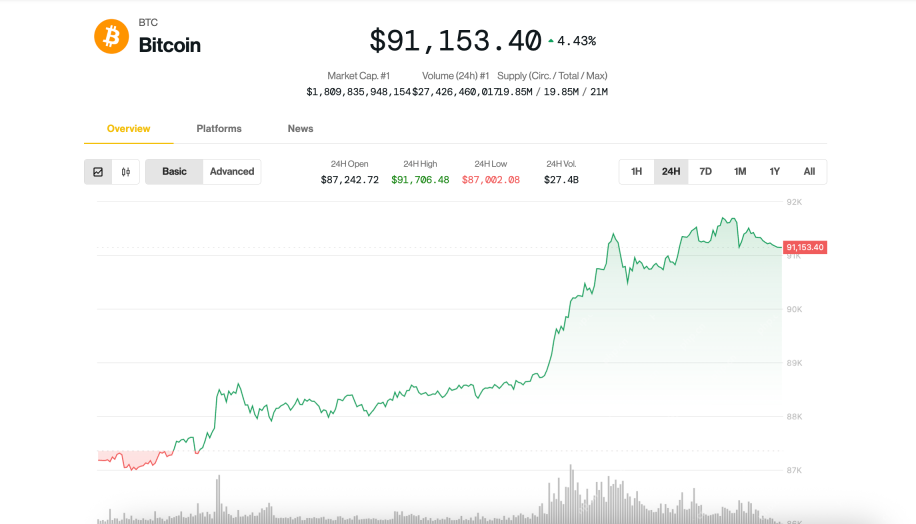

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AM

Bitcoin (BTC) Soars Past $90,000, But Headwinds Persist That Could Cap Further UpsideApr 23, 2025 am 11:22 AMBitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions,

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AM

As XRP Seemed to Gain Clearer Federal Standing, a New Oregon Lawsuit Targeting Crypto Exchange Coinbase Stirs Fresh ConcernsApr 23, 2025 am 11:20 AMAs XRP seemed to gain clearer federal standing, a new Oregon lawsuit targeting crypto exchange Coinbase stirs fresh concerns about potential state-level clampdowns.

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AM

Cardano (ADA) vs Ethereum (ETH): Early Proof-of-Stake and Network DesignApr 23, 2025 am 11:18 AMCardano launched with a proof-of-stake (PoS) system. Ethereum originally used proof-of-work and switched to PoS years later.

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AM

XploraDEX (XPL) Token Distribution Begins, Signaling the Platform's Transition to Active DeploymentApr 23, 2025 am 11:16 AMZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AM

Chainlink (LINK) Is Again in the Spotlight Amidst Price DiscoveryApr 23, 2025 am 11:14 AMDecentralized blockchain oracle network Chainlink (LINK) is again in the spotlight amid price discovery.

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AM

UXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.Apr 23, 2025 am 11:12 AMUXLink is excited to announce its strategic partnership with SolV protocol to unite decentralized technology and traditional finance.

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AM

BlackRock's Spot Bitcoin ETF (IBIT) Records a Massive $4.2 Billion in Trading Volume TodayApr 23, 2025 am 11:10 AMBlackRock’s spot Bitcoin ETF, IBIT, recorded a massive $4.2 billion in trading volume today as the price of Bitcoin soared above $90,000 for the first time since early March

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AM

India's Crypto Investors Shift From Long-Term Holdings to High-Frequency Trading of Meme CoinsApr 23, 2025 am 11:08 AMCoinSwitch, India's largest crypto trading platform, has released fresh insights into the investment and trading behavior of Indian crypto investors for Q1 2025.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

SublimeText3 Chinese version

Chinese version, very easy to use

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.