Quantile regression for time series probabilistic forecasting

Do not change the meaning of the original content, fine-tune the content, rewrite the content, and do not continue writing. "Quantile regression meets this need, providing prediction intervals with quantified chances. It is a statistical technique used to model the relationship between a predictor variable and a response variable, especially when the conditional distribution of the response variable is of interest When. Unlike traditional regression methods, quantile regression focuses on estimating the conditional magnitude of the response variable rather than the conditional mean.”

##Figure (A): Quantile. Regression

##Figure (A): Quantile. Regression

!pip install neuralprophet!pip uninstall numpy!pip install git+https://github.com/ourownstory/neural_prophet.git numpy==1.23.5Import the required libraries.

%matplotlib inlinefrom matplotlib import pyplot as pltimport pandas as pdimport numpy as npimport loggingimport warningslogging.getLogger('prophet').setLevel(logging.ERROR)warnings.filterwarnings("ignore")

DatasetShared bicycle data. The dataset is a multivariate dataset that contains daily rental demand as well as other weather fields such as temperature or wind speed.

data = pd.read_csv('/bike_sharing_daily.csv')data.tail()

Picture (B): Shared bicycles

Picture (B): Shared bicycles

# convert string to datetime64data["ds"] = pd.to_datetime(data["dteday"])# create line plot of sales dataplt.plot(data['ds'], data["cnt"])plt.xlabel("date")plt.ylabel("Count")plt.show()

Figure (C): Daily demand for bicycle rental

Figure (C): Daily demand for bicycle rental

df = data[['ds','cnt']]df.columns = ['ds','y']

构建分位数回归模型

直接在 NeuralProphet 中构建分位数回归。假设我们需要第 5、10、50、90 和 95 个量级的值。我们指定 quantile_list = [0.05,0.1,0.5,0.9,0.95],并打开参数 quantiles = quantile_list。

from neuralprophet import NeuralProphet, set_log_levelquantile_list=[0.05,0.1,0.5,0.9,0.95 ]# Model and predictionm = NeuralProphet(quantiles=quantile_list,yearly_seasnotallow=True,weekly_seasnotallow=True,daily_seasnotallow=False)m = m.add_country_holidays("US")m.set_plotting_backend("matplotlib")# Use matplotlibdf_train, df_test = m.split_df(df, valid_p=0.2)metrics = m.fit(df_train, validation_df=df_test, progress="bar")metrics.tail()分位数回归预测

我们将使用 .make_future_dataframe()为预测创建新数据帧,NeuralProphet 是基于 Prophet 的。参数 n_historic_predictions 为 100,只包含过去的 100 个数据点。如果设置为 True,则包括整个历史数据。我们设置 period=50 来预测未来 50 个数据点。

future = m.make_future_dataframe(df, periods=50, n_historic_predictinotallow=100) #, n_historic_predictinotallow=1)# Perform prediction with the trained modelsforecast = m.predict(df=future)forecast.tail(60)

预测结果存储在数据框架 predict 中。

图 (D):预测

图 (D):预测

上述数据框架包含了绘制地图所需的所有数据元素。

m.plot(forecast, plotting_backend="plotly-static"#plotting_backend = "matplotlib")

预测区间是由分位数值提供的!

图 (E):分位数预测

图 (E):分位数预测

预测区间和置信区间的区别

预测区间和置信区间在流行趋势中很有帮助,因为它们可以量化不确定性。它们的目标、计算方法和应用是不同的。下面我将用回归来解释两者的区别。在图(F)中,我在左边画出了线性回归,在右边画出了分位数回归。

图(F):置信区间与预测区间的区别

图(F):置信区间与预测区间的区别

首先,它们的目标不同:

- 线性回归的主要目标是找到一条线,使预测值尽可能接近给定自变量值时因变量的条件均值。

- 分位数回归旨在提供未来观测值的范围,在一定的置信度下。它估计自变量与因变量条件分布的不同量化值之间的关系。

其次,它们的计算方法不同:

- 在线性回归中,置信区间是对自变量系数的区间估计,通常使用普通最小二乘法 (OLS) 找出数据点到直线的最小总距离。系数的变化会影响预测的条件均值 Y。

- 在分位数回归中,你可以选择依赖变量的不同量级来估计回归系数,通常是最小化绝对偏差的加权和,而不是使用OLS方法。

第三,它们的应用不同:

- 在线性回归中,预测的条件均值有 95% 的置信区间。置信区间较窄,因为它是条件平均值,而不是整个范围。

- 在分位数回归中,预测值有 95% 的概率落在预测区间的范围内。

写在最后

本文介绍了分位数回归预测区间的概念,以及如何利用 NeuralProphet 生成预测区间。我们还强调了预测区间和置信区间之间的差异,这在商业应用中经常引起混淆。后面将继续探讨另一项重要的技术,即复合分位数回归(CQR),用于预测不确定性。

The above is the detailed content of Quantile regression for time series probabilistic forecasting. For more information, please follow other related articles on the PHP Chinese website!

Tesla's Robovan Was The Hidden Gem In 2024's Robotaxi TeaserApr 22, 2025 am 11:48 AM

Tesla's Robovan Was The Hidden Gem In 2024's Robotaxi TeaserApr 22, 2025 am 11:48 AMSince 2008, I've championed the shared-ride van—initially dubbed the "robotjitney," later the "vansit"—as the future of urban transportation. I foresee these vehicles as the 21st century's next-generation transit solution, surpas

Sam's Club Bets On AI To Eliminate Receipt Checks And Enhance RetailApr 22, 2025 am 11:29 AM

Sam's Club Bets On AI To Eliminate Receipt Checks And Enhance RetailApr 22, 2025 am 11:29 AMRevolutionizing the Checkout Experience Sam's Club's innovative "Just Go" system builds on its existing AI-powered "Scan & Go" technology, allowing members to scan purchases via the Sam's Club app during their shopping trip.

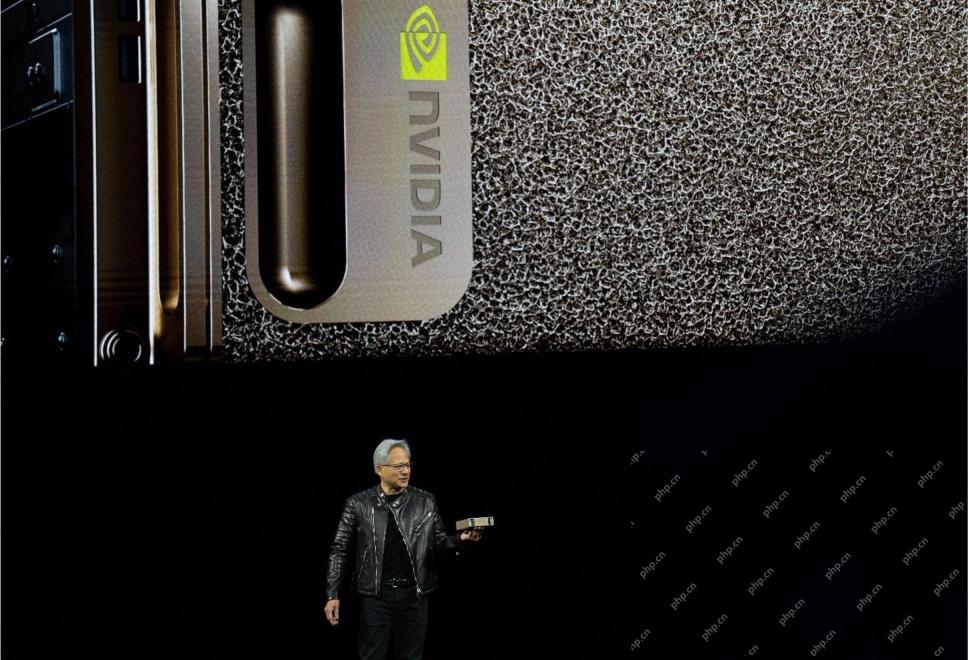

Nvidia's AI Omniverse Expands At GTC 2025Apr 22, 2025 am 11:28 AM

Nvidia's AI Omniverse Expands At GTC 2025Apr 22, 2025 am 11:28 AMNvidia's Enhanced Predictability and New Product Lineup at GTC 2025 Nvidia, a key player in AI infrastructure, is focusing on increased predictability for its clients. This involves consistent product delivery, meeting performance expectations, and

Exploring the Capabilities of Google's Gemma 2 ModelsApr 22, 2025 am 11:26 AM

Exploring the Capabilities of Google's Gemma 2 ModelsApr 22, 2025 am 11:26 AMGoogle's Gemma 2: A Powerful, Efficient Language Model Google's Gemma family of language models, celebrated for efficiency and performance, has expanded with the arrival of Gemma 2. This latest release comprises two models: a 27-billion parameter ver

The Next Wave of GenAI: Perspectives with Dr. Kirk Borne - Analytics VidhyaApr 22, 2025 am 11:21 AM

The Next Wave of GenAI: Perspectives with Dr. Kirk Borne - Analytics VidhyaApr 22, 2025 am 11:21 AMThis Leading with Data episode features Dr. Kirk Borne, a leading data scientist, astrophysicist, and TEDx speaker. A renowned expert in big data, AI, and machine learning, Dr. Borne offers invaluable insights into the current state and future traje

AI For Runners And Athletes: We're Making Excellent ProgressApr 22, 2025 am 11:12 AM

AI For Runners And Athletes: We're Making Excellent ProgressApr 22, 2025 am 11:12 AMThere were some very insightful perspectives in this speech—background information about engineering that showed us why artificial intelligence is so good at supporting people’s physical exercise. I will outline a core idea from each contributor’s perspective to demonstrate three design aspects that are an important part of our exploration of the application of artificial intelligence in sports. Edge devices and raw personal data This idea about artificial intelligence actually contains two components—one related to where we place large language models and the other is related to the differences between our human language and the language that our vital signs “express” when measured in real time. Alexander Amini knows a lot about running and tennis, but he still

Jamie Engstrom On Technology, Talent And Transformation At CaterpillarApr 22, 2025 am 11:10 AM

Jamie Engstrom On Technology, Talent And Transformation At CaterpillarApr 22, 2025 am 11:10 AMCaterpillar's Chief Information Officer and Senior Vice President of IT, Jamie Engstrom, leads a global team of over 2,200 IT professionals across 28 countries. With 26 years at Caterpillar, including four and a half years in her current role, Engst

New Google Photos Update Makes Any Photo Pop With Ultra HDR QualityApr 22, 2025 am 11:09 AM

New Google Photos Update Makes Any Photo Pop With Ultra HDR QualityApr 22, 2025 am 11:09 AMGoogle Photos' New Ultra HDR Tool: A Quick Guide Enhance your photos with Google Photos' new Ultra HDR tool, transforming standard images into vibrant, high-dynamic-range masterpieces. Ideal for social media, this tool boosts the impact of any photo,

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

Zend Studio 13.0.1

Powerful PHP integrated development environment

SublimeText3 Linux new version

SublimeText3 Linux latest version

Atom editor mac version download

The most popular open source editor

SublimeText3 English version

Recommended: Win version, supports code prompts!