Home >Technology peripherals >AI >bunq launches Finn AI tool to quickly query consumer spending

bunq launches Finn AI tool to quickly query consumer spending

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-01-04 18:25:521003browse

IT House reported on December 25 that bunq, Europe’s second largest online banking institution, recently launched an artificial intelligence tool called “Finn”, becoming the first European bank to adopt artificial intelligence technology. Financial Institutions

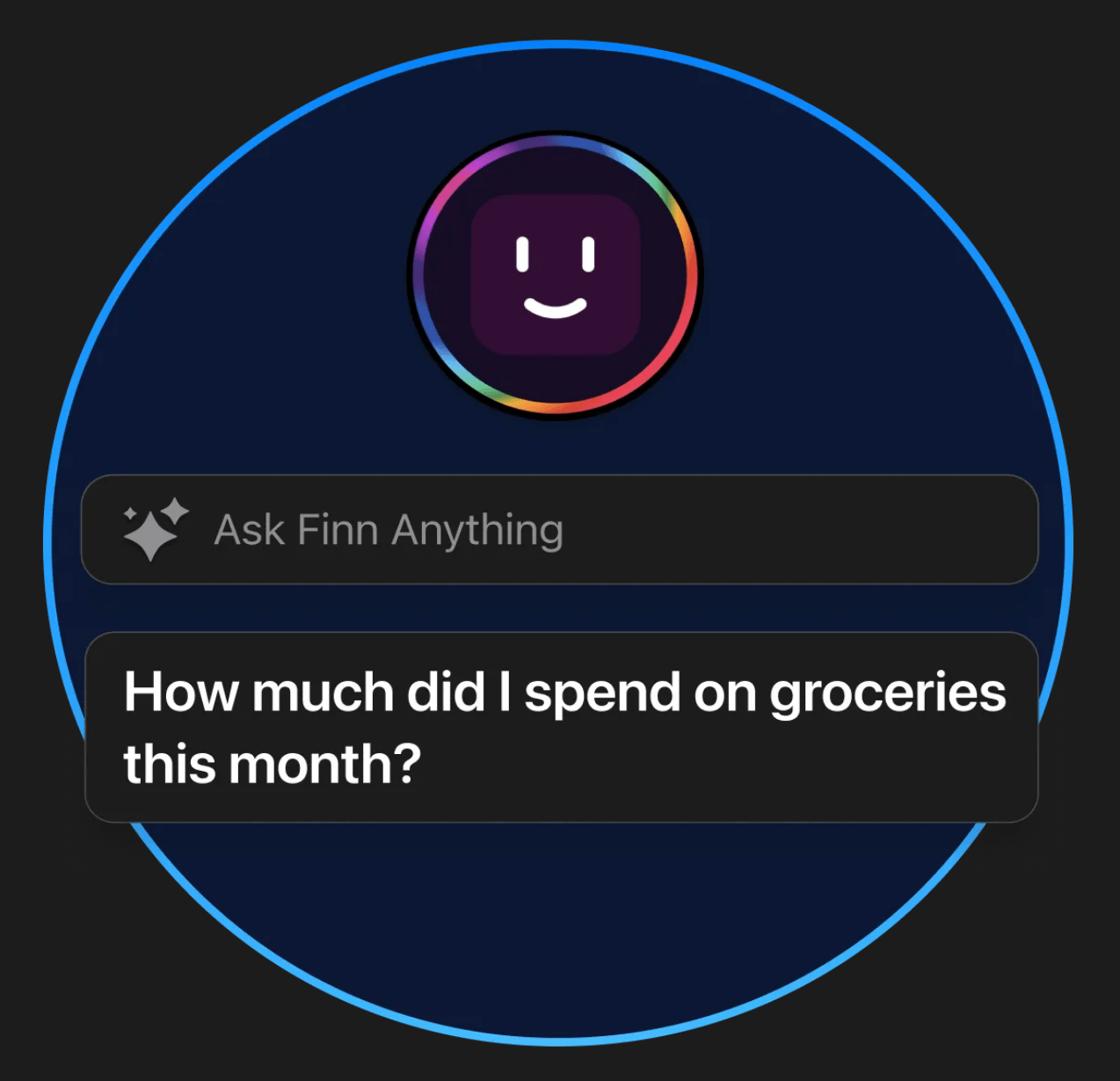

It is reported that an AI tool called Finn allows users to directly raise "consumption issues" through dialogue. Users can directly ask how much they spend on specific categories of consumption, such as "average monthly spending on food and daily necessities" or "total annual consumption on the Amazon platform"

bunq claims that Finn AI’s biggest advantage over its competitors is “the complete integration of all users’ billing and location information” because “the bank has successfully established connections with multiple upstream and downstream companies” to achieve this "Accurate analysis of user billing information"

IT House noticed that this AI assistant can also answer questions based on the transaction location and transaction time. For example, users can ask the AI: "Which restaurant did I spend $200 on with a friend last time?" or "How much do I spend on coffee near Central Park every year?" Such complex questions

▲ Picture source bunq official website

In the field of personal finance, for some people who pay attention to daily accounting, it is indeed very useful to introduce the "AI analysis" function into billing information. After inquiries from IT House, although the current mainstream payment applications provide the "expenditure classification" function, they still lack flexibility compared to the "conversational bill inquiry tool". However, it is only a matter of time before the relevant functions are implemented

The above is the detailed content of bunq launches Finn AI tool to quickly query consumer spending. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Technology trends to watch in 2023

- How Artificial Intelligence is Bringing New Everyday Work to Data Center Teams

- Can artificial intelligence or automation solve the problem of low energy efficiency in buildings?

- OpenAI co-founder interviewed by Huang Renxun: GPT-4's reasoning capabilities have not yet reached expectations

- Microsoft's Bing surpasses Google in search traffic thanks to OpenAI technology