Home >Technology peripherals >AI >NVIDIA's GeForce GPUs are selling well, but its AI GPU sales are even scarier

NVIDIA's GeForce GPUs are selling well, but its AI GPU sales are even scarier

- PHPzforward

- 2023-11-23 17:29:04613browse

Data center revenue increased by 279% compared with the same period last year.

Most computer users and enthusiasts are probably most familiar with NVIDIA for its decades-old GeForce graphics cards for gaming PCs, but more recently NVIDIA's server GPU business has made GeForce look like a hobby project.

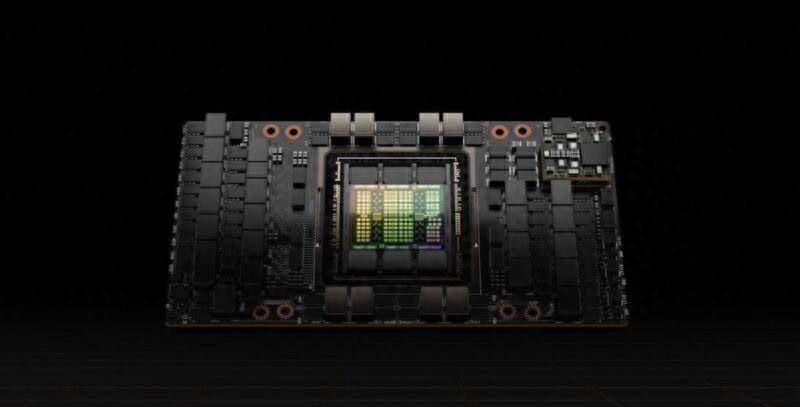

NVIDIA’s third-quarter earnings report showed that the company’s revenue increased 206% from the same period last year and 34% from the second quarter. The company's total revenue was $18.12 billion, of which $14.51 billion came from its data center segment, which includes the artificial intelligence acceleration chip H200 Tensor Core GPU and other cloud and server products

While GeForce revenue was much smaller at $2.86 billion, it was still a solid recovery compared to the same quarter in Nvidia's fiscal 2023, when GeForce GPU revenue was just $1.51 billion, compared with $1.51 billion in 2022 This was a 51% decrease compared to the fiscal year. Nvidia released several new mainstream GeForce RTX 40-series GPUs this year, including the $299 RTX 4060. While these more affordable GPUs aren't spectacular upgrades from previous generation graphics cards, data from the Steam Hardware Survey shows adoption of the RTX 4060 and 4060 Ti has been quite rapid, outpacing competing GPUs like AMD's RX 7600 or Intel's Arc series .

The company's overall revenue numbers weren't as good a year ago, with revenue down 17% year over year in the third quarter of fiscal 2023. The quarter before that came after the company missed its own forecast by $1.4 billion as sales fell due to a GPU oversupply and a cryptocurrency mining collapse.

Demand for Nvidia’s AI acceleration GPUs may not fluctuate much compared to demand for crypto mining GPUs. First, some major companies have spent a lot of money to purchase almost all HGX GPUs produced by Nvidia, and companies such as Microsoft and Amazon continue to make major AI announcements and investments. In addition, Nvidia also said that it is cooperating with Dropbox, Foxconn, Lenovo and other companies to carry out various artificial intelligence projects. Nvidia's dominance in PC and workstation graphics is likely to be further strengthened as software tools are designed and optimized first for Nvidia's chips

However, the case of cryptocurrency mining is revealing. If this bubble bursts, or competing products from AMD or Intel start to undercut Nvidia's sales, Nvidia could face a few tough quarters before revenue numbers return to normal levels. Nvidia has also encountered difficulties in selling its artificial intelligence chips in China. Due to U.S. export restrictions on certain high-performance chips, Nvidia has been forced to modify or stop providing some products to comply with regulations

Nvidia’s workstation GPU and automotive divisions are also growing year by year, but at $416 million and $261 million respectively, the contribution of these two divisions to Nvidia’s profits is much lower than that of data center or GeForce products.

If friends like it, please pay attention to "Knowing the New"!

The above is the detailed content of NVIDIA's GeForce GPUs are selling well, but its AI GPU sales are even scarier. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Technology trends to watch in 2023

- How Artificial Intelligence is Bringing New Everyday Work to Data Center Teams

- Can artificial intelligence or automation solve the problem of low energy efficiency in buildings?

- OpenAI co-founder interviewed by Huang Renxun: GPT-4's reasoning capabilities have not yet reached expectations

- Microsoft's Bing surpasses Google in search traffic thanks to OpenAI technology