Home >Technology peripherals >AI >SoftBank, Temasek, and Saudi Aramco suddenly invested in shares, 'the first collaborative robot stock' to save shares: powerful enemies are around, and continuous blood loss is the norm

SoftBank, Temasek, and Saudi Aramco suddenly invested in shares, 'the first collaborative robot stock' to save shares: powerful enemies are around, and continuous blood loss is the norm

- 王林forward

- 2023-06-15 14:51:421725browse

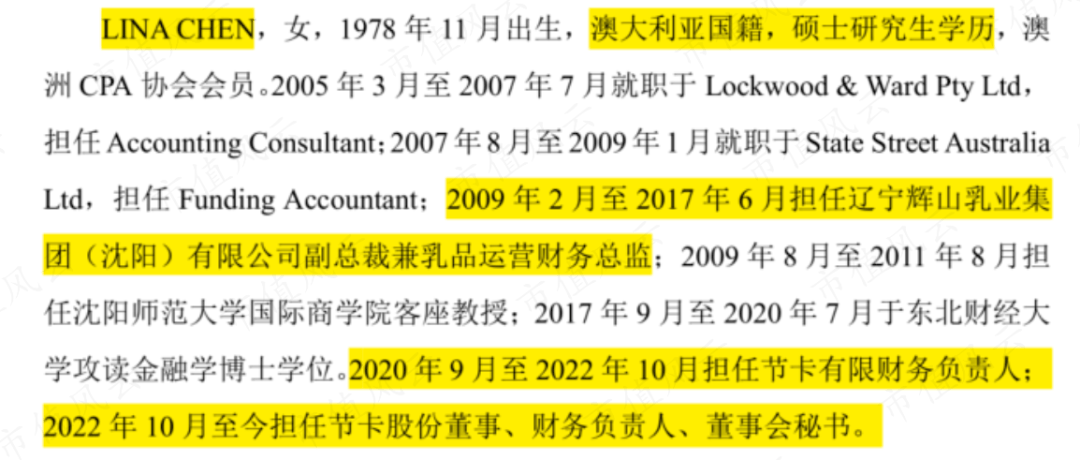

The current CFO once served during the financial fraud period of Huishan Dairy.

Author | Fusu

Editor | Xiaobai

Recently, the Science and Technology Innovation Board IPO application of Jieka Robot Co., Ltd. ("Jieka Co., Ltd.", the "Company") has been accepted by the Shanghai Stock Exchange and is currently in the inquiry stage.

(Source: Shanghai Stock Exchange)

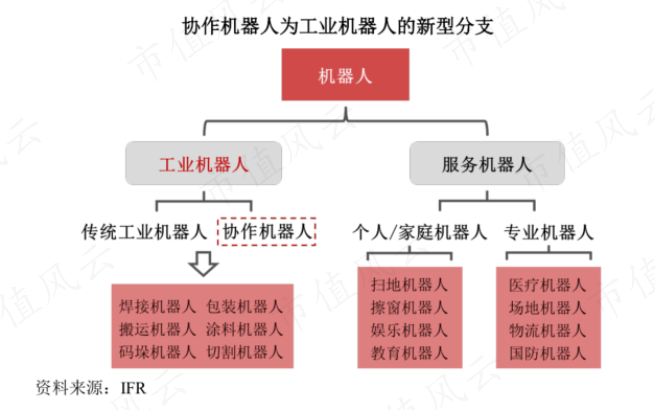

The company focuses on the field of collaborative robots, which is a new branch of industrial robots.

(Source: Company Prospectus)

According to the prospectus, major global manufacturers focusing on this segment also include Universal Robots, Aobo Intelligence and Elite Robots.

Among them, the Danish manufacturer Universal Robots was acquired by Teradyne (TER.O) in 2015, and the other domestic manufacturers have not been listed on the market.

Can the company become the “first collaborative robot stock” in China?

The penetration rate is still low, but the localization rate is high

In industrial and manufacturing scenarios, due to safety considerations, traditional industrial robots need to remain relatively independent of people in space when working, while collaborative robots place more emphasis on being able to work collaboratively with people in the same work space.

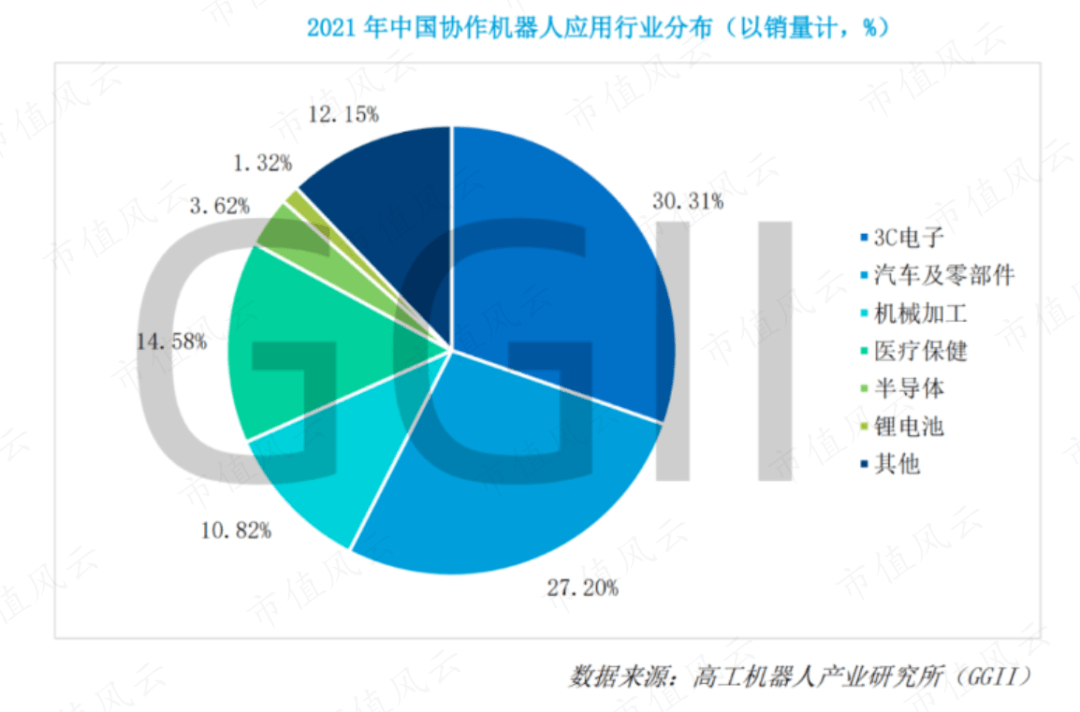

Domestic collaborative robots are mainly used in two main fields: 3C electronics (accounting for about 30% in 2021) and automobiles and their parts (accounting for about 27%).

(Source: GGII "2022 Collaborative Robot Industry Development Blue Book")

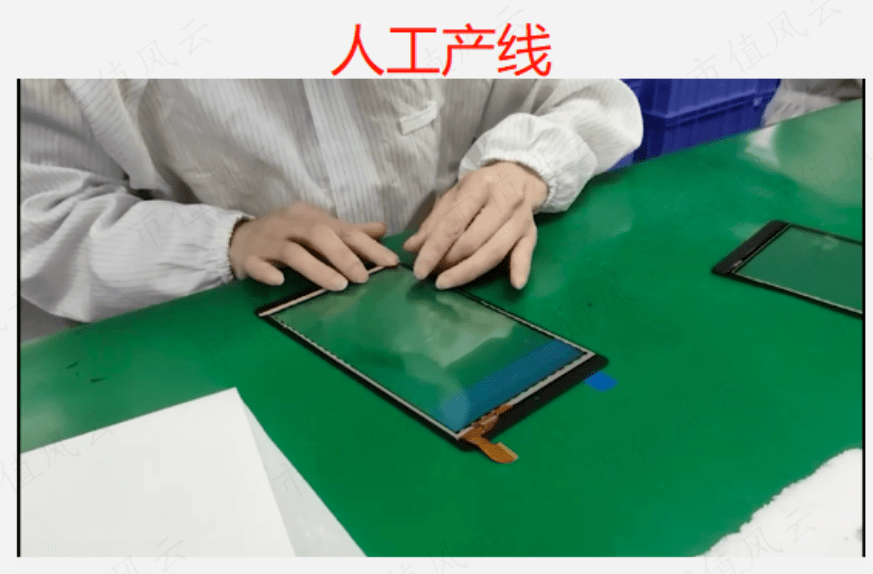

For example, a certain 3C electronics factory originally installed a manual production line for touch screen gluing, which required skilled workers to glue different types of screens.

Because gluing requires high precision, manual operation is time-consuming and laborious, and the production efficiency can only reach 100 pieces per person per hour. Manufacturers have long been faced with the labor problem of "it is difficult to hire newbies and it is difficult to recruit experienced ones".

(Case source: company official website)

After the automation upgrade, collaborative robots replaced workers in applying films, and the efficiency increased to about 2,000 pieces/hour/unit.

Nowadays, workers only need to perform a line change operation every 10 minutes. This work can be performed by ordinary workers after one hour of training, and manufacturers no longer need to equip skilled workers.

(Case source: company official website)

As an emerging field of industrial robots, collaborative robots have a low penetration rate at this stage.

According to GGII data, domestic sales of collaborative robots will reach 18,000 units in 2021, with a market size of approximately 2.1 billion yuan. According to MIR data, domestic industrial robot shipments reached 256,000 units during the same period, with a market size of approximately 44.6 billion yuan.

However, compared with traditional industrial robots, collaborative robots have a higher localization rate.

Due to the late start of industrial robots in my country, the overall market is still dominated by foreign brands. The domestic share of industrial robots of foreign brands such as ABB, KUKA, FANUC, and Yaskawa has long exceeded 60%.

(Source: Topstar 2022 Annual Report)

In terms of collaborative robots, Danish manufacturer Universal Robots launched its first commercial product UR5 in 2008.

Domestic manufacturers such as Jieka Co., Ltd., Aobo Intelligence, Elite Robot, etc., although they did not launch collaborative robot products until 2015-2019, they have made rapid progress in occupying the domestic market.

According to GGII data, in 2021, the localization rate of collaborative robots was 79.0%, an increase of 9.6 percentage points from the previous year.

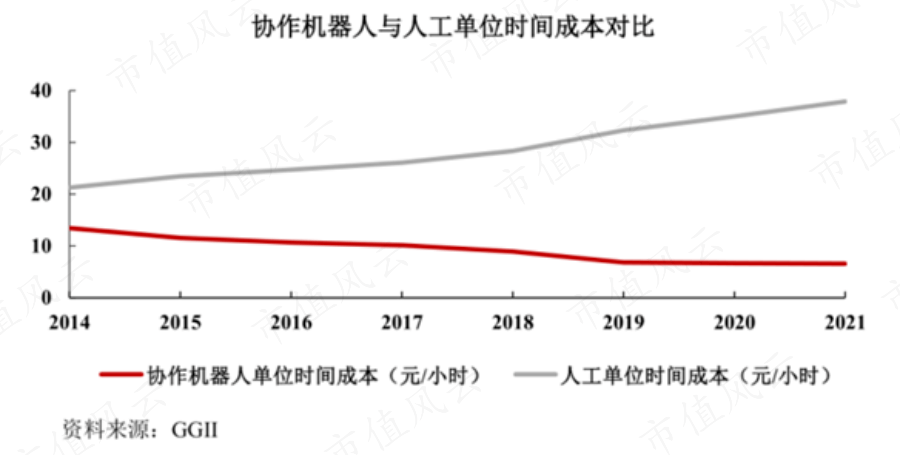

One of the reasons for the rapid increase in the degree of domestic substitution of collaborative robots is that the increase in domestic labor costs in recent years has intensified the urgency of "machine substitution" for enterprises. Since domestic brands are closely close to local industrial groups, they have the "advantage of close proximity."

According to GGII data, from the perspective of end customer usage costs, in 2021, the unit time cost of collaborative robots will be 6.6 yuan/hour, while the labor cost will be 37.9 yuan/hour, which is nearly 6 times the former.

(Source: Company Prospectus)

The industry has passed the outbreak period

(1) The competitive landscape is poor and the CFO is from Huishan Dairy

Jieka Co., Ltd. was established in 2014. Its main business is the research and development, production and sales of collaborative robot products and system integration.

The company stated in the prospectus that based on sales volume in 2021, the company's global market share is approximately 6%, making it a first-tier enterprise in the industry.

(Source: Company Prospectus)

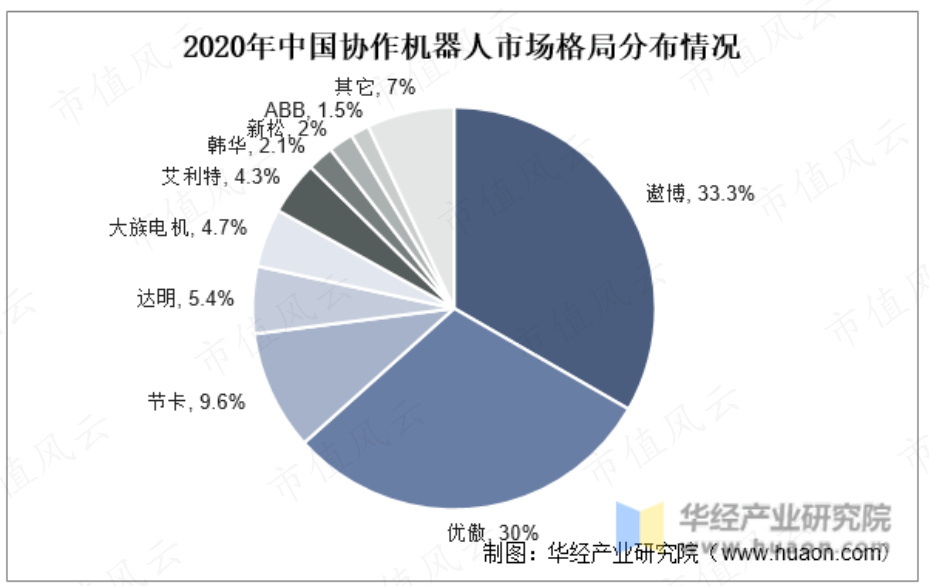

However, according to data from the Huajing Industrial Research Institute, the market concentration of the domestic collaborative robot industry is relatively high. The combined market share of Aobo Intelligent and Universal Robots exceeds 60%, forming a duopoly competition pattern.

In 2020, the company was the third largest manufacturer of collaborative robots in China, with a market share of 9.6%, significantly lagging behind the two leaders.

(Source: Huajing Intelligence Network)

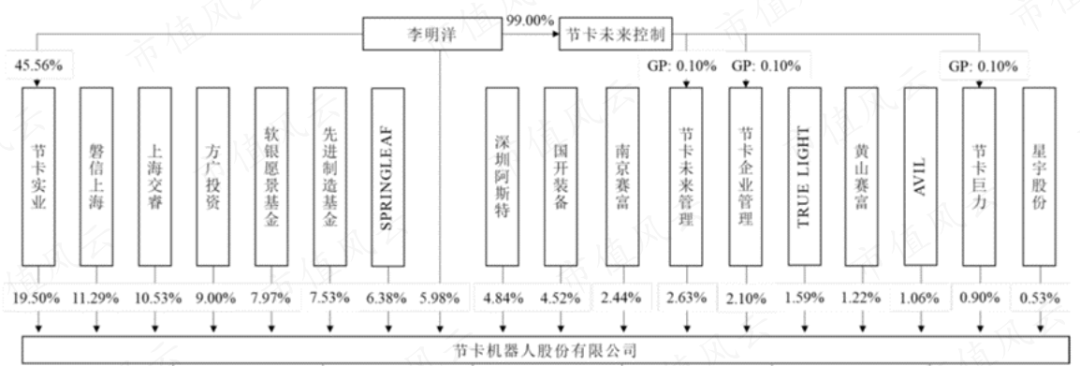

But this has not affected the company's luxurious shareholder lineup, including Advanced Manufacturing Fund, Temasek (note: through SPRINGLEAF and TRUE LIGHT), Saudi Aramco (note: through AVIL), SoftBank Vision Fund, etc.

Disclosure shows that the company’s equity distribution is relatively even, with no shareholder holding more than 20% of the shares and no controlling shareholder. The largest shareholder is Jieka Industrial, directly holding 19.50% of the shares.

(Source: Company Prospectus)

Li Mingyang, the founder and chairman of the company, is the actual controller. He directly holds 5.98% of the shares. He also controls 35.65% of the voting rights through a concerted action agreement, and ultimately controls 41.63% of the voting rights in total.

It is worth mentioning that foreign shareholders SoftBank (holding 7.97%), Temasek (holding 7.97%) and Saudi Aramco (holding 1.06%) all entered the market in the first half of 2022 before the IPO. .

In other words, these top institutions are also here to give it a try and turn bicycles into motorcycles. For the company, it is another round of valuation.

According to public reports, the last round of financing before the IPO pushed the company’s valuation to approximately 3.5 billion yuan.

With the entry of new shareholders such as SoftBank, Li Mingyang personally cashed out nearly 19 million yuan through equity transfer.

In addition, Fengyun Jun was also surprised to find that Lina Chen, who also benefited from the transfer of Jieka Industrial equity in this round of financing, actually has a close relationship with the notorious Huishan Dairy.

(Source: Company Prospectus)

Lina Chen is a member of the company's core management and indirect shareholder. She is currently the company's director, financial director and secretary to the board of directors, and has worked in Jieka Industrial, Jieka Future Management and Jieka Enterprise Management (Note: Company Employee Stock Ownership Platform) Both hold a small number of shares.

(Source: Company Prospectus)

According to disclosures, Lina Chen served as vice president and dairy operations financial director of Liaoning Huishan Dairy Group (Shenyang) Co., Ltd. ("Liaoning Huishan Dairy") from 2009 to 2017, serving for 8 years.

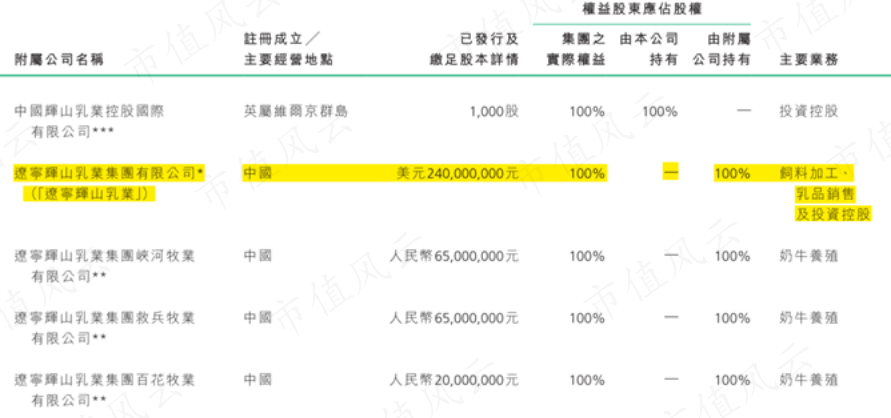

Liaoning Huishan Dairy is a wholly-owned subsidiary of Huishan Dairy, a former Hong Kong-listed enterprise. Its main business is feed processing, dairy sales and investment holding. It is the main operating entity of Huishan Dairy.

(Source: Huishan Dairy 2016 Annual Report)

In 2016, the well-known short-selling institution Muddy Waters issued an announcement to short-sell Huishan Dairy, accusing the latter of financial fraud and inflated profits since at least 2014. Judging from the time point, it happened to be during Lina Chen's tenure.

Huishan Dairy denied it at the time, but a debt crisis broke out in March 2017, causing the stock price to plummet, triggering a mandatory trading suspension on the Hong Kong Stock Exchange, and was eventually officially delisted in 2019.

Judging from Lina Chen’s resume, she quickly left Huishan Dairy after its debts exploded, and then studied for a doctorate in finance at Dongbei University of Finance and Economics from September 2017 to July 2020.

In September 2020, Lina Chen, who had not yet obtained her doctorate, left school early and "seamlessly connected" to join the company's predecessor, Jieka Co., Ltd., and has since served as the financial director.

(2) Revenue is unstable and powerful enemies are waiting around

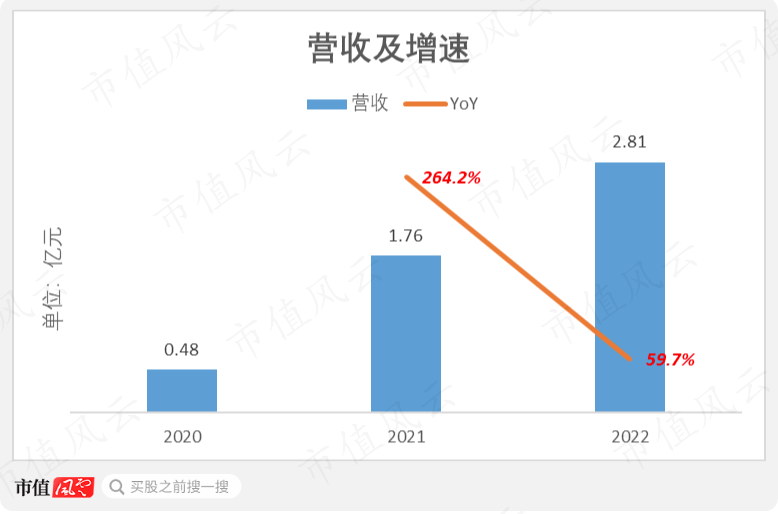

From 2020 to 2022, the company's revenue increased from 50 million yuan to 280 million yuan, with a CAGR of 141% during the period. The overall growth rate is relatively fast, but it is still a younger brother.

However, the company’s revenue growth rate is not stable, with year-on-year increases of 264% and 60% in 2021 and 2022 respectively.

(Chart: Market Value Fengyun App)

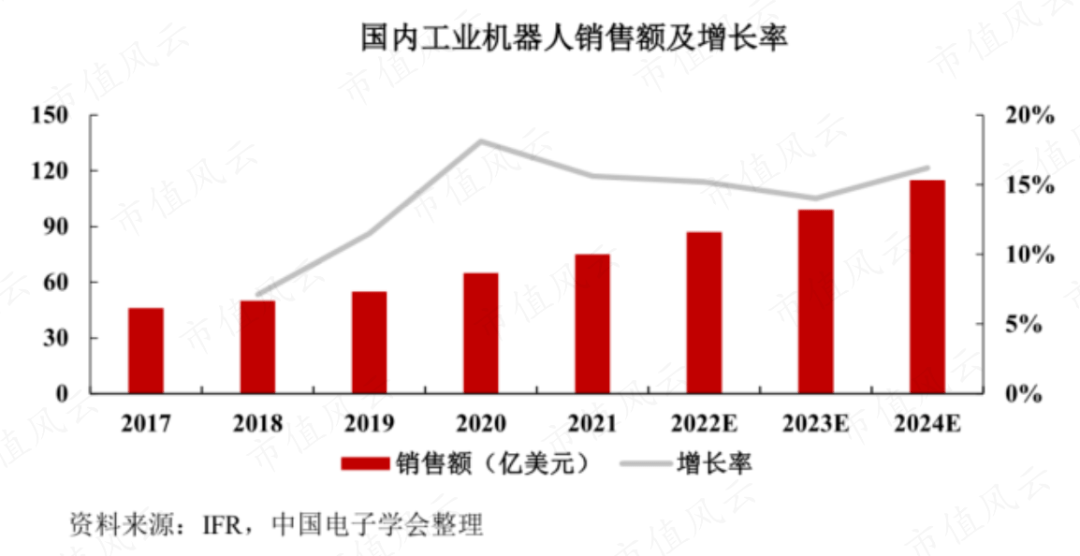

The company's growth comes more from the industry as a whole.

According to data from the China Business Intelligence Network, the domestic collaborative robot market size will increase by 77% year-on-year in 2021, the highest growth rate in the past five years, and then fall back to 31% in 2022.

(Source: China Business Intelligence Network)

It is expected that in 2023, the domestic collaborative robot market will increase by 18% year-on-year, which is close to the growth rate of the entire industrial robot industry.

(Source: Company Prospectus)

To sum up, the outbreak period of the domestic collaborative robot industry is basically over. When the industry dividends fade away, it will be the time for all manufacturers to go into battle and compete for strength.

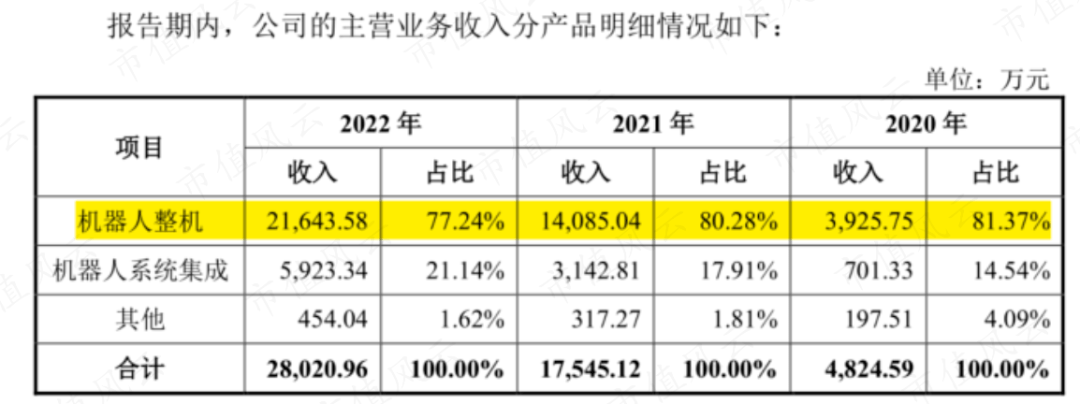

The company's revenue mainly comes from the collaborative robot machine business and the robot system integration business.

(Source: Company Prospectus)

Among them, the complete robot machine is a standardized product. After the customer purchases it, it can realize automated operations through simple programming and assembly of end tools; the robot system integration business is a customer-customized product.

The complete robot has always been the company's core product, but its revenue share has declined slightly in recent years. Revenue in 2022 will be 220 million yuan, a year-on-year increase of 54%, accounting for 77% of the total revenue, a decrease of 4.1% from 2020. percentage points.

At the same time, the proportion of revenue from robot system integration has increased. Revenue in 2022 will be 59.23 million yuan, a year-on-year increase of 88%, accounting for 21% of total revenue, an increase of 6.6 percentage points from 2020.

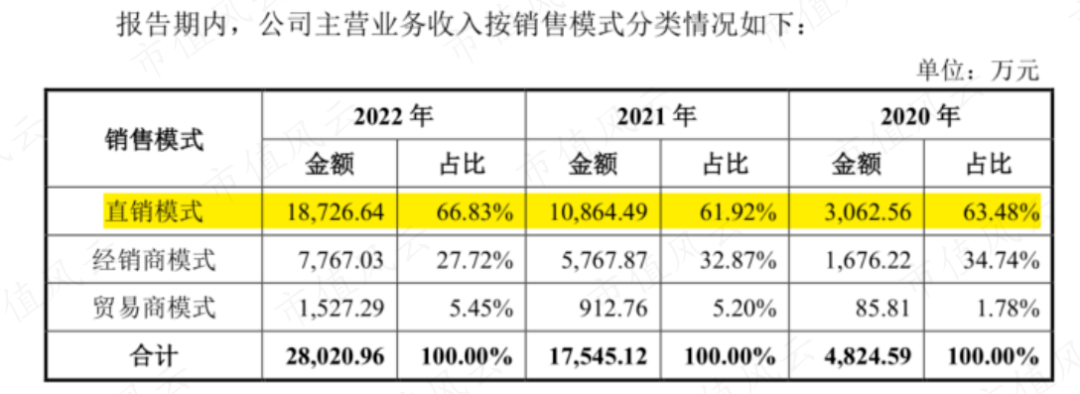

The company's sales model is mainly direct sales, which accounts for more than 60% of revenue, and is relatively stable overall.

(Source: Company Prospectus)

Large customers are of high importance to the company, especially the robot system integration business with long-term projects. The latter's customer relationship usually lasts for 2-3 years, while the complete robot business is often a "one-time transaction." ".

From 2020 to 2022, the total sales proportion of the top five customers will be more than 40%, and in 2022 it will be 47%.

(Source: Company Prospectus)

In fact, robot products are increasingly becoming customized, which has become a major trend in the industrial robot industry as a whole.

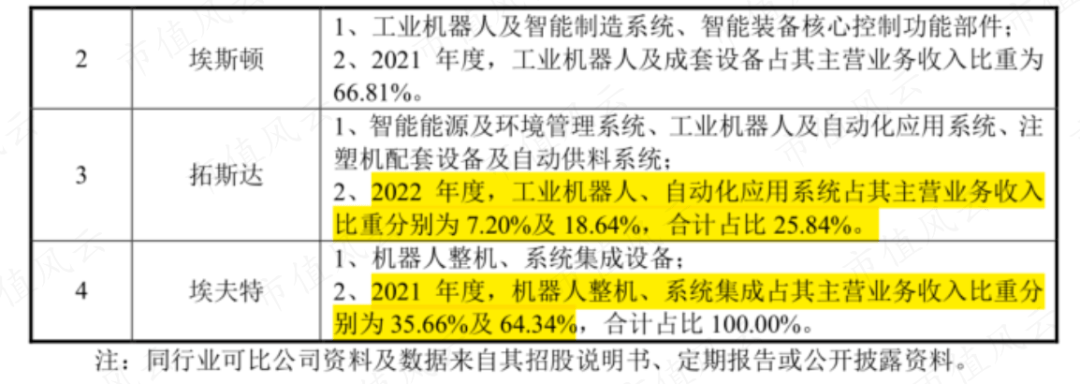

Take the four traditional industrial robot companies KUKA (Note: Acquired by Midea), Eston (002747.SZ), Topstar (300607.SZ) and Eft (688165.SH) as examples. .

Currently, KUKA’s revenue share of complete robot machines and system integration is close to the same; the revenue share of Topstar and Evert is mainly based on system integration, supplemented by complete robot machines.

(Source: Company Prospectus)

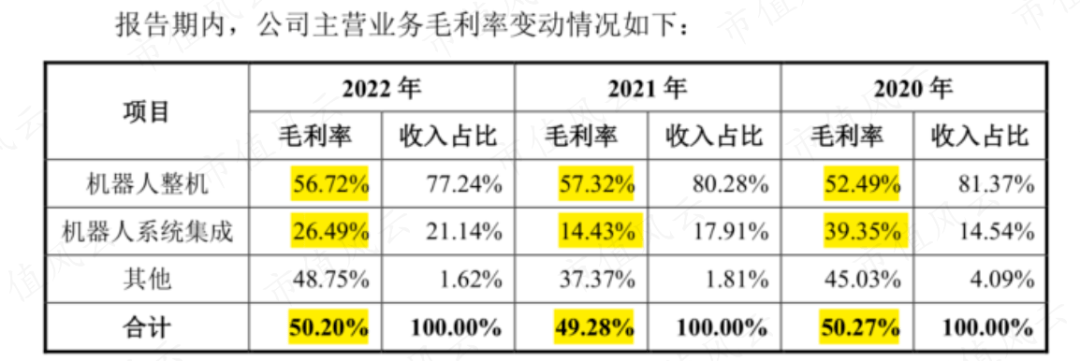

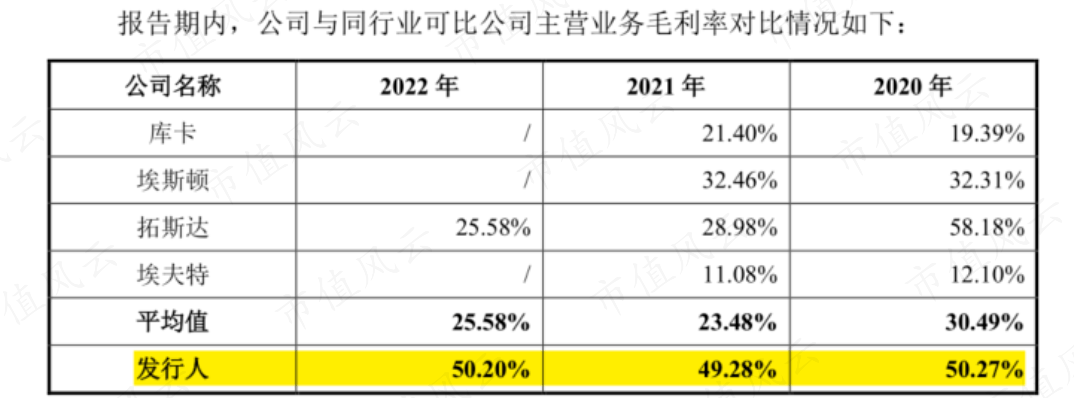

In recent years, the company's overall gross profit margin has remained relatively stable, reaching 50.2% in 2022.

(Source: Company Prospectus)

Compared with traditional industrial robot listed companies, the company's gross profit margin is about 25 percentage points higher than the industry average.

(Source: Company Prospectus)

As an emerging market, collaborative robots have fewer participants at this stage, but as competition intensifies, can the company's bargaining power be maintained?

In fact, it is only a matter of time before traditional industrial robot manufacturers enter the collaborative robot market segment.

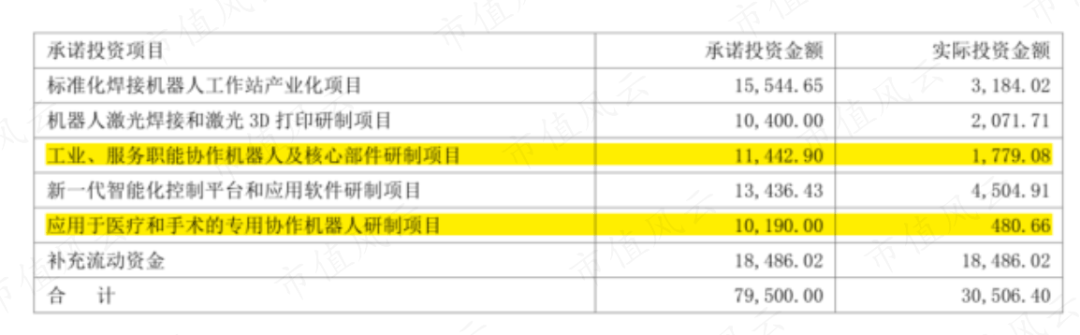

Eston will go public in 2021 to raise 790 million yuan, of which 210 million yuan is expected to be invested in collaborative robot development projects in the industrial, service and medical industries.

However, judging from the use of fundraising funds, Eston’s collaborative robot project is progressing slowly.

(Source: Eston 2022 Annual Report)

According to Topstar, they have applied the launched TMCR series robot controllers in batches on independently developed SCARA, six-axis and collaborative robots.

(Source: Topstar 2022 Annual Report)

The business model is risky, and continuous blood loss is the norm

(1) Large investment in R&D and obvious sales drive

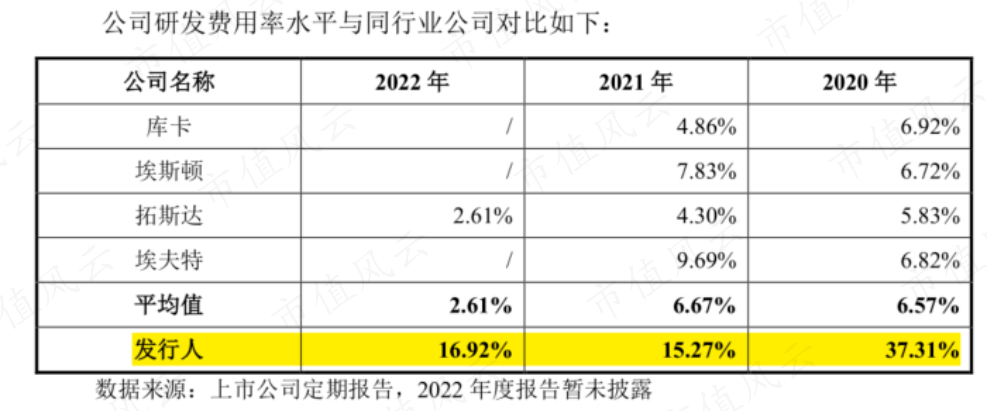

Collaborative robots are a technology-intensive emerging industry and require large R&D investment.

In 2022, the company's R&D expense rate will be 16.9%, which has dropped significantly by 20.4 percentage points from 2020, but is still significantly higher than the average of the traditional industrial robot industry. The latter's R&D expense rate has been controlled within 10% for a long time.

(Source: Company Prospectus)

Feng Yunjun believes that collaborative robot companies face higher R&D expense rates, which will continue to be the norm in the future.

Although collaborative robot technology has developed, it must be acknowledged that its environmental adaptability, complex operation capabilities and human-machine collaboration capabilities still need to be significantly improved.

If the key factor of scale effect is delayed and customer demands are "discussed on a case-by-case basis", then the company will face challenges from the root of the business model. This is also one of the reasons for the current low penetration rate of collaborative robots.

In fact, at this stage, collaborative robot products often have bugs in downstream application scenarios. The company has encountered situations where downstream customers did not buy it several times.

According to the prospectus, the company delivered collaborative robots with a total price of 16.65 million yuan to Inner Mongolia Grassland Red Sun Food Co., Ltd. ("Red Sun") in the first half of 2021, but the latter has so far refused to accept and pay Final payment. The company took Red Sun to court, and the case is still in the second instance stage.

Why did Red Sun go back on its promise?

Since the front-end equipment does not match the company's automated production line, Red Sun refused to accept the new production line. Judging from the details disclosed, this was the reason for its rejection of acceptance. That is the issue of technical compatibility.

(Source: Company Prospectus)

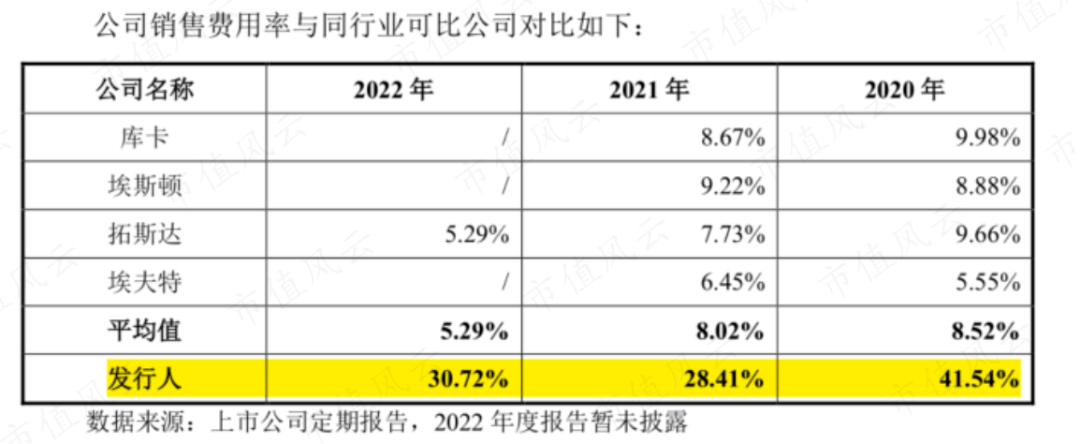

In addition, the collaborative robot industry shows obvious sales-driven characteristics.

In 2022, the company's sales expense rate is 30.7%, a decrease of 10.8 percentage points from 2020, but still much higher than the average of the traditional industrial robot industry, which has remained within 10% for a long time.

(Source: Company Prospectus)

The collaborative robot industry is still in the market and customer introduction stage. In order to seize market opportunities, companies need to invest a large number of sales personnel to develop and maintain business.

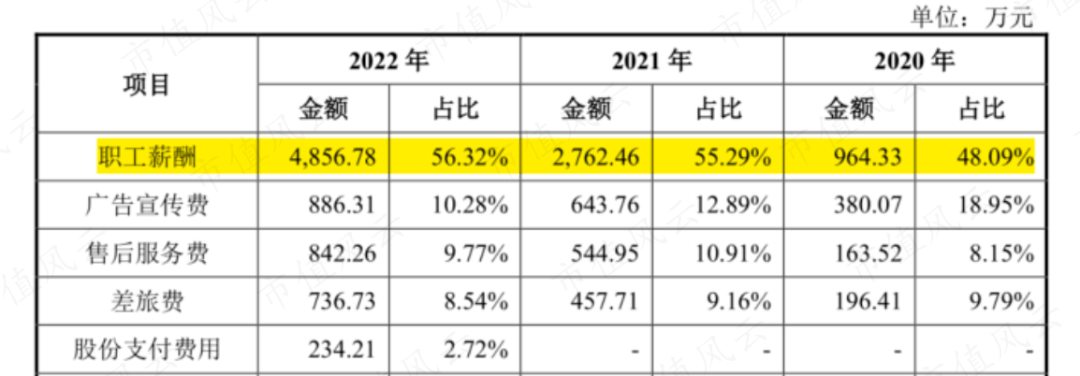

According to disclosures, about half of the company’s sales expenses are salaries paid to sales staff.

(Source: Company Prospectus)

The company's number of employees has also increased from 192 as of the end of 2020 to 465 as of the end of 2022, of which sales staff account for the largest proportion, accounting for more than 30%.

(Source: Company Prospectus)

(2) Cash flow continues to outflow

Under the high R&D and sales expense rates, although the company's profitability has improved in recent years, it is still quite "shabby".

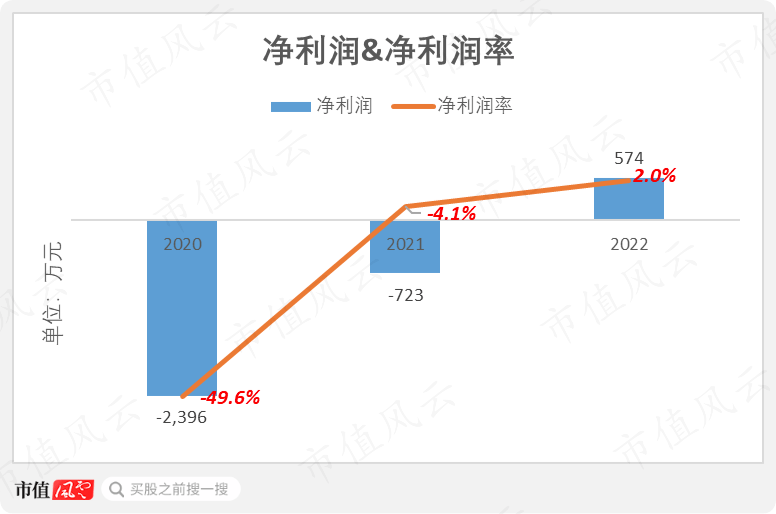

The company did not achieve net profit until 2022, with a net profit of 5.74 million yuan that year and a net profit margin of 2.0%. The net profit margins in 2020 and 2021 were -49.6% and -4.1% respectively.

(Chart: Market Value Fengyun App)

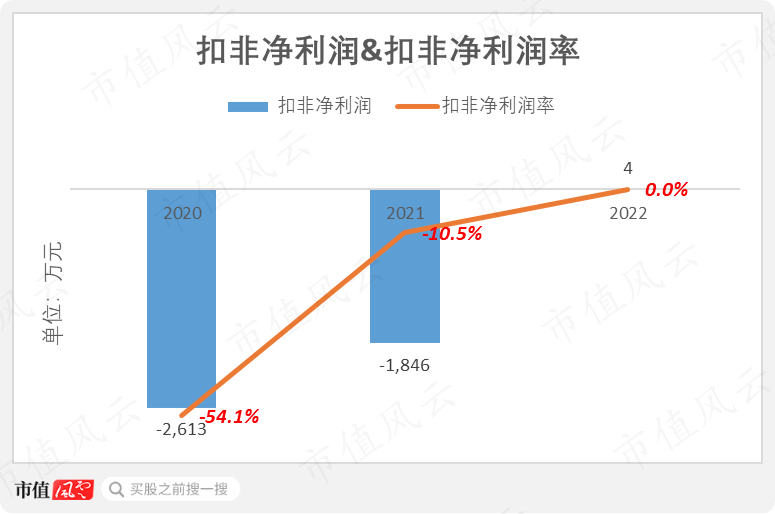

The non-net profit after excluding government subsidies, gains and losses from changes in fair value and investment income will be only 40,000 yuan in 2022, barely achieving breakeven.

(Chart: Market Value Fengyun App)

In contrast, Eston and Topstar have already achieved sustained profitability in net profit and net profit attributable to parent companies.

(Source: Registered Stock Trading Artifact Market Value Fengyun App)

In addition, the increase in profitability driven by the expansion of sales has not brought improvement to the company's cash flow indicators.

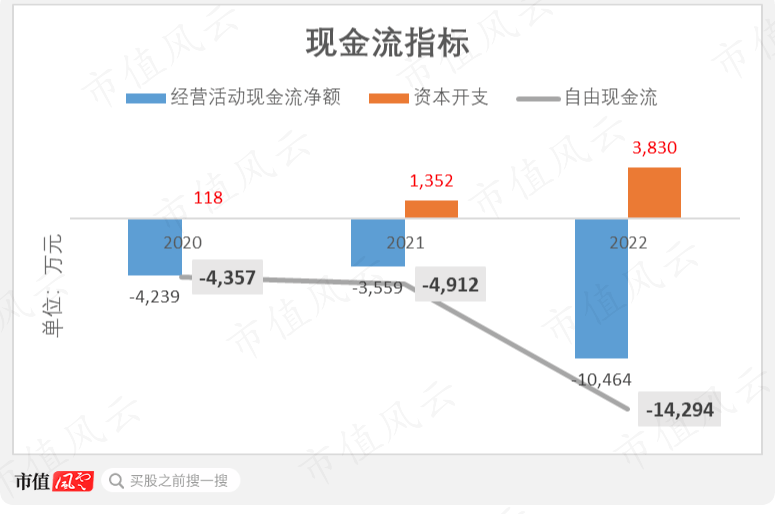

The company's cash flow from operating activities still shows a continuous net outflow, expanding from -42.39 million yuan in 2020 to -100 million yuan in 2022.

(Chart: Market Value Fengyun App)

At the same time, the company's capital expenditures are increasing day by day, reaching as high as 38.3 million yuan in 2022, and the current free cash flow gap is 140 million yuan.

It is foreseeable that the company's next cash flow situation will still be quite tight.

The company’s IPO plans to raise 750 million yuan, most of which will be used to expand robot production capacity and build a research and development center. In Fengyunjun’s view, it is obviously unreasonable.

(Source: Company Prospectus)

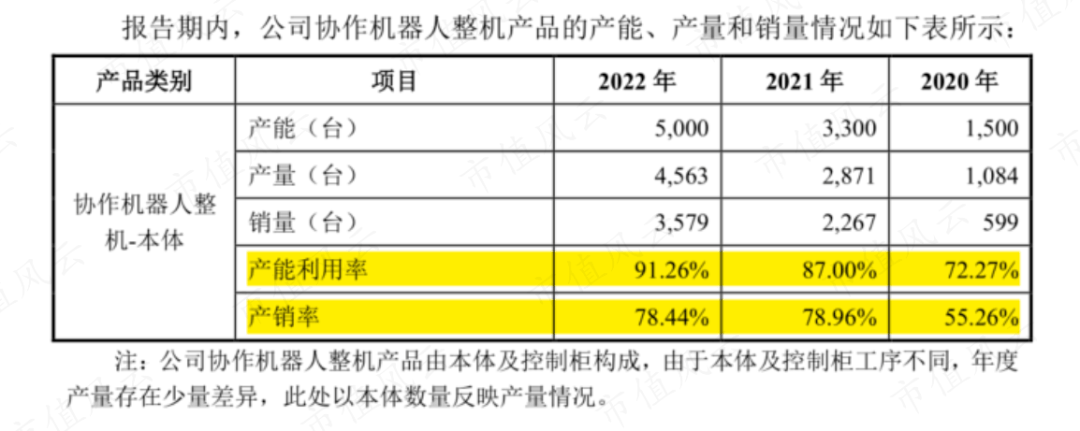

The company’s current collaborative robot production capacity is 5,000 units, and the investment project plans to increase the production capacity to 50,000 units, which is 10 times the existing production capacity. The handwriting was so big that Feng Yunjun's chrysanthemums tightened in fear.

The company has gradually increased its capacity utilization rate since 2020 until it reaches 91% in 2022. However, the company's production-to-sales ratio has always been low, reaching 78% in 2022, which means a large amount of unsalable inventory.

(Source: Company Prospectus)

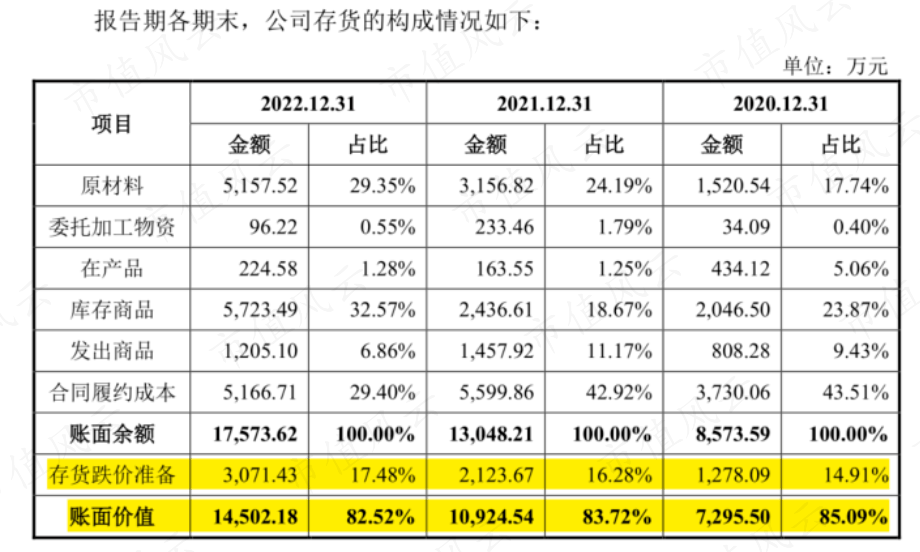

As of the end of 2022, the book value of the company's inventory has reached a high of 150 million yuan, and the proportion of inventory depreciation provisions has also increased year by year, reaching 17.5%.

(Source: Company Prospectus)

Fengyun Jun believes that for the company, the more important issue facing the company at this stage is how to reasonably arrange production plans and improve inventory management capabilities, which is by no means a hard stack of production capacity.

As a new branch of industrial robots, collaborative robots are currently in their infancy, and the profitability of participants, including companies, is low.

It is expected that this market will still face the embarrassing situation of continuous customer cultivation and heavy investment in R&D.

In fact, this is also the dilemma faced by a large number of subdivided track robot companies in recent years.

For example, humanoid robot industry participants Boston Dynamics and Ubisoft have suffered from poor profitability and continuous cash flow losses for a long time. They can only rely on rounds of financing in the primary market for support, or turn to the secondary market to seek exits (tao ) Road (xian).

(Source: Market Value Fengyun App)

Speaking of which, SoftBank Vision Fund, one of the company’s major shareholders, was also locked into robot investment for a time.

In 2017, SoftBank took over Boston Dynamics from Google (GOOG.O) for a consideration of US$180 million.

During 2019-2020, Boston Dynamics received US$150 million in operating funds from SoftBank, but its revenue was only US$30 million.

However, despite Boston Dynamics’ dismal performance, SoftBank finally sold it successfully through the primary market.

In June 2021, SoftBank sold Boston Dynamics to "successor" Hyundai Motor for US$1.1 billion, which was 6 times the original acquisition consideration.

Back to the company, SoftBank entered the market just before the IPO this time, perhaps because of the lessons learned from Boston Dynamics.

I would like to ask all the veterans of the secondary market, do you have the luck and strength to spread the word like SoftBank?

Disclaimer: This report (article) is based on the public company attributes of listed companies and the information publicly disclosed by the above listed companies in accordance with their legal obligations (including but not limited to temporary announcements, regular reports and official interactions platform, etc.) as the core basis; Market Capitalization Fengyun strives to be objective and fair in the content and opinions contained in the report (article), but does not guarantee its accuracy, completeness, timeliness, etc.; the information in this report (article) or The opinions expressed do not constitute any investment advice, and Market Capitalization does not assume any responsibility for any actions taken as a result of the use of this report.

The above content is original from Market Value Fengyun APP

Unauthorized reprinting will be punished

The above is the detailed content of SoftBank, Temasek, and Saudi Aramco suddenly invested in shares, 'the first collaborative robot stock' to save shares: powerful enemies are around, and continuous blood loss is the norm. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Technology trends to watch in 2023

- How Artificial Intelligence is Bringing New Everyday Work to Data Center Teams

- Can artificial intelligence or automation solve the problem of low energy efficiency in buildings?

- OpenAI co-founder interviewed by Huang Renxun: GPT-4's reasoning capabilities have not yet reached expectations

- Microsoft's Bing surpasses Google in search traffic thanks to OpenAI technology