Home >Technology peripherals >AI >When banks encounter AI: Which commercial bank has the strongest artificial intelligence patents?

When banks encounter AI: Which commercial bank has the strongest artificial intelligence patents?

- 王林forward

- 2023-06-09 21:58:21916browse

Author | Yan Jingchi Source | Lingyi Finance

At present, artificial intelligence technology has brought profound changes to the development of all walks of life, and the banking industry is no exception.

The bank’s operating model determines that it is very suitable to use artificial intelligence to replace manual labor. Artificial intelligence technology can help banks improve efficiency, reduce costs, improve customer service and improve risk management capabilities, etc., so it has been widely used in the banking industry.

According to McKinsey’s “Looking into Artificial Intelligence Banking: When Banks Encounter AI” report, by using artificial intelligence, the banking industry can gain an additional US$1 trillion in value. In addition, according to OpenText's survey of global financial service providers, many banks plan to use AI-powered solutions, and 75% of banks with assets of more than US$100 billion have begun to implement artificial intelligence strategies; for banks with assets of less than US$100 billion, This proportion is 46%.

Under the conditions of rapid development of artificial intelligence applications in the global banking industry, what is the technical reserve of artificial intelligence in my country's banking industry? Which banks are doing the best job promoting the use of artificial intelligence? Lingyi Think Tank made a detailed analysis through the artificial intelligence patent applications of banks and their financial technology subsidiaries.

01

Total number of artificial intelligence patent applications: Bank of China ranks first, WeBank ranks among the top four

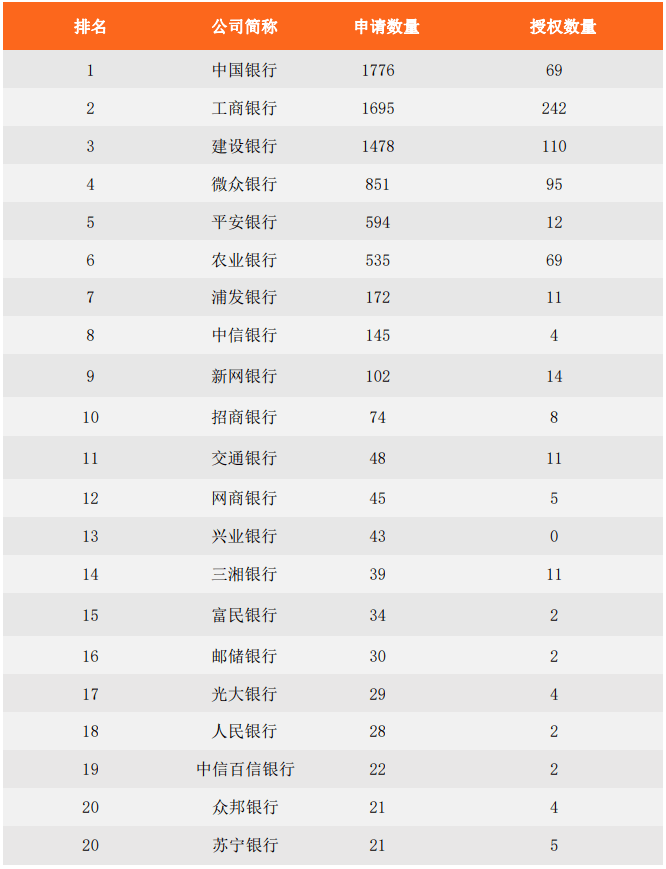

Judging from the total number of domestic bank artificial intelligence patent applications, Bank of China ranked first with 1,776, followed by Industrial and Commercial Bank of China and China Construction Bank, with 1,695 and 1,478 respectively. WeBank, the first domestic Internet bank, entered the top four with 851 cases.

Looking at the total number of artificial intelligence patent authorizations, ICBC ranked first with 242, followed by China Construction Bank and WeBank, with 110 and 95 respectively.

It can be seen that the top-ranking banks are mostly state-owned banks and joint-stock commercial banks. For leading state-owned banks and national joint-stock banks, the number of customers reaches tens or even hundreds of millions. It is imperative to use technological means such as AI to empower customer operations, improve customer service quality and efficiency, and reduce customer operating costs. In addition, they also have sufficient financial and technical advantages to promote the implementation and development of AI.

Table 1: Top 20 bank artificial intelligence patent applications and authorizations

Note: 1) Due to the delay in patent disclosure, for the convenience of comparison, the statistical time is as of April 30, 2023; 2) The list includes patents jointly applied by banks and their financial technology subsidiaries.

Data source: Wisdom Ya, Lingyi Think Tank

The Bank of China has spared no effort in its AI deployment. For example, through the construction of the "BOC Brain" project based on artificial intelligence technology, Bank of China has created a group-level artificial intelligence platform that is embedded in the entire process, covers all channels, and supports multiple scenarios. Bank of China has also built a "Network Control" intelligent risk control and defense system, building a full-process digital risk control system to achieve real-time risk control monitoring and disposal of high-risk transactions through mobile banking, online banking, micro-banking and other channels. Bank of China extensively uses artificial intelligence technology in fields such as biometrics, payment technology, and RPA.

WeBank has invested in the field of artificial intelligence for a long time, laying the foundation for developing inclusive finance and serving the real economy. For example, when WeBank is doing small and micro loans, it is difficult to identify certain frauds because it relies on traditional verification methods. Therefore, it uses a large number of legal and compliant artificial intelligence technologies such as face recognition and big data screening to fight fraud and prevent counterfeiting. Do a good job in risk control and cost control.

02

Financial OneConnect and Jianxin Jinke are far ahead in the number of artificial intelligence patent applications

Judging from the number of artificial intelligence patent applications filed by bank fintech subsidiaries, OneConnect and CCB Finance ranked top two with 1,158 and 497 respectively, far ahead of other bank fintech subsidiaries. In terms of the number of authorizations, OneConnect and CCB Financial ranked the top two with 73 and 12 respectively, surpassing other bank fintech subsidiaries.

Table 2: Artificial Intelligence Patent Application and Authorization Status of Bank Fintech Subsidiaries

Note: 1) Due to the delay in patent disclosure, for the convenience of comparison, the statistical time is as of April 30, 2023; 2) The list includes patents jointly applied by banks and their financial technology subsidiaries

Data source: Wisdom Ya, Lingyi Think Tank

Financial OneConnect has strong cutting-edge technological capabilities such as artificial intelligence, big data and blockchain. As of the end of December 2022, Financial OneConnect has submitted a total of 5,905 global patent applications, covering core technology fields such as artificial intelligence, blockchain, big data, cloud computing, and information security.

According to Xu Liang, chief engineer of Financial OneConnect Artificial Intelligence Research Institute, after the emergence of ChatGPT, Financial OneConnect will further deepen the scenario application of related technologies, give full play to its unique competitiveness of "business technology", and use technological progress to Help financial institutions consolidate their AI digital base.

CCB Jinke has always been committed to independent research and development, mastering various core competitive technologies, such as artificial intelligence, big data and blockchain. Its artificial intelligence platform has covered mainstream fields such as computer vision, natural language processing, and intelligent recommendation, and has pioneered domestic applications such as intelligent ticket review and full-line face recognition for subway riding.

It can be seen that the fintech subsidiaries of large state-owned commercial banks are still leading in artificial intelligence patents, and they are closely related to the efforts of their parent banks in promoting the application of artificial intelligence. In addition, top-ranked bank fintech subsidiaries have already stepped out of their own banking systems to provide "technical business" solutions to financial institutions in banking, insurance, investment and other industries. Therefore, they pay more attention to R&D investment in technologies such as artificial intelligence.

The above is the detailed content of When banks encounter AI: Which commercial bank has the strongest artificial intelligence patents?. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Technology trends to watch in 2023

- How Artificial Intelligence is Bringing New Everyday Work to Data Center Teams

- Can artificial intelligence or automation solve the problem of low energy efficiency in buildings?

- OpenAI co-founder interviewed by Huang Renxun: GPT-4's reasoning capabilities have not yet reached expectations

- Microsoft's Bing surpasses Google in search traffic thanks to OpenAI technology