Currently, artificial intelligence (AI) has been widely used in various fields and has become a hot topic in the technology community and capital market. Many ESG rating agencies also mention the use of AI in their rating method introductions. For example, Miaoying Technology uses AI algorithms to multi-dimensionally estimate core data such as greenhouse gas emissions and energy consumption to fill gaps in corporate disclosure; Weizhong Lanyue uses AI to achieve the fusion of high- and low-frequency data, automated data processing and rating updates, providing real-time , independent and effective ESG scores and indices.

Does this mean that with the help of AI, the pain points and difficulties of ESG rating can be solved one by one, and will related work be completely replaced by AI?

It is true that the integration of AI technology in the entire ESG evaluation process can improve the efficiency and accuracy of evaluation, mainly reflected in the following aspects:

The second is intelligent scoring. Based on expert scoring rules, the application of AI technology for semantic analysis and understanding can, to a certain extent, solve the pain point of lack of objective standards for qualitative indicator scoring in ESG ratings. For example, in the ESG evaluation system, to evaluate the environmental management of listed companies, expert rules can be set first, and then AI technology can be used to analyze the company's regular reports and ESG-related reports to determine whether the company has qualitative description goals related to environmental management or measures and score according to the rules. AI intelligent scoring is faster than manual scoring and can improve the accuracy and objectivity of scoring.

The third is intelligent analysis. AI can assist ESG experts in their analysis work, such as using machine learning and natural language processing technology to mine relationships, patterns and trends that are potentially valuable to ESG performance from massive data (including text information); in the assessment modeling stage, it can Evaluate the model to perform auxiliary optimization work.

The fourth is intelligent visual display. In the ESG results application stage, interactive visualization technology is used to visualize ESG data into interactive, concise and easy-to-understand charts, images and other presentation forms, making the data information clearer and easier to understand and communicate.

However, we must also realize that it is still difficult for AI to completely replace the work of ESG experts, which is specifically reflected in the following aspects:

The first is data collection. Unlike financial data, which is highly standardized and internationalized, ESG data contains qualitative information whose definition and measurement standards are vague. Currently, there is no AI tool that can completely replace manual collection of this information. For example, at the level of employee issues, when assessing employee satisfaction and cultural identity with the company, it is necessary to have in-depth communications with employees and obtain effective data through in-depth and detailed surveys and research.

The second is data quality. The accuracy of AI’s extraction of qualitative data cannot reach 100%. Currently, for some uncomplicated information, such as an enterprise's environmental management goals, machine learning can be used to extract passages that it thinks may be the enterprise's environmental management goals, and can achieve an accuracy of 90%; but for some complex information, such as TCFD (Climate-related Financial Disclosure Working Group) framework, which extracts information on corporate governance, strategy, risk management and goals in response to climate change, currently can only achieve 60% accuracy.

The third is data prediction. ESG ratings cover dozens of issues in the environment, society, and governance, with over a hundred key indicators. Many indicators exhibit non-linear characteristics and are highly uncertain. Changes in the future may exceed the data sets that the machine has learned. The accuracy of predictions of missing indicators using AI technology will also decline over time.

The fourth is to determine the weight. Effective ESG ratings need to start from the analysis of similarities and differences among various industries, and set corresponding substantive issues for different industries. The weight is determined by the relative importance of this issue and other issues. However, AI algorithms only consider historical data to estimate the relationships and weights between variables, and cannot fully understand the importance ranking of industry-specific issues in different industries.

The fifth is morality and ethics. ESG issues such as human rights, gender equality, and anti-discrimination involve moral ethics. Judging the quality of these issues is subjective and requires complex emotional cognition and experience. AI can only make decisions based on the moral and ethical principles built into the algorithm by its designers. Making value judgments does not in itself possess the ability to judge good or bad.

Sixth is privacy and security. ESG involves sensitive environmental and social issues. Although AI can anonymize users when processing data, it is essentially a tool that uses AI systems to collect data when security and privacy protection technologies and regulations have not yet matured. , analyzing and processing these sensitive data may expose some sensitive information, and privacy security issues cannot be fully resolved.

As artificial intelligence continues to develop, new technologies in the future may alleviate or even alleviate the problems faced by ESG ratings to a certain extent. However, as a comprehensive assessment method, ESG rating is very complex. ESG experts still need to fully consider the ethical judgment of ESG issues and the setting of industry-specific topics. The high-quality extraction of qualitative information also needs to rely on a large amount of ESG professional. Therefore, in the foreseeable future, AI cannot completely replace the work of ESG experts.

Editor: Wan Jianyi

Proofreading: Yang Lilin

Taking advantage of the comprehensive registration system, the official website of Securities Times has been completely upgraded

Grandly launched the "Xinpi" channel↓↓↓

Copyright Notice

Without written authorization, no unit or individual may reproduce all original content on Securities Times platforms. Our company reserves the right to pursue legal liability of relevant actors.

The above is the detailed content of ESG Observation丨A rational view of the role of AI in ESG ratings. For more information, please follow other related articles on the PHP Chinese website!

Are You At Risk Of AI Agency Decay? Take The Test To Find OutApr 21, 2025 am 11:31 AM

Are You At Risk Of AI Agency Decay? Take The Test To Find OutApr 21, 2025 am 11:31 AMThis article explores the growing concern of "AI agency decay"—the gradual decline in our ability to think and decide independently. This is especially crucial for business leaders navigating the increasingly automated world while retainin

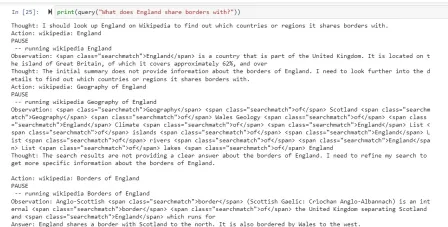

How to Build an AI Agent from Scratch? - Analytics VidhyaApr 21, 2025 am 11:30 AM

How to Build an AI Agent from Scratch? - Analytics VidhyaApr 21, 2025 am 11:30 AMEver wondered how AI agents like Siri and Alexa work? These intelligent systems are becoming more important in our daily lives. This article introduces the ReAct pattern, a method that enhances AI agents by combining reasoning an

Revisiting The Humanities In The Age Of AIApr 21, 2025 am 11:28 AM

Revisiting The Humanities In The Age Of AIApr 21, 2025 am 11:28 AM"I think AI tools are changing the learning opportunities for college students. We believe in developing students in core courses, but more and more people also want to get a perspective of computational and statistical thinking," said University of Chicago President Paul Alivisatos in an interview with Deloitte Nitin Mittal at the Davos Forum in January. He believes that people will have to become creators and co-creators of AI, which means that learning and other aspects need to adapt to some major changes. Digital intelligence and critical thinking Professor Alexa Joubin of George Washington University described artificial intelligence as a “heuristic tool” in the humanities and explores how it changes

Understanding LangChain Agent FrameworkApr 21, 2025 am 11:25 AM

Understanding LangChain Agent FrameworkApr 21, 2025 am 11:25 AMLangChain is a powerful toolkit for building sophisticated AI applications. Its agent architecture is particularly noteworthy, allowing developers to create intelligent systems capable of independent reasoning, decision-making, and action. This expl

What are the Radial Basis Functions Neural Networks?Apr 21, 2025 am 11:13 AM

What are the Radial Basis Functions Neural Networks?Apr 21, 2025 am 11:13 AMRadial Basis Function Neural Networks (RBFNNs): A Comprehensive Guide Radial Basis Function Neural Networks (RBFNNs) are a powerful type of neural network architecture that leverages radial basis functions for activation. Their unique structure make

The Meshing Of Minds And Machines Has ArrivedApr 21, 2025 am 11:11 AM

The Meshing Of Minds And Machines Has ArrivedApr 21, 2025 am 11:11 AMBrain-computer interfaces (BCIs) directly link the brain to external devices, translating brain impulses into actions without physical movement. This technology utilizes implanted sensors to capture brain signals, converting them into digital comman

Insights on spaCy, Prodigy and Generative AI from Ines MontaniApr 21, 2025 am 11:01 AM

Insights on spaCy, Prodigy and Generative AI from Ines MontaniApr 21, 2025 am 11:01 AMThis "Leading with Data" episode features Ines Montani, co-founder and CEO of Explosion AI, and co-developer of spaCy and Prodigy. Ines offers expert insights into the evolution of these tools, Explosion's unique business model, and the tr

A Guide to Building Agentic RAG Systems with LangGraphApr 21, 2025 am 11:00 AM

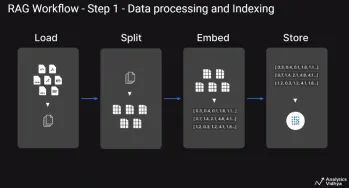

A Guide to Building Agentic RAG Systems with LangGraphApr 21, 2025 am 11:00 AMThis article explores Retrieval Augmented Generation (RAG) systems and how AI agents can enhance their capabilities. Traditional RAG systems, while useful for leveraging custom enterprise data, suffer from limitations such as a lack of real-time dat

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

Dreamweaver Mac version

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

WebStorm Mac version

Useful JavaScript development tools