Technology peripherals

Technology peripherals AI

AI Why are some major automakers rethinking their autonomous driving investments?

Why are some major automakers rethinking their autonomous driving investments?Why are some major automakers rethinking their autonomous driving investments?

Until a few months ago, autonomous driving was one of the hottest investment themes. However, many major automakers, including Ford, have recently been reconsidering their investments in self-driving businesses, and other companies such as Alphabet are facing financial pressure to cut spending on self-driving businesses.

Uber was the first company to divest itself of its self-driving business

Uber was one of the first companies to give up its self-driving business. In 2020, the business was sold to autonomous driving start-up Aurora Innovation. In return, Uber received a majority stake in the company.

Aurora Innovation went public through a SPAC reverse merger, and its current share price is less than $2 per share. According to reports, Uber has incurred huge losses on its investments in companies such as Aurora, Grab and Zomato.

Aurora Innovation is a pure-play autonomous driving business developer, and its stock price plunge is reminiscent of investor pessimism about the industry. Not only that, but some companies are also reconsidering their investments in autonomous driving.

Ford exits the self-driving business

Last month, Argo AI, a self-driving startup jointly established by Ford and Volkswagen, collapsed, and Ford canceled its investment in the company. This marks that major automobile manufacturers have also "retired" from autonomous driving.

Ford said Argo AI has not attracted new investors. Ford also announced that it will not focus on developing L4 autonomous driving systems. The company's CEO said that although some investors have invested a total of $100 billion in L4 autonomous driving technology, no company has yet been able to determine a profitable business model.

On an earnings call, Doug Field, Ford’s director of advanced product development and technology, said: “Large-scale commercialization of L4 autonomous driving will take far longer than we previously anticipated. L2 and L3 driver assistance technology has a larger addressable customer base, which will allow it to scale more quickly and become profitable."

And Ford Chief Financial Officer John Lawler said that the company does not see the need Develop self-driving technology yourself.

Alphabet’s autonomous driving is facing loss pressure

Alphabet owns its autonomous driving business subsidiary Waymo, which is facing pressure from shareholders to question due to rising losses. TCI Fund Management, which holds about $6 billion worth of Alphabet stock, sent a letter to Alphabet management calling for Waymo's losses to be reduced.

TCI said in the letter, "Unfortunately, people have lost enthusiasm for autonomous driving, and competitors have also withdrawn from the market." TCI also mentioned in the letter that Volkswagen and Ford have withdrawn from this business. fact.

Coincidentally, Nuro, a self-driving startup backed by Alphabet, Tiger Global and SoftBank, recently announced that it would lay off one-fifth of its workforce in an effort to save money while investing in the long term.

GM said cars will not withdraw from the autonomous driving market

Industry insiders also pointed out that the situation in the autonomous driving market is not bleak, and some companies are still continuing to invest in autonomous driving. General Motors, for example, has said it will not withdraw from its investment in the business. The company owns Cruise, a company that develops autonomous driving business, and received investment from Microsoft last year.

GM CEO Mary Barra said: "We are the only self-driving car company ready to launch and bring revenue in three markets."

Barra on GM's self-driving Expressed optimism about business development. She said: "When we consider the strength of the business and the business we have established, we feel we can reinvest in the autonomous vehicle business because we see a tremendous opportunity."

General Motors also upgraded cash flow guidance for 2022 and expects its electric vehicle business to become profitable in 2025.

Tesla sees software as the main driver of its business

Tesla sees autonomous driving as a key driver of its business growth. The company has adjusted the price of its Fully Self-Driving System (FSD) twice this year, now raising it to $15,000.

Industry sources said that given the deteriorating macroeconomic environment, many autonomous driving companies are facing pressure to raise funds. Because the business is still in its infancy, many businesses are likely to continue to post losses in the coming years. Now with the Federal Reserve aggressively raising interest rates, few investors want to fund money-losing companies like self-driving cars.

On the one hand, there is the "unexpected future" and huge investment of autonomous driving, and on the other hand, there is the sluggish economic environment. What do you think the future direction of autonomous driving will be?

The above is the detailed content of Why are some major automakers rethinking their autonomous driving investments?. For more information, please follow other related articles on the PHP Chinese website!

Tesla's Robovan Was The Hidden Gem In 2024's Robotaxi TeaserApr 22, 2025 am 11:48 AM

Tesla's Robovan Was The Hidden Gem In 2024's Robotaxi TeaserApr 22, 2025 am 11:48 AMSince 2008, I've championed the shared-ride van—initially dubbed the "robotjitney," later the "vansit"—as the future of urban transportation. I foresee these vehicles as the 21st century's next-generation transit solution, surpas

Sam's Club Bets On AI To Eliminate Receipt Checks And Enhance RetailApr 22, 2025 am 11:29 AM

Sam's Club Bets On AI To Eliminate Receipt Checks And Enhance RetailApr 22, 2025 am 11:29 AMRevolutionizing the Checkout Experience Sam's Club's innovative "Just Go" system builds on its existing AI-powered "Scan & Go" technology, allowing members to scan purchases via the Sam's Club app during their shopping trip.

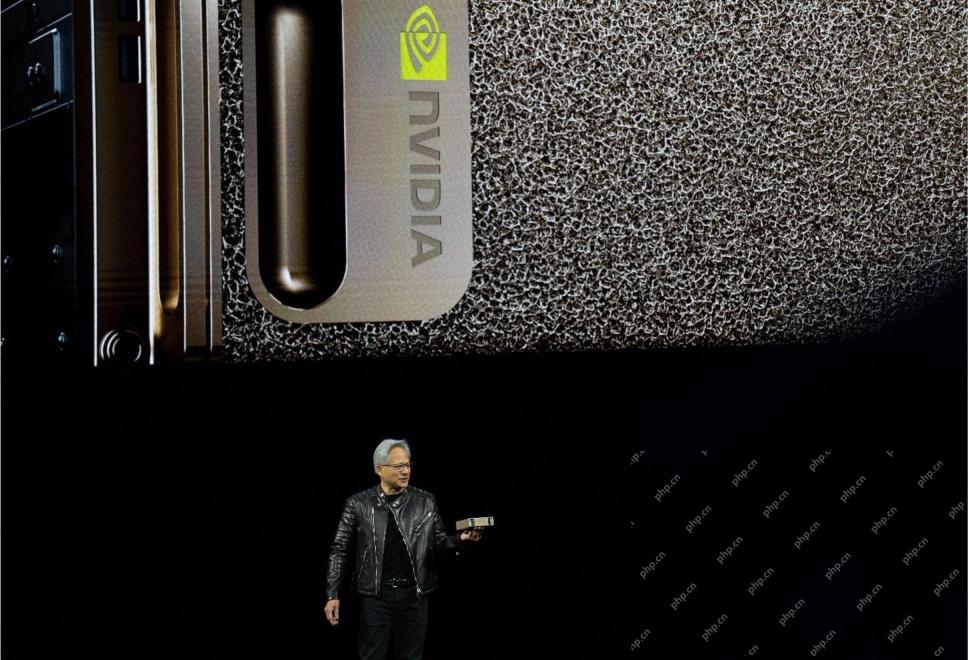

Nvidia's AI Omniverse Expands At GTC 2025Apr 22, 2025 am 11:28 AM

Nvidia's AI Omniverse Expands At GTC 2025Apr 22, 2025 am 11:28 AMNvidia's Enhanced Predictability and New Product Lineup at GTC 2025 Nvidia, a key player in AI infrastructure, is focusing on increased predictability for its clients. This involves consistent product delivery, meeting performance expectations, and

Exploring the Capabilities of Google's Gemma 2 ModelsApr 22, 2025 am 11:26 AM

Exploring the Capabilities of Google's Gemma 2 ModelsApr 22, 2025 am 11:26 AMGoogle's Gemma 2: A Powerful, Efficient Language Model Google's Gemma family of language models, celebrated for efficiency and performance, has expanded with the arrival of Gemma 2. This latest release comprises two models: a 27-billion parameter ver

The Next Wave of GenAI: Perspectives with Dr. Kirk Borne - Analytics VidhyaApr 22, 2025 am 11:21 AM

The Next Wave of GenAI: Perspectives with Dr. Kirk Borne - Analytics VidhyaApr 22, 2025 am 11:21 AMThis Leading with Data episode features Dr. Kirk Borne, a leading data scientist, astrophysicist, and TEDx speaker. A renowned expert in big data, AI, and machine learning, Dr. Borne offers invaluable insights into the current state and future traje

AI For Runners And Athletes: We're Making Excellent ProgressApr 22, 2025 am 11:12 AM

AI For Runners And Athletes: We're Making Excellent ProgressApr 22, 2025 am 11:12 AMThere were some very insightful perspectives in this speech—background information about engineering that showed us why artificial intelligence is so good at supporting people’s physical exercise. I will outline a core idea from each contributor’s perspective to demonstrate three design aspects that are an important part of our exploration of the application of artificial intelligence in sports. Edge devices and raw personal data This idea about artificial intelligence actually contains two components—one related to where we place large language models and the other is related to the differences between our human language and the language that our vital signs “express” when measured in real time. Alexander Amini knows a lot about running and tennis, but he still

Jamie Engstrom On Technology, Talent And Transformation At CaterpillarApr 22, 2025 am 11:10 AM

Jamie Engstrom On Technology, Talent And Transformation At CaterpillarApr 22, 2025 am 11:10 AMCaterpillar's Chief Information Officer and Senior Vice President of IT, Jamie Engstrom, leads a global team of over 2,200 IT professionals across 28 countries. With 26 years at Caterpillar, including four and a half years in her current role, Engst

New Google Photos Update Makes Any Photo Pop With Ultra HDR QualityApr 22, 2025 am 11:09 AM

New Google Photos Update Makes Any Photo Pop With Ultra HDR QualityApr 22, 2025 am 11:09 AMGoogle Photos' New Ultra HDR Tool: A Quick Guide Enhance your photos with Google Photos' new Ultra HDR tool, transforming standard images into vibrant, high-dynamic-range masterpieces. Ideal for social media, this tool boosts the impact of any photo,

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

SublimeText3 Linux new version

SublimeText3 Linux latest version