Technology peripherals

Technology peripherals AI

AI Nanyang Polytechnic releases quantitative trading master TradeMaster, covering 15 reinforcement learning algorithms

Nanyang Polytechnic releases quantitative trading master TradeMaster, covering 15 reinforcement learning algorithmsNanyang Polytechnic releases quantitative trading master TradeMaster, covering 15 reinforcement learning algorithms

Recently, the quantitative platform family has welcomed a new member, an open source platform based on reinforcement learning: TradeMaster—Trading Master.

#TradeMaster Developed by Nanyang Technological University is a unified, end-to-end, user-friendly quantitative trading platform covering four major financial markets, six major trading scenarios, 15 reinforcement learning algorithms and a series of visual evaluation tools!

Platform address: https://github.com/TradeMaster-NTU/TradeMaster

Background introductionIn recent years, artificial intelligence technology is occupying an increasingly important position in quantitative trading strategies. Due to its outstanding decision-making ability in complex environments, there is huge potential in applying reinforcement learning technology to tasks in quantitative trading. However, the low signal-to-noise ratio of the financial market and the unstable training of reinforcement learning algorithms make reinforcement learning algorithms currently unable to be deployed on a large scale in real financial markets. The specific challenges are as follows:

- Development The process is complex and involves a huge amount of engineering, making it difficult to realize

- The performance of the algorithm is highly dependent on the market state at the time of testing, the risk is high, and it is difficult to systematically evaluate

- The design, optimization, and maintenance of the algorithm There is a high technical threshold and it is difficult to deploy on a large scale.

TradeMaster’s potential contribution to the deep integration of industry, academia, research and application

TradeMaster FrameworkTradeMaster consists ofsix core modules, including the complete process of design, implementation, testing and deployment of reinforcement learning algorithms for quantitative trading , below we will introduce it to you in detail:

# The framework structure of the TradeMaster platform

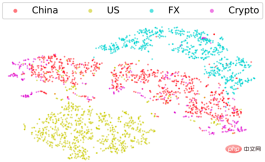

Data module: TradeMaster provides long-term multi-modal (K-line and order flow) financial data at different granularities (minute level to daily level), covering four major markets: China, US stocks and foreign exchange.Preprocessing module: TradeMaster provides a standardized financial time series data preprocessing pipeline, including 6 steps: 1. Data cleaning 2. Data filling 3. Regularization 4. Automatic features Discovery 5. Feature embedding 6. Feature selection

Simulator module: TradeMaster provides a series of data-driven high-quality financial market simulators, supporting 6 mainstream quantitative trading tasks: 1 . Currency trading 2. Portfolio management 3. Intraday trading 4. Order execution 5. High-frequency trading 6. Market making

Algorithm module: TradeMaster implements 7 latest reinforcement learning-based trading algorithms (DeepScalper, OPD, DeepTrader, SARL, ETTO, Investor-Imitator, EIIE) and 8 classic reinforcement algorithms (PPO, A2C, Rainbow, SAC, DDPG, DQN, PG, TD3). At the same time, TradeMaster introduces automated machine learning technology to help users efficiently adjust the hyperparameters of training reinforcement learning algorithms.

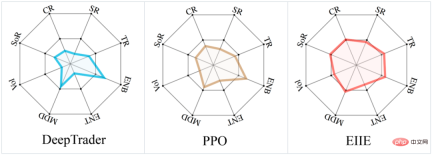

Evaluation module: TradeMaster implements 17 evaluation indicators and visualization tools from 6 dimensions: profitability, risk control, diversity, interpretability, robustness, and universality Systematic evaluation. The following are two examples:

Radar chart indicating profitability, risk control, and strategy diversity

Financial time series data visualization

Running process pseudocode

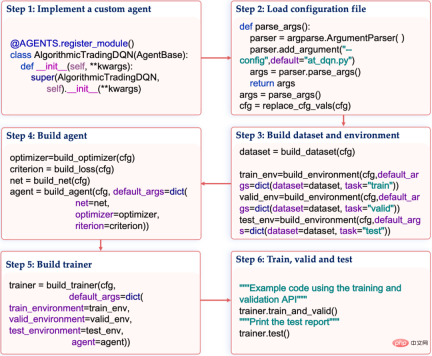

TradeMaster is based on object-oriented programming ideas, encapsulates different functional modules, realizes functional decoupling and encapsulation of different modules, and has good scalability and reusability. The specific process includes the following 6 steps:

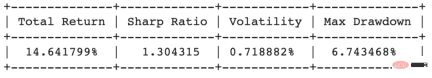

Test result

Based on the Dow Jones 30 Index Taking the classic task of investment portfolio as an example, the EIIE algorithm achieved stable positive returns and a high Sharpe ratio on the test set:

TradeMaster provides a series of different Reinforcement learning algorithm tutorial for trading tasks, presented in the form of Jupyter Notebook to facilitate users to get started quickly:

For details, see: https://github.com/TradeMaster-NTU/TradeMaster/tree/1.0.0/tutorial

The above is the detailed content of Nanyang Polytechnic releases quantitative trading master TradeMaster, covering 15 reinforcement learning algorithms. For more information, please follow other related articles on the PHP Chinese website!

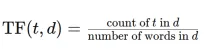

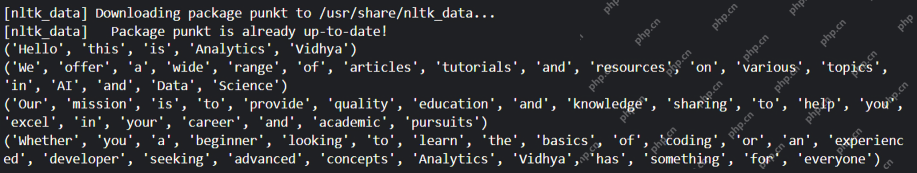

Convert Text Documents to a TF-IDF Matrix with tfidfvectorizerApr 18, 2025 am 10:26 AM

Convert Text Documents to a TF-IDF Matrix with tfidfvectorizerApr 18, 2025 am 10:26 AMThis article explains the Term Frequency-Inverse Document Frequency (TF-IDF) technique, a crucial tool in Natural Language Processing (NLP) for analyzing textual data. TF-IDF surpasses the limitations of basic bag-of-words approaches by weighting te

Building Smart AI Agents with LangChain: A Practical GuideApr 18, 2025 am 10:18 AM

Building Smart AI Agents with LangChain: A Practical GuideApr 18, 2025 am 10:18 AMUnleash the Power of AI Agents with LangChain: A Beginner's Guide Imagine showing your grandmother the wonders of artificial intelligence by letting her chat with ChatGPT – the excitement on her face as the AI effortlessly engages in conversation! Th

Mistral Large 2: Powerful Enough to Challenge Llama 3.1 405B?Apr 18, 2025 am 10:16 AM

Mistral Large 2: Powerful Enough to Challenge Llama 3.1 405B?Apr 18, 2025 am 10:16 AMMistral Large 2: A Deep Dive into Mistral AI's Powerful Open-Source LLM Meta AI's recent release of the Llama 3.1 family of models was quickly followed by Mistral AI's unveiling of its largest model to date: Mistral Large 2. This 123-billion paramet

What is Noise Schedules in Stable Diffusion? - Analytics VidhyaApr 18, 2025 am 10:15 AM

What is Noise Schedules in Stable Diffusion? - Analytics VidhyaApr 18, 2025 am 10:15 AMUnderstanding Noise Schedules in Diffusion Models: A Comprehensive Guide Have you ever been captivated by the stunning visuals of digital art generated by AI and wondered about the underlying mechanics? A key element is the "noise schedule,&quo

How to Build a Conversational Chatbot with GPT-4o? - Analytics VidhyaApr 18, 2025 am 10:06 AM

How to Build a Conversational Chatbot with GPT-4o? - Analytics VidhyaApr 18, 2025 am 10:06 AMBuilding a Contextual Chatbot with GPT-4o: A Comprehensive Guide In the rapidly evolving landscape of AI and NLP, chatbots have become indispensable tools for developers and organizations. A key aspect of creating truly engaging and intelligent chat

Top 7 Frameworks for Building AI Agents in 2025Apr 18, 2025 am 10:00 AM

Top 7 Frameworks for Building AI Agents in 2025Apr 18, 2025 am 10:00 AMThis article explores seven leading frameworks for building AI agents – autonomous software entities that perceive, decide, and act to achieve goals. These agents, surpassing traditional reinforcement learning, leverage advanced planning and reasoni

What's the Difference Between Type I and Type II Errors ? - Analytics VidhyaApr 18, 2025 am 09:48 AM

What's the Difference Between Type I and Type II Errors ? - Analytics VidhyaApr 18, 2025 am 09:48 AMUnderstanding Type I and Type II Errors in Statistical Hypothesis Testing Imagine a clinical trial testing a new blood pressure medication. The trial concludes the drug significantly lowers blood pressure, but in reality, it doesn't. This is a Type

Automated Text Summarization with Sumy LibraryApr 18, 2025 am 09:37 AM

Automated Text Summarization with Sumy LibraryApr 18, 2025 am 09:37 AMSumy: Your AI-Powered Summarization Assistant Tired of sifting through endless documents? Sumy, a powerful Python library, offers a streamlined solution for automatic text summarization. This article explores Sumy's capabilities, guiding you throug

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

SublimeText3 English version

Recommended: Win version, supports code prompts!

SublimeText3 Chinese version

Chinese version, very easy to use

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool