Registering your business as a Limited Liability Partnership (LLP) is an increasingly popular choice among entrepreneurs and professionals due to its unique blend of flexibility, legal protection, and simplified compliance. LLP registration offers distinct advantages and comes with specific legal requirements that ensure a streamlined and efficient business structure. Here’s a detailed look at the key advantages and legal requirements of LLP registration.

Key Advantages of LLP Registration

1.Limited Liability Protection

o LLPs offer limited liability protection to partners, meaning their personal assets are not at risk for the business’s debts and obligations. This shields partners from personal financial loss beyond their investment in the LLP, making it a secure business structure.

2.Separate Legal Entity

o An LLP is a separate legal entity, distinct from its partners. This allows the LLP to own property, enter contracts, sue, and be sued independently of its partners, which provides legal security and continuity for the business.

3.Operational Flexibility

o LLPs provide operational flexibility with fewer regulatory requirements compared to companies. Partners can manage the business directly without mandatory board meetings or stringent governance structures, allowing for quicker decision-making and adaptability.

4.No Minimum Capital Requirement

o Unlike other corporate structures that require a specific minimum paid-up capital, LLPs have no such requirement. This makes it easier for businesses to start operations with minimal initial funding, making LLPs accessible for startups and small enterprises.

5.Tax Benefits

o LLPs enjoy several tax benefits, including exemption from dividend distribution tax, and they are not subject to double taxation, unlike companies. Profits are taxed at the LLP level, and partners are not taxed on the income they receive, which can lead to significant tax savings.

6.Ease of Compliance and Lower Costs

o LLPs have simplified compliance requirements compared to private limited companies. There are fewer mandatory filings and no requirement for an annual audit unless certain thresholds are exceeded, reducing the administrative burden and associated costs.

7.Perpetual Succession

o he LLP structure allows for perpetual succession, meaning the business continues to exist regardless of changes in partnership due to retirement, death, or resignation. This ensures stability and longevity for the business, which is beneficial for long-term planning.

8.Enhanced Credibility

o Registering as an LLP enhances the credibility of the business, making it easier to attract clients, partners, and investors. Being a recognized legal entity demonstrates commitment to regulatory compliance and structured operations.

9.Simplified Ownership Transfer

o LLPs allow for easy transfer of ownership, with partners able to transfer their rights in accordance with the LLP agreement. This flexibility facilitates changes in partnership without disrupting the business’s operations.

10.Suitable for Various Business Models

o LLPs are versatile and can accommodate a wide range of business models, including professional services, joint ventures, and startups. This adaptability makes them a preferred choice for businesses looking for a flexible yet structured legal framework.

Legal Requirements for LLP Registration

1.Minimum Number of Partners

o To register an LLP, a minimum of two partners is required, with no upper limit on the maximum number of partners. At least one partner must be an Indian resident.

2.Designated Partners and DIN

o LLPs must have at least two designated partners who are responsible for regulatory and compliance obligations. These designated partners must obtain a Designated Partner Identification Number (DPIN), similar to a Director Identification Number (DIN) required for company directors.

3.Digital Signature Certificate (DSC)

o All designated partners must obtain a Digital Signature Certificate (DSC) as all documents for LLP registration are filed electronically. The DSC ensures the authenticity and security of the submitted documents.

4.Unique Name and Approval

o The proposed LLP name must be unique and not identical to an existing company or LLP. The name must comply with naming guidelines and should not be misleading or offensive. The Registrar of Companies (ROC) will approve the name upon verification.

5.LLP Agreement

o An LLP agreement outlines the mutual rights, duties, and responsibilities of the partners. This agreement must be filed with the ROC within 30 days of incorporation and should cover aspects such as profit-sharing ratios, decision-making processes, and the procedure for adding or removing partners.

6.Registered Office Address

o An LLP must have a registered office within India where official communications and notices can be sent. The registered office address must be provided during the registration process and must comply with local laws and regulations.

7.Filing of Incorporation Documents

o Key documents such as Form FiLLiP (Form for incorporation of LLP), proof of address, identity proofs of partners, and the LLP agreement must be submitted to the ROC. Upon successful verification, the Certificate of Incorporation will be issued.

8.Compliance and Reporting

o LLPs are required to file an annual return (Form 11) and a Statement of Accounts and Solvency (Form 8) with the ROC. While annual audits are not mandatory unless the turnover exceeds INR 40 lakhs or contribution exceeds INR 25 lakhs, maintaining accurate financial records is essential.

9.Tax Registrations

o Depending on the business activities, LLPs may need to register for GST, Professional Tax, and other applicable state or central taxes. Ensuring compliance with tax regulations is critical for avoiding penalties and legal issues.

10.Maintenance of Statutory Records

o LLPs must maintain statutory records, including the register of partners, minutes of meetings, and financial statements. These records should be kept up-to-date and made available for inspection when required by authorities.

Conclusion

LLP registration and LLP closure offers significant advantages for modern businesses, including limited liability protection, operational flexibility, and tax benefits, all while maintaining a simpler compliance framework. By understanding and fulfilling the legal requirements, businesses can leverage the LLP structure to build a robust, credible, and sustainable enterprise.

The above is the detailed content of LLP Registration: Key Advantages and Legal Requirements. For more information, please follow other related articles on the PHP Chinese website!

Replace String Characters in JavaScriptMar 11, 2025 am 12:07 AM

Replace String Characters in JavaScriptMar 11, 2025 am 12:07 AMDetailed explanation of JavaScript string replacement method and FAQ This article will explore two ways to replace string characters in JavaScript: internal JavaScript code and internal HTML for web pages. Replace string inside JavaScript code The most direct way is to use the replace() method: str = str.replace("find","replace"); This method replaces only the first match. To replace all matches, use a regular expression and add the global flag g: str = str.replace(/fi

8 Stunning jQuery Page Layout PluginsMar 06, 2025 am 12:48 AM

8 Stunning jQuery Page Layout PluginsMar 06, 2025 am 12:48 AMLeverage jQuery for Effortless Web Page Layouts: 8 Essential Plugins jQuery simplifies web page layout significantly. This article highlights eight powerful jQuery plugins that streamline the process, particularly useful for manual website creation

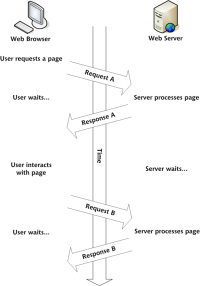

Build Your Own AJAX Web ApplicationsMar 09, 2025 am 12:11 AM

Build Your Own AJAX Web ApplicationsMar 09, 2025 am 12:11 AMSo here you are, ready to learn all about this thing called AJAX. But, what exactly is it? The term AJAX refers to a loose grouping of technologies that are used to create dynamic, interactive web content. The term AJAX, originally coined by Jesse J

10 jQuery Fun and Games PluginsMar 08, 2025 am 12:42 AM

10 jQuery Fun and Games PluginsMar 08, 2025 am 12:42 AM10 fun jQuery game plugins to make your website more attractive and enhance user stickiness! While Flash is still the best software for developing casual web games, jQuery can also create surprising effects, and while not comparable to pure action Flash games, in some cases you can also have unexpected fun in your browser. jQuery tic toe game The "Hello world" of game programming now has a jQuery version. Source code jQuery Crazy Word Composition Game This is a fill-in-the-blank game, and it can produce some weird results due to not knowing the context of the word. Source code jQuery mine sweeping game

How do I create and publish my own JavaScript libraries?Mar 18, 2025 pm 03:12 PM

How do I create and publish my own JavaScript libraries?Mar 18, 2025 pm 03:12 PMArticle discusses creating, publishing, and maintaining JavaScript libraries, focusing on planning, development, testing, documentation, and promotion strategies.

Load Box Content Dynamically using AJAXMar 06, 2025 am 01:07 AM

Load Box Content Dynamically using AJAXMar 06, 2025 am 01:07 AMThis tutorial demonstrates creating dynamic page boxes loaded via AJAX, enabling instant refresh without full page reloads. It leverages jQuery and JavaScript. Think of it as a custom Facebook-style content box loader. Key Concepts: AJAX and jQuery

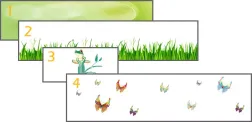

jQuery Parallax Tutorial - Animated Header BackgroundMar 08, 2025 am 12:39 AM

jQuery Parallax Tutorial - Animated Header BackgroundMar 08, 2025 am 12:39 AMThis tutorial demonstrates how to create a captivating parallax background effect using jQuery. We'll build a header banner with layered images that create a stunning visual depth. The updated plugin works with jQuery 1.6.4 and later. Download the

How to Write a Cookie-less Session Library for JavaScriptMar 06, 2025 am 01:18 AM

How to Write a Cookie-less Session Library for JavaScriptMar 06, 2025 am 01:18 AMThis JavaScript library leverages the window.name property to manage session data without relying on cookies. It offers a robust solution for storing and retrieving session variables across browsers. The library provides three core methods: Session

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

WebStorm Mac version

Useful JavaScript development tools

Atom editor mac version download

The most popular open source editor

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment