FTX creditors will receive up to 142% compensation, creditors unhappy with exemption clause

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-05-09 08:37:18434browse

May 8 News: Cryptocurrency exchange FTX has accumulated billions of dollars in funds, more than it needs for customers who lost in its collapse in November 2022, allowing them to obtain full recovery after the company went bankrupt. amount of compensation. The additional cash will be used to pay interest on the company's more than 2 million customers, and according to a company statement, the company will have as much as $16.3 billion in cash available for distribution once the sale of all assets is completed. It owes about $11 billion to customers and other nongovernmental creditors.

All debt will be repaid in full with interest and shareholders will be left with nothing, according to court documents filed late Tuesday in federal court in Wilmington, Delaware, where the FTX case is being handled. Depending on the type of claim in the case, some creditors can recover up to 142%. The vast majority of customers will likely receive 118% of the payments they made on the FTX platform on the date the company went bankrupt under Chapter 11.

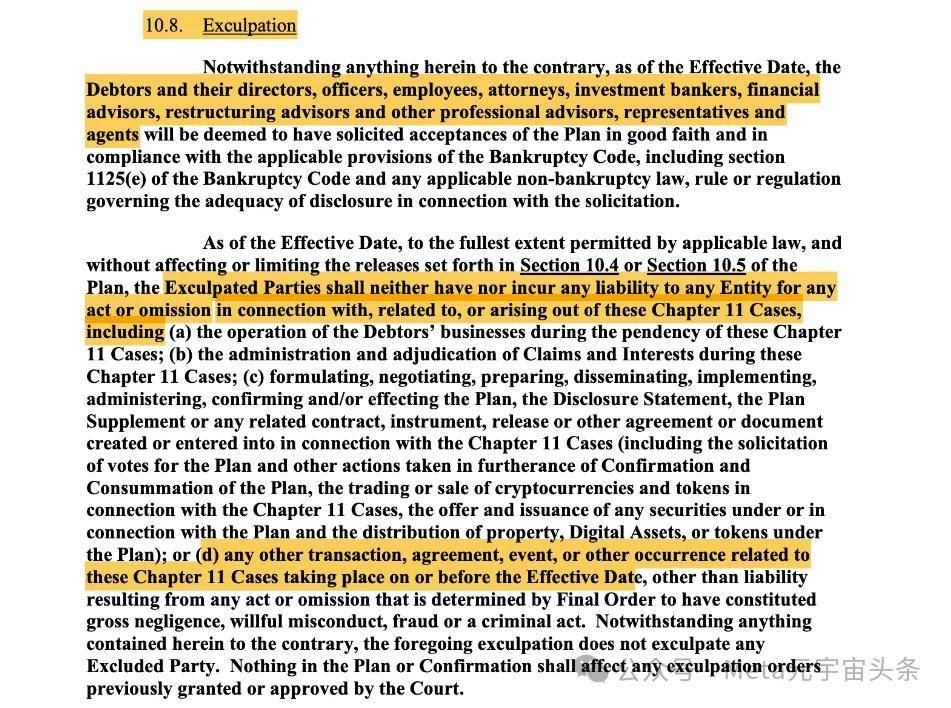

However, while FTX's newly revised proposal promises "billions of dollars in compensation," creditors have expressed dissatisfaction with specific terms related to law firm Sullivan & Cromwell (S&C). The amendment to the debt repayment case announced by FTX on the 7th contains an exemption clause, which may exempt some parties from liability during bankruptcy proceedings. FTX creditor Sunil pointed out that in FTX’s case, S&C may have included clauses exempting itself from any potential liability, which caused concern and dissatisfaction among creditors.

“S&C included a disclaimer so they would not be held liable for wrongdoing if we accepted the program – offering discounts of 70% to 90% to their own customers and insiders ( Ledger X, Galaxy) sell FTX assets, do not restart FTX 2.0, etc.”

Disclaimer. Source: Sunil

The controversial clause comes nearly three months after FTX’s top creditor sued bankrupt firm Sullivan & Cromwell (S&C). The creditors allege that S&C actively participated in "FTX Group's multi-billion dollar fraud" and allege that the company benefited financially from FTX's fraud, according to a court filing on February 16:

“S&C was aware of FTX US and FTX Trading Ltd.’s negligent, dishonest and fraudulent conduct and misappropriation of class members’ funds. Despite this knowledge, S&C would benefit financially from the FTX Group’s misconduct and therefore agrees that ( At least implicitly) assisting this illegal behavior to obtain self-interest”

Will FTX’s amendment plan be rejected?

FTX’s new plan has sparked widespread outrage among cryptocurrency investors, largely because of its not-guilty clauses that could prompt creditors, including pseudonymous FTX creditor Rob, who is also Paradex’s head of growth, to vote against it. Rob wrote in a post on May 8: "The team's icing on the cake destroys billions of potential value for FTX customers. This cannot be allowed. I vote against this plan."

While FTX Debtors said they would pay 11% to more than 98% of creditors, plus "billions of dollars in compensation" to the remaining creditors, some believe this is unfair because the debtors Holders are compensated based on the Bitcoin price of $16,800.

BitGo CEO Mike Belshe stated in a May 8 post that none of FTX’s creditors would accept this compensation structure:

“0% of FTX creditors agree to your Bitcoin Getting $16,800 is full compensation. I understand why the bankruptcy process needs to be conducted this way, but let's not pretend that the victims have gotten their money back, or that FTX isn't as bad as it once was."

The company. Currently run by a restructuring adviser, it has also proposed setting up a fund to pay some creditors, including those who lent FTX cryptocurrency, funds that would otherwise go to government regulators.

As FTX moves into the final stages of its bankruptcy case, payments may still be months away.

The above is the detailed content of FTX creditors will receive up to 142% compensation, creditors unhappy with exemption clause. For more information, please follow other related articles on the PHP Chinese website!