What role does block size play in cryptocurrency?

Block size usually refers to the data storage capacity or size of each block in the blockchain. The blockchain is a distributed database composed of blocks, and each block contains a certain number of Transaction data and information related thereto. But what is the role of block size in cryptocurrencies? What many people don’t understand is that block size actually plays a crucial role in affecting the efficiency and structure of a blockchain network, because a block in a blockchain contains a set of transactions, and the capacity of transactions within a block depends on to its size. Next, the editor will tell you in detail.

What is the role of block size in cryptocurrency?

Block size directly affects blockchain network performance. Larger block sizes can increase transaction throughput, but also have the disadvantage of increasing resource requirements for network users and extending verification periods.

Smaller block sizes help increase the ease of use of the network, thereby increasing decentralization and reducing the resources required to participate in the blockchain. The blockchain community often debates optimal block sizes to design blockchain protocols that strike a delicate balance between security, decentralization, and scalability.

Bitcoin’s original 1MB block size caused congestion during periods of high demand, limiting transaction processing per block. However, Bitcoin Cash takes a different approach to enhance scalability. By increasing the block size to 8MB, Bitcoin Cash can accommodate more transactions, thereby increasing overall transaction processing capabilities. This change allows Bitcoin Cash to better meet user needs and reduces the risk of transaction congestion.

There is a trade-off in adjusting block size, as larger blocks increase bandwidth and storage requirements. Maintaining a delicate balance is critical to scalability. While increasing block size can improve transaction performance, it also has the potential to lead to centralization, as only nodes with sufficient resources can process the additional data.

Sharding is a solution introduced by the Ethereum blockchain to divide the network into smaller, manageable data sets, known as shards. Each shard runs independently and is responsible for managing its smart contracts and transactions. Compared with the linear scaling model, sharding distributes transaction processing among different shards, thereby eliminating dependence on the performance of a single node and providing a more distributed and efficient architecture. This sharding technology allows the Ethereum network to handle more transactions and achieve higher scalability and throughput. By dividing the network into multiple shards, each shard only needs to process its own related transactions and smart contracts, thereby improving the performance and efficiency of the entire network.

In the sharding model, the impact of block size on scalability is not very important, but scalability is achieved through the combination of multiple parallel shards. Each shard contributes to the network’s overall transaction processing capabilities, allowing for concurrent execution, thus enhancing the overall scalability of the blockchain.

What does block size mean?

The block size represents the block's ability to accommodate data. Each block is used to carry data for a period of time and is connected in series through cryptography technology to form a distributed database.

When Bitcoin was founded, each block contained no more than 36 megabytes of transaction data, and the block size was only 1M. The reason why the block size is exactly 1M is that the Bitcoin block must permanently record the transaction data on the Bitcoin network. These data are classified to form a ledger and then added to the blockchain. If the block is too large, it will be restricted by the network. , and may even refuse. Block size can affect the verification pass rate of data volume.

The size of the block affects the number of transactions that the Bitcoin network can handle every minute and every second, because the Bitcoin block records various transaction data and conducts classified accounts. If an individual block If the block is too large, the amount of data will be rejected by the network, so the block can effectively restrain the expansion of the network. This prevents blocks from filling up and causing network congestion. Once that happens, transaction fees will continue to rise.

As Bitcoin transactions attract more and more people's attention, Bitcoin operations and transactions have become more frequent. The data recorded on the Bitcoin network has become more and more complex. The Bitcoin network has begun to become congested, and the number of transactions has increased. And the block size has reached its limit, so Bitcoin transaction fees are getting higher and higher.

The above is the detailed content of What role does block size play in cryptocurrency?. For more information, please follow other related articles on the PHP Chinese website!

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AM

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AMHis visit comes as the U.S. Congress moves closer to introducing legislation regulating stablecoins, which Ardoino believes is necessary for financial inclusion and preserving U.S. dollar dominance.

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AM

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AMThe XRP price holds still in the $2.10-2.20 range for the past few days, but this is not stopping Ripple's community from continuing to post various content about XRP

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AM

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AM

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AM

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AMRipple (XRP) price rallied through a weekend rise from its $2.00 critical support mark to reach $2.23.

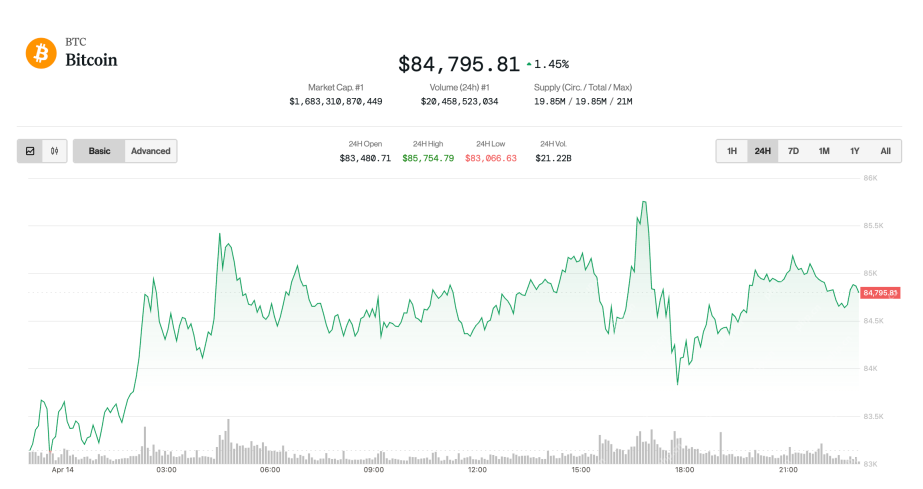

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AM

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AMThe largest cryptocurrency was up 1.6% in the last 24 hours and is now trading just shy of $85,000. Ether (ETH), meanwhile, rose 2.7%

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AM

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AMADA has risen by 1.5% in the past 24 hours, with its move to $0.644 coming as the crypto market suffers a 2% loss today.

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AM

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AMJimmy has nearly 10 years of experience as a journalist and writer in the blockchain industry. He has worked with well-known publications such as Bitcoin Magazine, CCN, and Blockonomi, covering news...

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Chinese version

Chinese version, very easy to use

Atom editor mac version download

The most popular open source editor

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

Zend Studio 13.0.1

Powerful PHP integrated development environment

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software