13F report: A total of 169 asset companies bought BlackRock IBIT! SIG holds 9 Bitcoin ETFs

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-05-08 17:40:11982browse

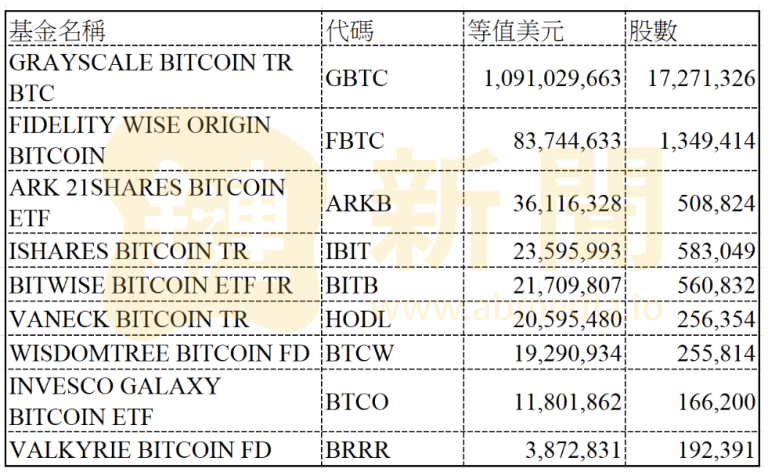

According to the latest 13F report, a total of 169 asset management companies currently declare to hold BlackRock’s Bitcoin spot ETF IBIT. Haina International Group (SIG) holds nine Bitcoin spot ETFs with a total amount of US$1.31 billion. The largest amount is Grayscale's GBTC, with a total of 17.27 million shares purchased, worth US$1.09 billion.

Susquehanna International Group bought $1.3 billion in Bitcoin spot ETFs

According to a report submitted by Susquehanna International Group (SIG), it owns nine U.S. Bitcoin spot ETFs shares, with a total value of more than 1.3 billion US dollars.

Haina International Group is an American multinational private financial technology company whose business scope covers securities investment, trading, financial services, etc. It is also the "designated market maker" for approximately 600 stock options and 45 stock index options on the Chicago Board Options Exchange, the American Stock Exchange, the Philadelphia Stock Exchange, and the International Stock Exchange. Its declared holdings this quarter amounted to more than 7,000 (excluding options), and it was all-encompassing. It bought nine Bitcoin spot ETFs alone, and the largest amount turned out to be Grayscale's GBTC, with a total of 17.27 million shares bought. , worth up to US$1.09 billion.

SIG bought nine Bitcoin spot ETFs this season for a total amount of US$1.31 billion.

Currently, 169 asset management companies have purchased IBIT

In addition, according to statistics from HODL15 Capital, a total of 168 asset management companies have currently declared holdings. There is BlackRock's IBIT, two of which have larger asset management companies located in Hong Kong.

However, its statistics do not include Haina International Group. According to statistical analysis, Haina International has 508,824 IBIT, which owns shares, is the second largest shareholder in the current 13F report according to statistics, but based on the number of IBIT's outstanding shares of 481,720,000, it only accounts for 0.1%. The number one YONG RONG (HK) ASSET MANAGEMENT LIMITED accounted for about 0.23%, but IBIT was its second largest holding in the first quarter.

The above is the detailed content of 13F report: A total of 169 asset companies bought BlackRock IBIT! SIG holds 9 Bitcoin ETFs. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- What are the platforms for buying Bitcoin? List of the top ten Bitcoin trading platforms!

- The best virtual currency exchange in China

- What are the legal virtual currency platforms in China? Virtual Bitcoin Trading Platform

- It is expected that after the Bitcoin halving, these 4 cryptocurrencies will explode in profits by 20 times!

- What will happen after Bitcoin halving?