Home >Technology peripherals >It Industry >The impact of the AI wave is obvious. TrendForce has revised up its forecast for DRAM memory and NAND flash memory contract price increases this quarter.

The impact of the AI wave is obvious. TrendForce has revised up its forecast for DRAM memory and NAND flash memory contract price increases this quarter.

- 王林forward

- 2024-05-07 21:58:121082browse

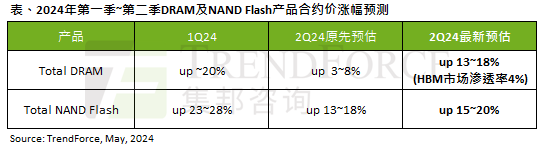

According to TrendForce’s survey report, the AI wave has a significant impact on the DRAM memory and NAND flash memory markets. In this site’s news on May 7, TrendForce said in its latest research report today that the agency has increased the contract price increases for two types of storage products this quarter.

Specifically, TrendForce originally estimated that the DRAM memory contract price in the second quarter of 2024 will increase by 3~8%, and now estimates it at 13~18%;

As for NAND flash memory, the original forecast It is estimated to increase by 13~18%, and the new estimate is 15~20%. Only eMMC/UFS has a lower increase of 10%.

TrendForce said that the agency originally expected to increase prices in two or three consecutive quarters. Later, the demand side of DRAM memory and NAND flash memory was not willing to accept significant price increases.

But in late April, storage companies completed the first round of contract price negotiations after the earthquake in Taiwan, and the increase was larger than expected. The reason is that in addition to the buyer's intention to support the price of the inventory in hand, the greater impact is that the AI craze has brought psychological changes to both supply and demand sides of the storage industry.

In terms of the DRAM market, storage manufacturers are worried that the increase in HBM memory production capacity will further crowd out the supply of traditional memory:

According to an earlier report by this website, Micron stated that the wafer volume consumption of HBM3E memory 3 times that of traditional DDR5 memory; the research report stated that by the end of 2024, about 60% of Samsung Electronics’ overall DRAM production capacity in the 1αnm process will be occupied by HBM3E memory.

After the assessment, the demand side considered preparing DRAM memory in advance in the second quarter to deal with the supply tension caused by the increase in HBM memory production starting from the third quarter.

In terms of NAND flash memory products, energy saving has become a priority for AI inference servers, and North American cloud service providers are expanding their adoption of QLC enterprise-class solid-state drives. The inventory of flash memory products has accelerated. Against this background, some suppliers have become reluctant to sell.However, the research report also mentioned that due to the uncertainty about the recovery of demand for consumer products, storage manufacturers’ capital expenditures on non-HBM memory production capacity still tend to be conservative, especially when they are still at the break-even point. DRAM flash memory.

The above is the detailed content of The impact of the AI wave is obvious. TrendForce has revised up its forecast for DRAM memory and NAND flash memory contract price increases this quarter.. For more information, please follow other related articles on the PHP Chinese website!