Capture 42+ DApps and 16+ blockchains, and interpret the entire chain liquidity infrastructure Entangle

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-05-06 21:20:01649browse

Written in front: The name of the Entangle project is taken from Quantum entanglement, which reflects the project’s vision of building connections, correlations and interoperability. Just like quantum entanglement links disparate particles together, Entangle aims to connect disparate blockchain networks together through its solutions for cross-chain liquidity and synthetic derivatives, creating a unified, interoperable Web3 ecosystem.

Sharding Capital invested in Entangle in July 2023 and has invested in both seed and private placements. The current book return is about 100 times, and the realized return is 3-4 times. Investing in Entangle is very attractive to us. Its innovative solutions, strong ecosystem and partnerships, technical strength and team background, as well as market demand and potential applications provide a solid foundation for the development of the project.

As a global market, the cryptocurrency and blockchain fields are constantly iterating and optimizing. New blockchains, new projects, and new technologies are increasing rapidly and splitting the entire encryption market into countless islands. The separation between chains and projects is a fact that cannot be ignored. The encryption field is facing severe fragmentation and interoperability problems. Cross-chain communication and seamless liquidity management are key issues that urgently need to be solved at the current stage of blockchain development.

Entangle is an innovative project aimed at solving these challenges, not only providing technical solutions but also making significant progress in terms of ecosystem and product suite.

As Entangle is about to launch on the mainnet at the end of this month, this article will delve into why Sharding Capital invested in Entangle.

Innovative Solutions

There are multiple independent networks and chains in the cryptocurrency and blockchain ecosystem, and the lack of effective interoperability and connectivity between them leads to users and assets cannot move between different chains. This fragmentation not only limits users’ choices and flexibility, but also increases the complexity of cross-chain interactions and hinders the development and maturity of the entire ecosystem.

Entangle helps solve the fragmentation problem in the crypto market through multiple innovative components and provides users and developers with seamless cross-chain interoperability and liquidity management.

Photon Messaging: Customizable, high-speed, and cost-effective full-chain messaging solution. Photon messaging allows fast messaging between any EVM or non-EVM network, making communication between different chains more convenient and efficient.

Universal Data Source: This is a low-latency, cost-effective data infrastructure compatible with any Web2 or Web3 data source. Universal data sources make data sharing and exchange between different chains simpler, providing developers with more flexibility and choices.

Liquid Vaults and Synthetic Vaults: Provide solutions for cross-chain liquidity management and synthetic assets. Users can manage and trade assets in these Vaults without worrying about barriers between different chains, thus increasing the liquidity and flexibility of assets.

Cross-chain liquidity and synthetic derivatives

Entangle is positioned as a full-chain connector in the Web3 ecosystem, providing developers with a powerful set of infrastructure and tools that enable them to Build in this dynamic environment!

Entangle’s Liquid Vaults and Synthetic Vaults provide solutions for cross-chain liquidity management and synthetic assets, using synthetic derivatives to synergize liquidity, and provide liquidity in the universal Layer1 and Layer2 ecosystem. Give value.

Entangle DEX allows users to exchange between USDC and LSD, as well as create, trade and manage their LSD. Entangle DEX also supports cross-chain exchange through Entangle Oracle.

Synthetic derivatives are a synthetically created financial product that derives its value from an underlying asset or index but does not directly hold that asset. The combination of cross-chain liquidity and synthetic derivatives provides users with more investment and trading options. Users can utilize cross-chain liquidity to seamlessly transfer assets between different chains, while using synthetic derivatives to track and trade the price movements of various assets on different chains. This combination provides users with more flexibility and choice and helps increase liquidity and efficiency across the DeFi ecosystem.

Market Demand and Potential Application

Entangle, as an innovative project dedicated to solving key issues in the field of cryptocurrency and blockchain, has a wide range of market demand and potential application.

Solving cross-chain communication and interoperability issues

Improving the liquidity and efficiency of the DeFi ecosystem

Provide more investment and trading options

Reduce transaction costs and risks

-

Meet the growing market demand

The infrastructure provided by Entangle provides users and developers with an efficient and flexible solution. With the continuous development of the cryptocurrency and blockchain fields, Entangle is expected to become a unified Web3 Full chain base layer.

Strong Ecosystem and Partnerships

Entangle has established strategic partnerships with industry leaders including Arbitrum, Mantle, Linea, AAVE, Polygon, Stargate, Velodrome, SushiSwap and other integrated 42 DApps, 16 Blockchains.

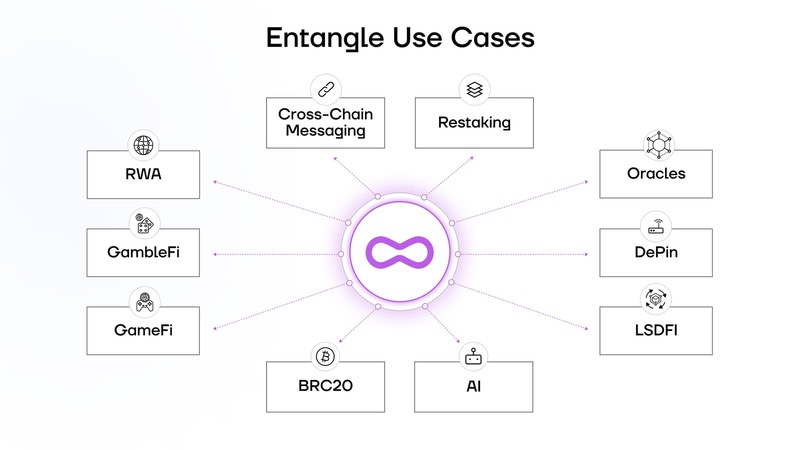

Entangle has made significant progress in establishing itself in the critical blockchain ecosystem. In the process, it unlocks a variety of use cases spanning various Layer1 and Layer2 networks, DeFi protocols, Real World Assets (RWA), GameFi, DEPin, AI, and more.

Invest now, shape the future

In Entangle’s investment decisions, Sharding Capital sees a revolutionary force that is not just Driven by innovative technology, it is also a deep understanding of the overall development direction of the cryptocurrency and blockchain industry. As an institution dedicated to mining and investing in innovative projects, Sharding Capital is convinced that Entangle’s full-chain liquidity infrastructure will become one of the important pillars of the future cryptocurrency and blockchain industry.

With the rapid development of the cryptocurrency and blockchain fields, Entangle will continue to play its unique role in promoting cross-chain communication and seamless liquidity management, providing users and developers with a unified, interoperable Web3 ecosystem. Sharding Capital will continue to pay close attention to the development of the Entangle project and is proud of its future success.

Investing in Entangle is a choice to invest in the future, and this future will be built by innovation, interconnection and win-win. In this cryptocurrency and blockchain world full of energy and opportunities, Entangle will continue to play an important role and lead the development direction of the industry.

The above is the detailed content of Capture 42+ DApps and 16+ blockchains, and interpret the entire chain liquidity infrastructure Entangle. For more information, please follow other related articles on the PHP Chinese website!