web3.0

web3.0 On the eve of drastic changes, Ethena initiated a deep penetration into the stablecoin market.

On the eve of drastic changes, Ethena initiated a deep penetration into the stablecoin market.On the eve of drastic changes, Ethena initiated a deep penetration into the stablecoin market.

Source: PANews

Core view: A crypto-native synthetic USD stablecoin, somewhere between centralization and decentralization It is a structured passive income product between , which keeps assets on the chain and maintains stability through Delta neutrality while earning income.

- The birth background is that USDT & USDC, represented by centralized stablecoins, dominate the stablecoin market, the collateral of the decentralized stablecoin DAI gradually becomes centralized, and the algorithmic stablecoins LUNA & UST are in It grew massively to the top five stablecoins in market capitalization and then collapsed. The birth of Ethena is a compromise and balance between the DeFi and CeFi markets.

- The OES service provided by the institution manages assets on the chain and maps the amount to a centralized exchange to provide margin. It retains the characteristics of DeFi and isolates the funds on the chain from the exchange to reduce the misappropriation of funds by the exchange. , insolvency and other risks. On the other hand, the characteristics of CeFi are retained to obtain sufficient liquidity.

- The underlying income consists of the Staking income from Ethereum liquidity derivatives and the funding rate income obtained from opening hedging positions on the exchange. Also known as a structured universal funding rate arbitrage income product.

- is incentivizing liquidity through a points system.

Its ecological assets include:

- USDe - a stable currency minted by depositing stETH (more assets and derivatives may be added in the future).

- s USDe - Voucher tokens obtained after staking USDe.

- ENA - Protocol token/governance token, currently flowing into the market after each period of points redemption, locking ENA can obtain greater points acceleration.

Research Report

1/6 • How USDe stablecoin is minted and redeemed

Deposit st ETH into the Ethena protocol, that is USDe can be minted at a ratio of 1:1 USD. The deposited st ETH is sent to the third-party custodian, and the balance is mapped to the exchange through "Off-exchange Settlement". Ethena then opens a short ETH perpetual position on CEX to ensure that the collateral value remains delta neutral or at USD pricing remains unchanged.

- Ordinary users can obtain USDe in permissionless external liquidity pools.

- Authorized institutions that have been screened by KYC/KYB and whitelisted can mint and redeem USDe at any time directly through the Ethena contract.

- Assets are always kept in transparent on-chain custody addresses, so they do not rely on traditional banking infrastructure and will not be affected by exchange misappropriation of funds, bankruptcy, etc.

2/6 • OES - ceDeFi’s fund custody method

OES (Off-exchange Settlement) is a settlement method for over-the-counter fund custody, which also takes into account the on-chain Transparent traceability and use of funds on centralized exchanges.

- Use MPC technology to build a custody address, save the user's assets on the chain to maintain transparency and decentralization, and the address is jointly managed by the user and the custody institution, eliminating the exchange counterparty risks, greatly mitigating potential security issues and misuse of funds. This can ensure that the assets are in the hands of the users to the greatest extent.

- OES providers usually cooperate with exchanges to enable traders to map asset balances to the exchange from wallets they jointly control to complete related transactions and financial services. This would allow, for example, Ethena to host funds off-exchange, but still be able to use those funds on the exchange to provide collateral for delta-hedged derivatives positions.

MPC Wallet is currently seen as the perfect choice for conglomerates to control a single pool of crypto assets. The MPC model distributes individual keys in separate units to respective wallet users, jointly managing escrow addresses.

##3/6 •Profit method

- ETH flow Ethereum staking benefits from sexual derivatives.

- The capital rate income obtained by opening a short position on the exchange, and the Basis Spread income.

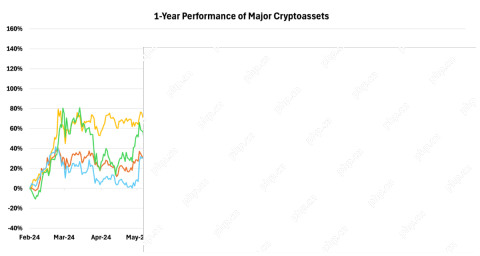

4/6 •Yield and Sustainability

In terms of yield, the maximum annualized return earned by the agreement in the past month is 35%, allocated to s USDe has a yield of 62%. The difference here is because USDe is not all pledged and converted into s USDe. In fact, it is basically impossible to achieve a 100% pledge rate. If only 50% of USDe is pledged and converted into s USDe, then this part of s USDe is equal to 50%. The pledge amount captures 100% of all returns. Because the application scenarios of USDe will enter DeFi protocols such as Curve and Pendle, this not only meets the needs of different application scenarios, but also potentially increases the yield of USDe.

However, as the market cools down and the number of long funds in the exchange decreases, the funding rate income will also decrease. Therefore, after entering April, the comprehensive income has an obvious downward trend. Currently, the Protocol Yield has decreased. to 2%, sUSDe Yield drops to 4%.

So in terms of yield, USDe is more dependent on the futures contract market in centralized exchanges, and will also be restricted by the scale of the futures market, because when the issuance of USDe exceeds the corresponding futures market capacity, It no longer meets the conditions for USDe to continue to expand.

5/6 •Scalability

The scalability of stablecoins is crucial, it refers to the conditions and possibilities for increasing the supply of stablecoins.

Stablecoin protocols like Maker often limit scalability due to over-collateralization requirements, requiring more than $1 in collateral to mint $1. Ethena is unique in that the main constraint on its scalability will be the ETH Perpetual Market Open Interest.

Open Interest refers to the total number of open positions on the exchange. Here, it specifically refers to the total value of open ETH perpetual contract positions on centralized exchanges. This number currently stands at approximately $12 billion (April 2024). This number reflects the current level of ETH positioning among market participants.

Comparing Ethena From its initial stage in early 2024, ETH Open Interest has grown from 8 billion to 12 billion. Recently, Ethena has supported the BTC market. The current BTC Open Interest is about 30 billion. The issuance of USDe is approximately US$2.3 billion. Of course, this includes the impact of many factors, such as the natural growth of market users, the price growth of ETH, BTC, etc. But the point here is that the scalability of USDe is closely related to the size of the perpetual market.

This is also the reason why Ethena cooperates with centralized exchanges. In 2023, the stablecoin project UXD Protocol on the Solana chain uses the same delta neutral method to issue stablecoins, but it chose decentralization on the chain. The exchange implements a hedging strategy, but due to the limited liquidity on the chain, when the stablecoin issuance reaches a certain scale, it means that a larger amount of short selling operations are required, which ultimately leads to negative funding rates and a large amount of additional costs. In addition, UXD used the leverage protocol Mango on the Solana chain for short selling. Later, Mango was attacked on the chain. Multiple reasons eventually led to the failure of the project.

So, can the market value of USDe reach USDT? DAI? Which level?

Currently, the market value of USDe is around US$2.3 billion, ranking fifth in the overall stablecoin market value ranking. It has surpassed most decentralized stablecoins, and is still US$3 billion away from DAI.

Currently, ETH Open Interest is close to the highest historical peak level, and BTC Open Interest has reached the highest historical peak. Therefore, the expansion of USDe’s market value requires increasing short positions of corresponding value in the existing market. This is detrimental to the current USDe Growth is challenging. As the main source of income for USDe, the funding rate is the mechanism used in perpetual contracts to adjust the price to match the spot market. This is usually achieved by paying periodic funding fees from long to short or from short to long. When excessive USDe is issued and short positions in the market increase, it may gradually push the funding rate down or even become negative. If the funding rate decreases or becomes negative, it may reduce Ethena’s earnings from the market.

As long as market sentiment remains unchanged, this is a typical market supply and demand balance problem, which requires finding a balance between expansion and yield. If we consider that the market sentiment is heading towards a bull market and the sentiment of going long when prices rise is high, the theoretical capacity for issuing USDe will increase. On the other hand, if the market sentiment is heading towards a bear market and the sentiment of going long when prices are falling decreases, the theoretical capacity for issuing USDe will decrease.

Combining yield and scalability, USDe may become a stable currency with high returns, limited scale in the short term, and long-term market trends.

6/6 •Risk Analysis

Funding Rate Risk - When there are insufficient long positions in the market, or USDe is issued excessively, you will face negative returns on the funding rate, Ethena Fees need to be paid to longs as shorts. At this point though, Ethena concludes based on historical data that the market is positive most of the time. In addition, Ethena uses LST (such as stETH) as collateral for USDe, which can provide an additional margin of safety for negative rates in the form of stETH earning an annualized rate of 3-5%. However, it is worth noting that similar agreements have previously attempted to expand the scale of synthetic U.S. dollar stablecoins, but all failed due to inverted yields.

Custody risk - Fund custody relies on OES and centralized institutions that provide services. The bankruptcy of the exchange may cause losses to unsettled profits, and the bankruptcy of the OES institution may cause delays in obtaining funds. Although OES has adopted MPC and kept funds in the simplest possible way, there is still a theoretical possibility of theft of funds.

Liquidity Risk - If a position needs to be closed or adjusted quickly at a specific moment, a large amount of funds may face the problem of insufficient liquidity, especially in times of market stress or panic. Ethena attempts to alleviate and solve this problem by cooperating with centralized exchanges, such as progressive liquidation, gradual closing of positions, or other convenient policies to mitigate market shocks. This partnership may provide strong flexibility and advantages, but This also means the risk of centralization is introduced.

Asset anchoring risk - st ETH and ETH are theoretically anchored at 1:1, but there have been brief decouplings in history, mainly before the Shanghai upgrade. The future flow in Ethereum There may still be some unknown risks at the level of sexual derivatives. Asset decoupling could also trigger the liquidation of exchanges.

In order to deal with the series of risks mentioned above, Ethena has established an insurance fund. The funds come from the distribution of income by the agreement in each cycle, and part of it will be credited to the insurance fund.

The above is the detailed content of On the eve of drastic changes, Ethena initiated a deep penetration into the stablecoin market.. For more information, please follow other related articles on the PHP Chinese website!

Top 10 virtual currency exchange app rankings The latest ranking of top 10 exchanges in the currency circle in 2025Apr 30, 2025 am 10:15 AM

Top 10 virtual currency exchange app rankings The latest ranking of top 10 exchanges in the currency circle in 2025Apr 30, 2025 am 10:15 AMTop 10 virtual currency exchange app rankings: 1. Binance, 2. OKX, 3. Coinbase, 4. Kraken, 5. Huobi, 6. Bitfinex, 7. Bittrex, 8. Poloniex, 9. KuCoin, 10. Gemini, each exchange is highly respected for its trading volume, currency richness, security, user-friendliness and other characteristics.

MVRV Ratio as an Analytical Lens, Not a Predictive ToolApr 30, 2025 am 10:14 AM

MVRV Ratio as an Analytical Lens, Not a Predictive ToolApr 30, 2025 am 10:14 AMKeep up with the latest in crypto market commentary as we share the insights from our institutional research partners.

Edge Blockchain Design Targets Institutional Use CasesApr 30, 2025 am 10:12 AM

Edge Blockchain Design Targets Institutional Use CasesApr 30, 2025 am 10:12 AMMiden, an independent blockchain protocol, has secured $25 million in seed funding to develop its zero-knowledge (ZK) infrastructure for privacy-centric

In a Maturing Crypto Market, Seasoned Investors Are Sharpening Their FocusApr 30, 2025 am 10:10 AM

In a Maturing Crypto Market, Seasoned Investors Are Sharpening Their FocusApr 30, 2025 am 10:10 AMIn a maturing crypto market, seasoned investors are beginning to sharpen their focus on early-stage opportunities with asymmetric upside.

The US Securities and Exchange Commission (SEC) delayed decisions on five crypto-related exchange-traded funds (ETFs) applicationsApr 30, 2025 am 10:08 AM

The US Securities and Exchange Commission (SEC) delayed decisions on five crypto-related exchange-traded funds (ETFs) applicationsApr 30, 2025 am 10:08 AMThe postponements affect Franklin Templeton's spot Solana (SOL) and XRP ETFs, Grayscale spot Hedera (HBAR) ETF, Bitwise spot Dogecoin (DOGE) ETF

title: A closely followed analyst believes that the crypto markets are primed for a corrective move following strong rallies over the past couple of weeks.Apr 30, 2025 am 10:04 AM

title: A closely followed analyst believes that the crypto markets are primed for a corrective move following strong rallies over the past couple of weeks.Apr 30, 2025 am 10:04 AMPseudonymous analyst Altcoin Sherpa tells his 245200 followers on the social media platform X that he thinks “a dip is going to come soon,” but he doesn't see any reason to be super bearish once the correction takes place.

Virtuals Protocol (VIRTUAL) Soars Past $1.50 as Binance.US Opens TradingApr 30, 2025 am 10:02 AM

Virtuals Protocol (VIRTUAL) Soars Past $1.50 as Binance.US Opens TradingApr 30, 2025 am 10:02 AMVirtuals Protocol (VIRTUAL), a popular AI agent project, soared past $1.50 early Tuesday after Binance.US opened trading for the altcoin.

BNB is not just another token - it is the fuel, the bony, the world's largest crypto exchange, and BNB ChainApr 30, 2025 am 10:00 AM

BNB is not just another token - it is the fuel, the bony, the world's largest crypto exchange, and BNB ChainApr 30, 2025 am 10:00 AMOriginally started as an ERC 20 token on Ethereum in 2017, BNB has now been migrated to its own blockchain and has developed into a hybrid Exchange

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Dreamweaver CS6

Visual web development tools

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

Atom editor mac version download

The most popular open source editor

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.