Keep up with the latest in crypto market commentary as we share the insights from our institutional research partners.

Keep up with the latest in crypto market commentary as we share the insights from our institutional research partners.

In this edition, Presto Research delves into how Bitcoin's MVRV ratio could be used as an analytical lens rather than a predictive tool, with evolving network dynamics such as declining on-chain volume and increasing institutional adoption.

Since Bitcoin’s inception, a myriad of approaches have sought to pin down its elusive fair value, navigating the uncharted waters of this novel asset class. Among these, the Market Value to Realized Value (MVRV) ratio has gained traction as a leading valuation metric in the crypto industry. Yet, too often, MVRV is narrowly wielded as a mere price predictor, a reductive lens that obscures its deeper potential, while inviting skepticism due to its inherent limitations.

This report ventures beyond such confines, illuminating MVRV’s true capabilities. First, we explore its conventional application, highlighting its foundational mechanics. Next, we examine why Bitcoin’s recent transformations – spanning investor behavior, network infrastructure, and mainstream adoption – render traditional approaches less effective. Finally, we offer a refined perspective, advocating for a holistic approach to leverage MVRV as a tool for decoding the Bitcoin network’s evolving fundamentals.

1. MVRV Recap: The Standard Approach

Popularized by CoinMetrics since December 2018, MVRV has become a widely cited metric for valuing the Bitcoin network. This section explores its concept and the factors driving the metric.

2.1. Definition

The Formula for MVRV Ratio is as below:

MVRV Ratio = Market Value / Realized Value

where,

Market Value (MV): The value of the circulating Bitcoin supply at the current price, akin to equity market capitalization, with all BTC valued at a single price.

Realized Value (RV): The value of the circulating Bitcoin supply based on the price when each BTC last moved on-chain, with each BTC valued at its respective price and then aggregated.

Figure 1: Bitcoin’s MVRV Ratio Since Inception

Source: Blockchain.com, Presto Research

2.2. Standard Interpretation

2.2.1. Realized Value

Unlike MV, which is straightforward, RV may be less intuitive for new industry entrants. Technically, it is calculated by valuing each Unspent Transaction Output (UTXO) at the price when it was created. For valuation purposes, framing it in one of the following three ways can aid understanding.

The Bitcoin blockchain serves as the official transaction ledger, where only on-chain transactions are considered the sole source of truth.

Inactive coins, being dormant and unused, are underweighted from the network's value. RV effectively marginalizes them from valuation.

Derived from market price and on-chain transfer volume, RV weights coins based on their actual activity in the Bitcoin economy.

Seen this way, the MVRV ratio also somewhat resembles the price-to-book ratio (PBR) in equity valuation. Book value reflects a company’s worth, calculated as the residual value of assets minus liabilities, based on agreed-upon accounting standards. Similarly, by treating on-chain transactions as the standard for "true price discovery," RV serves as a foundational measure of the Bitcoin network’s value, while broader and real-time price discovery occurs mostly through off-chain transactions.

2.2.2. The Relationship Between MV and RV

Since only a portion of the circulating Bitcoin supply changes hands on-chain at any given time, MV is typically, but not always, a multiple of RV. Comparing the current MVRV multiple to its historical range can therefore help assess the Bitcoin network’s valuation.

For example, BTC currently trades at an MVRV Ratio of 1.93, near the midpoint of its historical range. Since inception, BTC has spent only 15% of its time below an MVRV Ratio of 1 and 6% above 3.2, often interpreted as oversold or overbought zones, respectively. This concept particularly makes sense if one subscribes to the view that RV represents a weighted average of on-chain transaction values, or the "cost basis" for all BTC held in circulation. The MVRV ratio then can be viewed as aggregate profit margins for coin holders, potentially influencing buying or selling behavior – e.g., triggering profit-taking en masse at 3x return.

3. Rethinking MVRV for Bitcoin's New Era

MVRV is a valuation framework. As with all frameworks, understanding its assumptions and shortcomings is key to using the tool effectively. One major assumption with the conventional approach is ceteris paribus, or “other things being equal.” When the judgment on the valuation level relies on historical comparison, one implicitly assumes that the operating environment surrounding the network remains constant. Otherwise, the past valuation band would not hold much relevance.

Equity valuation metrics, such as price-to-

News data source: kdj.com

The above is the detailed content of MVRV Ratio as an Analytical Lens, Not a Predictive Tool. For more information, please follow other related articles on the PHP Chinese website!

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AM

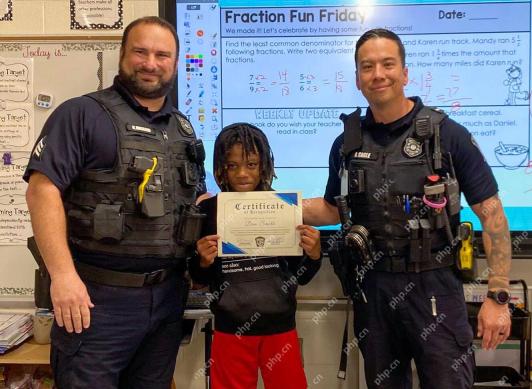

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AMFayetteville Police Department officers Kevin Ingram and David Cagle present Spring Hill Elementary fifth grader Dan Smith with a certificate of recognition for his heroic actions. By FPD

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AM

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AMArtificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is next. On April 14, the government of the United Arab Emirates (UAE) approved the implementation of what the media is calling the first AI-powered legisla

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AM

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AMOn-chain data reveals that large Shiba Inu investors, referred to as whales, sold their tokens as the coin's value declined.

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AM

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AMSmart crypto investors are looking for an asset with real-world utility and early potential gains in 2025. XRP and Chainlink (LINK) remain the bedrock of solid portfolios but new opportunities

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AM

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AMAs Bitcoin flirts with the $100,000 milestone and Ethereum climbs closer to the $2,000 mark, the eyes of crypto enthusiasts and investors alike are beginning to focus

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AM

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AMU.S. President Donald Trump’s media company, called Trump Media & Technology Group, is exploring yet another crypto-related venture, the company said in a letter to shareholders on Tuesday.

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AM

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AMTop 10 digital currency trading apps: 1. OKX, 2. Binance, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bitstamp, 10. Poloniex, these platforms are all known for their security, user experience and diverse features, suitable for users with different needs to conduct digital currency transactions.

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AM

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AMA video by DA CONTENT TV on YouTube dives deep into a bold new prediction for Pi Network (PI). According to the discussion, there is growing optimism that the Pi price could surge dramatically, potentially hitting $5 much sooner than many expected.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SublimeText3 Linux new version

SublimeText3 Linux latest version

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

Zend Studio 13.0.1

Powerful PHP integrated development environment