The sharp decline in Bitcoin before the halving is usually caused by adjustments in market expectations, short-term speculators closing positions and miner pressure. Within the halving window (2-4 months before halving), there has been a decline in the three halvings in history: 2012 (44%), 2016 (27%) and 2020 (18%). The magnitude of the decline is affected by factors such as overall market sentiment, altcoin performance and macroeconomic events.

The period of sharp decline before Bitcoin halving

The Bitcoin halving event, that is, the block reward reduction Halvings often result in large price swings, including large pre-halving drops.

Cause

The big drop before halving is usually caused by the following factors:

- Market expectation adjustment:Investors anticipate a sharp price increase after the halving, so sell Bitcoin before the halving to lock in profits.

- Short-term speculators close their positions: The eve of the halving has attracted many short-term speculators, who buy Bitcoin for profit. Once the price reaches the target, they will close their positions and leave.

- Miner Pressure: As block rewards decrease, miners’ costs will rise and they may need to sell Bitcoin to cover expenses, leading to selling pressure.

Typical period

The big drop before Bitcoin halving usually occurs 2-4 months before the halving date. This period is called the halving window.

Historical Data

The past three Bitcoin halvings have all seen declines within the halving window:

- 2012 Halving: Down 44%

- 2016 halving: down 27%

- 2020 halving: down 18%

Influencing factors

Factors that affect the magnitude of the decline within the halving window include:

- Overall market sentiment: Bullish sentiment will mitigate the magnitude of the decline, while bearish sentiment will exacerbate the decline.

- Altcoin Performance: If altcoins perform strongly, it may attract capital outflows from Bitcoin.

- Macroeconomic events: Major economic events (such as recessions or central bank policy changes) may affect Bitcoin prices.

The above is the detailed content of Bitcoin plunges before halving. For more information, please follow other related articles on the PHP Chinese website!

The latest ranking of the top ten virtual currency trading platforms The latest ranking of the top ten virtual currency trading platforms appsMay 15, 2025 pm 06:09 PM

The latest ranking of the top ten virtual currency trading platforms The latest ranking of the top ten virtual currency trading platforms appsMay 15, 2025 pm 06:09 PMThe latest rankings of the top ten virtual currency app trading platforms: 1. OKX, 2. Binance, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bitfinex, 7. Bittrex, 8. Poloniex, 9. Gemini, 10. KuCoin. These platforms all provide a variety of digital asset trading services, support spot, futures and leveraged trading, and provide staking and lending services. The user interface is simple and mobile application functions are powerful.

What are the income stablecoins? 20 types of income stablecoinsMay 15, 2025 pm 06:06 PM

What are the income stablecoins? 20 types of income stablecoinsMay 15, 2025 pm 06:06 PMIf users want to pursue profit maximization, they can maximize the value of the stablecoin through profit-based stablecoins. Earnings stablecoins are assets that generate returns through DeFi activities, derivatives strategies or RWA investments. Currently, this type of stablecoins accounts for 6% of the market value of the US$240 billion stablecoins. As demand grows, JPMorgan believes that the proportion of 50% is not out of reach. Income stablecoins are minted by depositing collateral into an agreement. The deposited funds are used to invest in the income strategy, and the income is shared by the holder. It's like a traditional bank lending out the funds deposited and sharing interest with depositors, except that the interest rate of the income stablecoin is higher

What is PIN AI? Interpretation of PIN AI financing, application, protocol economy, architectureMay 15, 2025 pm 06:03 PM

What is PIN AI? Interpretation of PIN AI financing, application, protocol economy, architectureMay 15, 2025 pm 06:03 PMWhat is PINAI? How is PINAI financing? How does PINAI innovate data privacy? Learn how PINAI solves the problem of digital identity fragmentation and provides truly personalized AI services through its decentralized architecture. Explore the advantages of secure edge computing and trusted execution environments (TEEs) in data privacy. Below, the editor of Script Home will introduce you in detail what PINAI is? and PINAI financing situation. Friends in need, let’s take a look! In today's digital world, personal data is scattered on the platforms of major technology giants, making it difficult for users to control their data. Current AI applications

oE Exchange app official download latest version oE Exchange official latest APP download linkMay 15, 2025 pm 06:00 PM

oE Exchange app official download latest version oE Exchange official latest APP download linkMay 15, 2025 pm 06:00 PMoE-East Exchange app is one of the most popular digital currency trading platforms in the market at present, attracting a large number of users with its efficient and secure trading environment. Whether you are an experienced trader or a new investor, the oE-East Exchange app can provide you with a convenient trading experience. This article will introduce you in detail how to download and install the latest version of the oE Exchange app. Please note that the download links provided in this article are official links, and using these links can ensure that you download the safest and latest version.

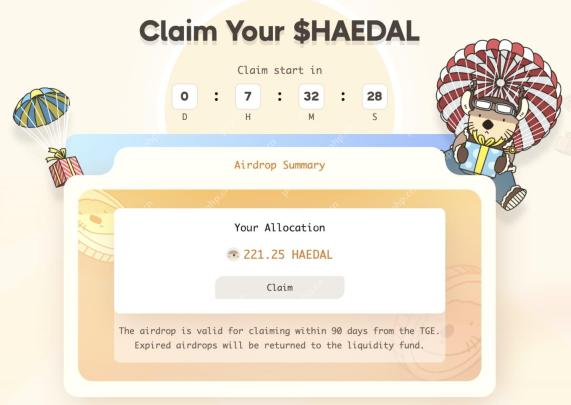

Binance Alpha is launched, HAEDAL airdrop value analysisMay 15, 2025 pm 05:57 PM

Binance Alpha is launched, HAEDAL airdrop value analysisMay 15, 2025 pm 05:57 PMHAEADL is the token of Sui's ecological liquidity staking protocol Haedal, and has been confirmed to be launched on Binance Alpha and Bybit spot. Haedal announced in January that it had completed a seed round of financing, with the specific amount not disclosed. Investors participating in this round of financing include Hashed, Comma 3Ventures, OKXVentures, AnimocaVentures, Sui Foundation, FlowTraders, Dewhales Capital, Cetus, Scallop, etc. also,

Cryptocurrency analyst PlanB: Ethereum is a junk coin! The degree of centralization is far greater than that of BitcoinMay 15, 2025 pm 05:54 PM

Cryptocurrency analyst PlanB: Ethereum is a junk coin! The degree of centralization is far greater than that of BitcoinMay 15, 2025 pm 05:54 PMCryptocurrency analyst and Bitcoin Stock-to-Flow (S2F) model developer PlanB strongly criticized Ethereum (ETH) on social platform X on April 20. He retweeted a tweet published by Ethereum founder Vitalik Buterin in June 2022 (which criticized the S2F model at the time) and took this opportunity to fight back Ethereum, calling it a junk coin that is "centralized, pre-mined, proof of stake (PoS) and arbitrary changes in supply plans." PlanB said in a tweet: Ethereum looks really bad now. I know schadenfreshing is a bit rude, but I think it's like Ether

Tesla's worst revenue in three years! Return to prevent blood and improve one's business: it will reduce the work in DOGEMay 15, 2025 pm 05:51 PM

Tesla's worst revenue in three years! Return to prevent blood and improve one's business: it will reduce the work in DOGEMay 15, 2025 pm 05:51 PMTesla's financial report hit its worst performance in three years. Musk took advantage of the situation and announced that he would reduce his work in the White House DOGE (Government Efficiency Department) department and focus on his "profession". Tesla's worst revenue in three years! Return to prevent and replenish blood to improve one's business: It will reduce its work at DOGE Tesla's revenue is "the worst in three years". US President Donald Trump has issued a big knife to the world with tariffs. It is expected to import all auto parts in May, with a 25% tariff. Even his good friend and good colleague Tesla Musk cannot avoid this whirlwind. Musk, who has always been confident, is in the latest

The world's largest exchange registration portal (Huobi Edition)May 15, 2025 pm 05:48 PM

The world's largest exchange registration portal (Huobi Edition)May 15, 2025 pm 05:48 PMAs the world's leading digital asset trading platform, Huobi Global has developed into one of the world's largest cryptocurrency exchanges since its establishment in 2013. Huobi is committed to providing users with safe and convenient digital asset trading services, supporting the transaction of a variety of mainstream cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), etc. Huobi's users are spread all over the world, with a strong technical team and strict security measures to ensure the security of users' assets and transactions.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

SublimeText3 Chinese version

Chinese version, very easy to use

SublimeText3 Mac version

God-level code editing software (SublimeText3)