From a $13 billion valuation to market adjustment: OpenSea's future strategy, is it just adapting to the game or reshaping the rules?

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-03-26 14:10:441084browse

OpenSea, this platform that emerged in the Web3 wave, has become the benchmark in the NFT market with its innovation and lasting influence. From a low-key start in 2018 to a valuation soaring to US$13 billion in 2021-2022, OpenSea's development trajectory is legendary. Although the initial market response was mediocre, through unremitting efforts, OpenSea's performance exploded in 2020 and grew significantly. Especially in 2021, the NFT craze pushed its trading volume to US$350 million in July, and it successfully obtained US$100 million in financing, with its valuation soaring to US$1.5 billion. Following this, trading volume surged to US$3.4 billion in August, with commission income reaching US$85 million, consolidating its market leadership.

However, behind the success lies challenges. In 2022, market volatility caused OpenSea's monthly trading volume to drop sharply, from nearly $2.6 billion in May to less than $700 million in June, until it dropped to $120 million, well below its peak valuation and market share All experienced significant shrinkage.

OpenSea has not flinched when faced with challenges, but continues to explore new development paths. In 2022, they will strive to find new growth drivers through various strategies such as acquiring NFT aggregation tool Gem. Although these mergers and acquisitions do not immediately change the situation, OpenSea's commitment to innovation and market adaptability makes people look forward to its future.

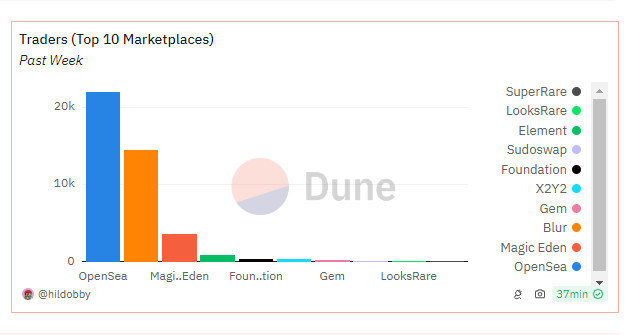

OpenSea ranked first in last week's top 10 market rankings, with a user activity of 21,975, far exceeding the second-ranked Blur, which had an activity of 14,444. Recent market analysis shows that OpenSea has achieved significant leadership in market share and user engagement, and continues to steadily maintain its market leadership.

Next, we will delve into how OpenSea responds to challenges in the NFT market and continues to consolidate its leading position, while analyzing the challenges and opportunities it faces.

Optimistic OpenSea CEO: Do you really have no regrets in the face of potential acquisitions?

In a recent interview, OpenSea CEO and co-founder Devin Finzer revealed discussions about acquisition intentions. Although he did not specify the specific time and proposer, his attitude showed that OpenSea is interested in potential acquisitions. of partners are open-minded. Finzer emphasized that although OpenSea is not currently actively seeking buyers and has no immediate plans to be acquired, they remain optimistic and open to transactions that can bring cooperation opportunities.

In addition, Finzer expressed no concern about the rise of its competitor Blur. He once again emphasized that OpenSea is committed to building a safe and reliable platform and actively removes suspicious NFT series to protect user interests. This focus not only demonstrates OpenSea's emphasis on brand value, but also reflects their firm commitment to user trust. This persistence has won OpenSea a good reputation and user loyalty, allowing it to maintain a leading position in market competition.

Although OpenSea once occupied about 90% of the NFT market, the latest data shows that its monthly trading volume has fallen sharply. At the same time, Blur has become the new favorite of the top market with its token airdrop strategy. However, Finzer’s focus is on the core value of the brand – ensuring the safety and reliability of user transactions, rather than short-term market share competition.

After the NFT industry has undergone a major adjustment, acquisition discussions have become a focus. For OpenSea, this is not only a battle for market share, but also about how to find new growth points and opportunities amid changes. OpenSea has been actively planning through mergers and acquisitions, including the acquisition of NFT aggregation tool Gem and other encryption technology companies, showing its emphasis on expanding its business and attracting talents.

At the same time, Finzer expressed optimism about working with luxury brands to develop customized NFT projects. He believes that as industry personnel gain an in-depth understanding and maturity of NFT, this type of cooperation is expected to open up new market opportunities. In addition, he also mentioned the growing trend of NFT and physical commodity exchange and the potential for brands to enter the metaverse, which have brought new development opportunities to OpenSea.

After a period of market adjustment, OpenSea maintains a positive attitude towards the future. Despite having to lay off staff last year to resize the team, Finzer sees a team that is more nimble and adaptable to market changes. While facing challenges, OpenSea is also exploring and seizing new opportunities, preparing to play an important role in the next stage of development of the NFT market.

OpenSea’s multi-dimensional attack: from game live streaming to luxury goods cooperation, the continuous upgrade of brand power and innovative vitality

OpenSea is not only the leader in the NFT market, It is also a pioneer in industry innovation and cooperation. A series of recent activities have demonstrated its key initiatives in ecological construction and brand cooperation, thus revealing its potential next step.

Game live streaming leads the trend: On March 22, OpenSea live broadcasted the game Sharpenel through its official platform, marking its exploration of the gaming field and real-time interaction. This step not only expands OpenSea's user base, but also enhances its influence in the fields of entertainment and virtual interaction.

On March 21, OpenSea announced the launch of the Seaport 1.6 NFT market protocol on the X platform. This new protocol introduces Seaport hooks functionality by leveraging Ethereum’s Cancun upgrade, allowing developers to build applications that extend the utility and liquidity of NFTs. This move not only reduces transaction costs, but also provides developers with greater creative space and accelerates technological innovation and ecological development in the NFT market.

Innovative cooperation with Coachella Music Festival: On March 6, OpenSea announced that it would cooperate with Coachella Music Festival to launch three NFT series based on the Avalanche chain, providing innovative products that combine virtual experience and real-life benefits. This not only provides participants with a unique VIP experience, but also demonstrates OpenSea’s leadership in integrating real and virtual experiences.

A new chapter in luxury brand cooperation: Finzer recently met with a number of luxury brand executives to discuss the development of customized NFT projects. Compared with the early exploration of brands such as Gucci and Louis Vuitton, OpenSea is now more focused on deepening cooperation with luxury brands and is committed to developing richer and more mature NFT application projects. This shows that OpenSea is not only at the forefront of technological innovation, but also expanding the application of NFT in the high-end market.

In the whirlpool of NFT field, where will OpenSea go?

2023 has witnessed profound changes in the NFT market landscape, in which OpenSea faces a complex situation with new challenges and opportunities. On the one hand, the rise of Blur has challenged OpenSea's market dominance. On the other hand, the rise of NFT on the Bitcoin chain and the emergence of new assets such as ERC404 have brought new development directions to the entire NFT field.

OpenSea continues to consolidate its market position through technological innovation and cross-border cooperation, such as through the launch of the Seaport 1.6 protocol, cooperation with the Coachella Music Festival, and exploring new projects with luxury brands. These initiatives reflect OpenSea's efforts to continuously expand its business scope and enhance user experience.

However, with the rapid evolution of the market, including the new trend of Bitcoin NFT led by Ordinals and the emergence of emerging trading platforms such as UniSat, competition in the NFT market has become more diversified. The challenge facing OpenSea is not only how to maintain its leading position in the traditional NFT trading field, but also how to effectively respond to the impact of emerging asset classes and trading models.

In the increasingly fierce competition in the NFT market, how will the future of OpenSea unfold? Can it remain innovative in this ever-changing trend, adapt to market demands, and continue to maintain its position as an industry leader? Or do we need to find new directions and cooperation models to meet the challenges of emerging competitors and asset classes? This is a problem that OpenSea and even the entire NFT ecosystem need to face together.

The above is the detailed content of From a $13 billion valuation to market adjustment: OpenSea's future strategy, is it just adapting to the game or reshaping the rules?. For more information, please follow other related articles on the PHP Chinese website!