Source: 深圳TechFlow

As a high-profile emerging project in the Solana ecosystem, Jupiter has been launched despite its launch time. It has not been long, but it has quickly emerged in the DeFi field. However, even in such a rapidly developing environment, the improvement of economic models and the stability of token prices are still crucial. Without these supports, a project can easily fall into a vicious cycle that may ultimately lead to its decline or even its inability to sustain itself. Therefore, Jupiter needs to continuously optimize its economic design and ensure token price stability to ensure the long-term development and success of the project.

Solana chain has performed strongly in the past week. Its token SOL has been rising rapidly in the secondary market, while Jupiter’s token $JUP has also increased significantly in the past two weeks. The price has almost doubled.

For Jupiter and $JUP, research on the market mainly focuses on the secondary perspective. In addition to its impressive market capitalization performance, the success behind this project is not only due to its outstanding fund managers and community, but also its excellent product design. So today we’re going to explore Jupiter’s design philosophy from a product perspective.

Jupiter’s rise in the Solana ecosystem is no accident. It represents the embodiment of the relentless pursuit of technological innovation and user experience among many DEXs. As one of the most popular DEXs on the Solana network, Jupiter has become the platform of choice for many Solana traders.

Jup’s three core functions

The key reason why Jupiter has attracted so much attention is that its product has three core functions: Liquidity aggregation instrument, current price order and DCA/fixed investment. The application of these three innovative technologies not only improves Jupiter's competitiveness, but also sets a new benchmark for the entire DEX field.

Core Function Module 1: Liquidity Aggregator

Jupiter’s liquidity aggregator technology is one of its core competencies. In the traditional DEX model, the liquidity pool of each exchange exists in isolation. When exchanging assets, users often need to find the best trading pool to obtain the best trading price. This is not only time-consuming and labor-intensive, but also Due to the dispersed liquidity, it is difficult to ensure the optimality of transactions. Jupiter's liquidity aggregator technology can span many liquidity pools in the Solana ecosystem, automatically find and aggregate optimal liquidity resources through algorithms, and provide users with a one-stop best trading path.

Users can choose to modify parameters such as transaction fees, slippage size, and whether to use a direct path before trading. This flexibility allows users to obtain the best trading prices and minimal slippage across the entire ecosystem on the same interface, thereby improving the efficiency and economy of asset exchange. Jupiter's transaction aggregation function is based on its advanced back-end intelligent routing technology.

In the backend, Jupiter monitors and analyzes the entire market’s trading data in real time through complex algorithms, including price, depth, slippage and other dimensions. Based on these data, the intelligent routing algorithm can dynamically select the best trading route for each transaction, ensuring the success rate and cost efficiency of user transactions even in the face of severe market fluctuations. Specifically, once Jupiter has access to market data, its multi-path search algorithm begins looking for the best trading path.

This process involves complex calculations, as it not only considers the direct trading pair, but also analyzes whether a better trading price can be obtained through a series of intermediate token conversions. For example, if a user wants to exchange from token A to token C, smart routing will not only consider the direct A→C transaction path, but also consider possible intermediate paths such as A→B→C or A→B→D→C. So as to find the lowest cost trading solution.

Although the technology behind smart routing is very complex, Jupiter is committed to providing users with a simple and easy-to-use trading experience. The operation of smart routing is completely transparent to users. Users only need to enter the tokens and amounts they want to exchange, and the rest of the work is automatically completed by smart routing. This design minimizes the user's operational difficulty, allowing users to easily conduct transactions even without a deep technical background.

Core Function Module 2: Limit Order

##Jupiter provides limit orders for traders function, effectively avoiding the cost increase and slippage problems caused by the price impact during transactions, and at the same time circumventing the MEV problem. When the order is not fully filled, the limit order can be partially filled and the tokens for the filled portion will be obtained. When proposing a transaction, users can select the order validity period, exchange price and exchange quantity to more accurately implement their trading strategies. The protocol partners with Birdeye and TradingView, with Birdeye providing on-chain price data for tokens and Jupiter using TradingView’s technology for charting data presentation. This feature makes the actual experience Jupiter provides users closer to that of a centralized exchange.

Core Function Module 3: DCA Fixed Investment

Dollar-Cost Averaging (DCA) is an investment strategy in which investors invest at specific time intervals Within a certain period of time, the purchase cost is spread over a preset price range through multiple investments. This method can help investors reduce the risk of investing at a single price point. To conduct DCA fixed investment in Jupiter, users only need to set the purchase frequency (Jupiter provides a minimum frequency of minutes and a maximum frequency of monthly), purchase price range, total time period and the assets they wish to purchase. After the fixed investment, the user's tokens will be transferred to the account related to the fixed investment, and transactions will be automatically executed based on the preset price range and transaction frequency.

After the fixed investment is completed, the tokens are automatically transferred back to the user's wallet, and the agreement charges one thousandth of the fee for the fixed investment. Controllable cost prices, low fees and fully managed trading processes make DCA a good choice for traders to accumulate assets in a bear market. However, in the bull market, this mechanism has become relatively unknown, so the overall demand for this feature is still relatively small.

Jup’s other ecological modules

Upstream incubator: Jupiter Labs

An independent company from Jupiter The operating laboratory will operate independently in the future and is committed to promoting innovative projects. Jupiter users and community members enjoy certain priorities, including first access and token incentives. Currently, Jupiter Labs is focusing on two major project areas: perpetual contracts and LSD stablecoins.

Derivatives Protocol: Jupiter Perpetual

is a derivatives protocol launched by Jupiter Labs. Its model is similar to GMX V1 and has now entered actual use stage. The protocol defines two main categories of participants: liquidity providers and traders. Liquidity providers provide funds to the pool, and these funds are converted into a basket of tokens, mainly including BTC, ETH, SOL, USDC, and USDT. Among them, SOL and USDC have higher weights and become the main trading objects.

Traders use the tokens in the pool to establish leveraged positions when conducting leveraged trading. They do not need to worry about transaction slippage and only need to pay transaction fees and borrowing fees. The latter is based on proxy Coin utilization calculation. Liquidity providers receive 70% of transaction fees and all borrowing fees, but they also bear the risk of losses caused by traders' profits and token depreciation.

LST Stablecoin Protocol XYZ

The project has not been launched yet. The protocol is similar to Lybra V1 and allows users to mint the interest-bearing stablecoin SUSD with no borrowing interest by staking SOL. Income earned through LST staking will be distributed to SUSD holders and governance tokens. What’s special is that when the LST yield is higher than the SOL borrowing rate, a leverage arbitrage strategy will be used to maximize returns.

In addition, the protocol also introduces a redemption mechanism to maintain the price stability of SUSD, although this may have an impact on borrower positions, especially during market fluctuations. To alleviate this problem, the protocol may adopt the strategy of using governance tokens to redeem SUSD within a small price range. When the price of SUSD is between 0.95-1 US dollars, the protocol may use SUSD to redeem governance tokens. way to reduce the frequency with which borrowers are called upon. However, this plan may result in the vast majority of redemptions being redemptions of governance tokens. If the price continues to be below $1, it will cause a more serious issuance of tokens.

Return to$JupEconomic Model

JUP token is in the Jupiter ecosystem governance token that allows token holders to vote on key ecosystem decisions, covering topics such as launching projects, dispute lists, and grants. The Jupiter team promises that token distribution will strictly adhere to the roadmap, and any transfer of tokens in cold wallets will require six months’ notice. The initial circulating supply is adjusted to 1.35 billion, and future circulation will be managed through community multi-signature wallets to ensure the healthy development of the Jupiter ecosystem.

After rising from the high-rise building - Meditations on the prosperity of the Jup ecosystem

And other DEXs in the Solana ecosystem In comparison, Jupiter shows its advantages in transaction efficiency and user experience. Although projects such as Raydium, Orca, and Serpent are also competing for market share, Jupiter still aggregates more than 50% of the trading volume on Solana, making DEX the true underlying liquidity protocol on the Solana network. However, with limited room for further growth in transaction volume, Jupiter has chosen the long-term strategy of expanding horizontally in the DeFi sector to broaden its business breadth. Jupiter Start or the main direction in which Jupiter expands its territory.

Currently Jupiter Start only has introduction, education and pre-launch functions. LFG Launchpad, the core function of Jupiter Start, has not been launched yet, but the first round of launchpad voting was launched on March 7. The top three projects are Zeus Network (cross-chain communication), SharkyFi (NFT lending protocol) and UpRock (DePIN) . Jupiter has a large user base and strong traffic effect. Considering its own resource advantages, the projects it launches are likely to be of higher quality.

On the other hand, Jupiter Labs, the financial innovation product incubation platform launched by Jupiter, has filled the gap in related projects on Solana and still has great potential with the support of Jupiter. This project demonstrates in-depth exploration of the fields of financial derivatives and stablecoins, aiming to bring new impetus to the DeFi field under the Solana ecosystem. However, while these innovations increase returns, they also bring additional risks, such as protocol risks and oracle quotation risks. It is necessary to maintain the balance of the system by building a complete economic model, appropriate incentive mechanisms, and dynamic redemption strategies.

As a hot star in the Solana ecosystem, Jupiter has already established a firm foothold in the DeFi field although it was launched not long ago. Its user-centered product design concept, comprehensive and innovative product functions and smooth trading experience have successfully captured the trust of users and become the DEX with the largest transaction volume on the Solana chain. In addition, the Jupiter team strives to break through the traditional DEX upper limit constrained by the development of public chains, and actively explores a broader development space laterally, which gives Jupiter the potential to grow into a sea of stars.

However, the potential problem that arises is that when exploring derivatives and stablecoins, whether as an incubator or a self-developed product, you will face greater risks. Due to the nature of such financial products using leverage to achieve high returns, without the support of a complete economic model and stable token prices, it is easy to end up in a death spiral, which may have a fatal impact on Jupiter itself.

The above is the detailed content of Analyzing Solana's DEX layout: Is Jupiter the future of ecology?. For more information, please follow other related articles on the PHP Chinese website!

解释一下explorer.exe进程是什么Feb 18, 2024 pm 12:11 PM

解释一下explorer.exe进程是什么Feb 18, 2024 pm 12:11 PMexplorer.exe是什么进程在我们使用Windows操作系统的时候,经常会听到一个名词"explorer.exe".那么,你是否好奇这个进程到底是什么?在本文中,我们将详细解释explorer.exe是什么进程以及其功能和作用。首先,explorer.exe是Windows操作系统的一个关键进程,它负责管理和控制Windows资源管理器(Window

r5 5600x最高能带动什么显卡 最新用5600X搭配RX6800XT性能Feb 25, 2024 am 10:34 AM

r5 5600x最高能带动什么显卡 最新用5600X搭配RX6800XT性能Feb 25, 2024 am 10:34 AM10月29日,AMD终于发布了备受用户期待的重磅产品,即基于全新RDNA2架构的RX6000系列游戏显卡。这款显卡与之前推出的基于全新ZEN3架构的锐龙5000系列处理器相辅相成,形成了一个全新的双A组合。这一次的发布不仅使得竞争对手“双英”黯然失色,也对整个DIY硬件圈产生了重大影响。接下来,围绕笔者手中这套AMD锐龙5600X和RX6800XT的组合作为测试例子,来见证下现如今的AMD究竟有多么Yse?首先说说CPU处理器部分,上一代采用ZEN2架构的AMD锐龙3000系列处理器其实已经令用

发生0x0000004e错误代表了什么问题Feb 18, 2024 pm 01:54 PM

发生0x0000004e错误代表了什么问题Feb 18, 2024 pm 01:54 PM0x0000004e是什么故障在计算机系统中,故障是一个常见的问题。当计算机遇到故障时,系统通常会因为无法正常运行而出现停机、崩溃或者出现错误提示。而在Windows系统中,有一个特定的故障代码0x0000004e,这是一个蓝屏错误代码,表示系统遇到了一个严重的错误。0x0000004e蓝屏错误是由于系统内核或驱动程序问题导致的。这种错误通常会导致计算机系统

内存频率和时序哪个对性能影响更大Feb 19, 2024 am 08:58 AM

内存频率和时序哪个对性能影响更大Feb 19, 2024 am 08:58 AM内存是计算机中非常重要的组件之一,它对计算机的性能和稳定性有着重要影响。在选择内存时,人们往往会关注两个重要的参数,即时序和频率。那么,对于内存性能来说,时序和频率哪个更重要呢?首先,我们来了解一下时序和频率的概念。时序指的是内存芯片在接收和处理数据时所需的时间间隔。它通常以CL值(CASLatency)来表示,CL值越小,内存的处理速度越快。而频率则是内

Planet Mojo:从自走棋游戏Mojo Melee建起Web3游戏元宇宙Mar 14, 2024 pm 05:55 PM

Planet Mojo:从自走棋游戏Mojo Melee建起Web3游戏元宇宙Mar 14, 2024 pm 05:55 PM成立于上个加密周期的热门元宇宙游戏项目们正在加速扩张。3月4日,Web3游戏元宇宙平台PlanetMojo宣布了其游戏生态的多个重要动态,包括预告即将推出跑酷游戏GoGoMojo、旗舰自走棋游戏MojoMelee推出新赛季“战之道”,以及为庆祝新赛季与MagicEden合作推出的首个ETH系列“WarBannerNFT”。另外,PlanetMojo还透露,他们计划在今年晚些时候推出MojoMelee的Android和iOS移动版本。这个项目在2021年底启动,经过在熊市中近两年的努力建设,即将在

DaVinci Resolve Studio 已支持AMD显卡的AV1硬件编码Mar 06, 2024 pm 10:04 PM

DaVinci Resolve Studio 已支持AMD显卡的AV1硬件编码Mar 06, 2024 pm 10:04 PM最近新消息,lackMagic目前推出了达芬奇DaVinciResolveStudio视频编辑软件的18.5PublicBeta2公测版更新,为AMDRadeon显卡带来了AV1编码支持。更新到最新版本后,AMD显卡用户将能够在DaVinciResolveStudio中利用硬件加速来进行AV1编码。尽管官方并未具体指明支持的架构或型号,但预计所有的AMD显卡用户都可以尝试这一功能。2018年,AOMedia发布了全新的视频编码标准AV1(AOMediaVideoCodec1.0)。AV1是由多家

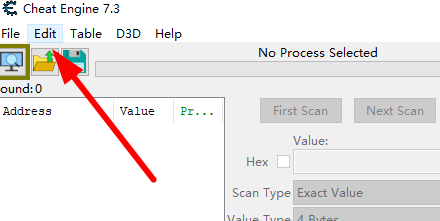

Cheat Engine如何设置中文?Cheat Engine设置中文方法Mar 13, 2024 pm 04:49 PM

Cheat Engine如何设置中文?Cheat Engine设置中文方法Mar 13, 2024 pm 04:49 PMCheatEngine是一款游戏编辑器,能够对游戏的内存进行编辑修改。但是它的默认语言是非中文的,对于很多小伙伴来说比较不方便,那么CheatEngine怎么设置中文呢?今天小编就给大家详细介绍一下CheatEngine设置中文的方法,希望可以帮助到你。 设置方法一 1、双击打开软件,点击左上角的“edit”。 2、接着点击下方选项列表中的“settings”。 3、在打开的窗口界面中,点击左侧栏中的“languages”

Microsoft Edge在哪设置显示下载按钮-Microsoft Edge设置显示下载按钮的方法Mar 06, 2024 am 11:49 AM

Microsoft Edge在哪设置显示下载按钮-Microsoft Edge设置显示下载按钮的方法Mar 06, 2024 am 11:49 AM大家知道MicrosoftEdge在哪设置显示下载按钮吗?下文小编就带来了MicrosoftEdge设置显示下载按钮的方法,希望对大家能够有所帮助,一起跟着小编来学习一下吧!第一步:首先打开MicrosoftEdge浏览器,单击右上角【...】标识,如下图所示。第二步:然后在弹出菜单中,单击【设置】,如下图所示。第三步:接着单击界面左侧【外观】,如下图所示。第四步:最后单击【显示下载按钮】右侧按钮,由灰变蓝即可,如下图所示。上面就是小编为大家带来的MicrosoftEdge在哪设置显示下载按钮的

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

Dreamweaver Mac version

Visual web development tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool