NFT collapsed across the board! KOL points out the problem: Who speculates in NFT in the bull market?

- PHPzforward

- 2024-03-13 16:07:12654browse

NFT KO Lwale.swoosh pointed out on Twitter that the recent sharp decline in floor prices and market value of blue-chip NFTs is not without reason. He emphasized that factors such as Ethereum's high gas fees and the high opportunity cost of NFT investment in the current bull market are the main challenges facing the current NFT market.

Problems with NFT

Yesterday (11), Bitcoin hit a new high again, and the entire crypto market, including Memecoins, fell into a carnival.

However, today seems to be a relatively calm day for the NFT market. In the past week, many well-known projects such as Bored Ape Yacht Club (BAYC) have experienced declines of more than 30%, which has led to continued losses of investors' funds.

Wales raised a series of questions about the current situation of the NFT market, emphasizing that only by solving these problems can the NFT market be revitalized.

High opportunity cost in bull market

In the beginning, investing in NFT usually requires a large amount of capital, which may reduce your capital efficiency. For example, if you invest $10,000 in an NFT, you cannot diversify the funds into other areas.

During a bull market, choosing to invest in NFTs may result in a higher opportunity cost because NFTs may not experience as spectacular growth compared to other meme coins.

Airdrops are not an effective solution

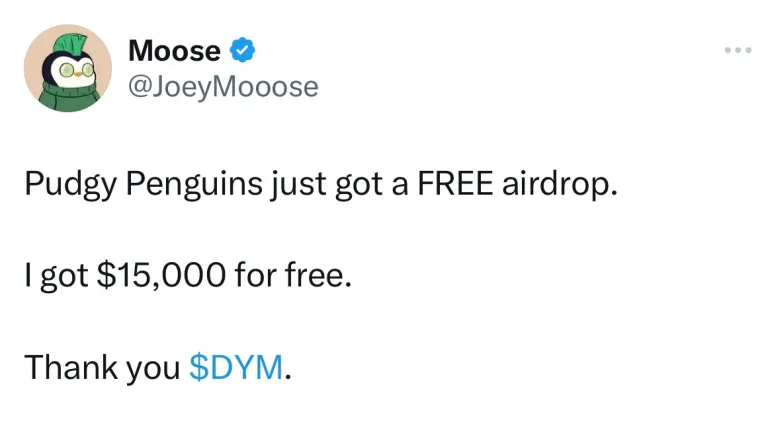

Next, many NFT projects will use airdrops to re-attract the attention of their holders. Previously, the veteran project Pudgy Penguins also appealed to some communities. Group members scattered tokens worth tens of thousands of dollars.

NFTGO market data

The above chart shows that the decline is even more obvious when looking at DeGods and CLONEX, which have fallen out of the 20th place in market value.

The above is the detailed content of NFT collapsed across the board! KOL points out the problem: Who speculates in NFT in the bull market?. For more information, please follow other related articles on the PHP Chinese website!