MicroStrategy doubles down on Bitcoin bets, buys $822 million, adds 12,000 BTC to treasury

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-03-13 12:00:04792browse

As Bitcoin (BTC) continues its unprecedented uptrend, surging to a new all-time high (ATH) of $72,300, software company MicroStrategy remains steadfast in its vision. It has generated strong returns from strategic investments in the largest cryptocurrencies on the market.

MicroStrategy recently made a major acquisition, led by Bitcoin supporter and former CEO Michael Saylor, further solidifying its position in the digital asset market.

MicroStrategy’s BitcoinGet a return on your investment

According to MicroStrategy’s filings with the U.S. Securities and Exchange Commission (SEC), the company purchased approximately 12,000 Bitcoins for approximately $821.7 million in cash between February 26 and March 10, 2024. The average purchase price per Bitcoin is $68,400.

In addition, MicroStrategy recently successfully issued an $800 million convertible senior note due 2030 to raise funds for the company. With its latest acquisition, MicroStrategy now holds a staggering 205,000 BTC, which it purchased at a cost of $6.9 billion.

Microstrategy’s MSTR stock is trending upward on daily chart | Source: MSTR on TradingView.com

MicroStrategy's stock price is $1,557, an increase of 9%, which has been obvious in the past 24 hours. The company’s share price has been on a sustained and continuous upward trend since February 26, consistent with Bitcoin breaking above $50,000 and entering a consolidation phase.

Over the past two weeks, Bitcoin’s price has surged to its current trading levels, solidifying its significant correlation with MicroStrategy. This close association further strengthens the company's strategy and has a positive impact on its stock performance.

MicroStrategy’s strategic investment in Bitcoin has achieved impressive results. The company's current holdings of Bitcoin have brought it a profit of $7.7 billion. As the price of Bitcoin continues to rise, its return on investment has reached an astonishing 112%. This successful case further proves the potential of Bitcoin as an investment asset, and also demonstrates MicroStrategy’s forward-looking strategic vision as an enterprise in the field of digital currency. As the market’s recognition of cryptocurrency continues to increase, such

ETF Experts Shocked by Bitcoin ETF’s Success

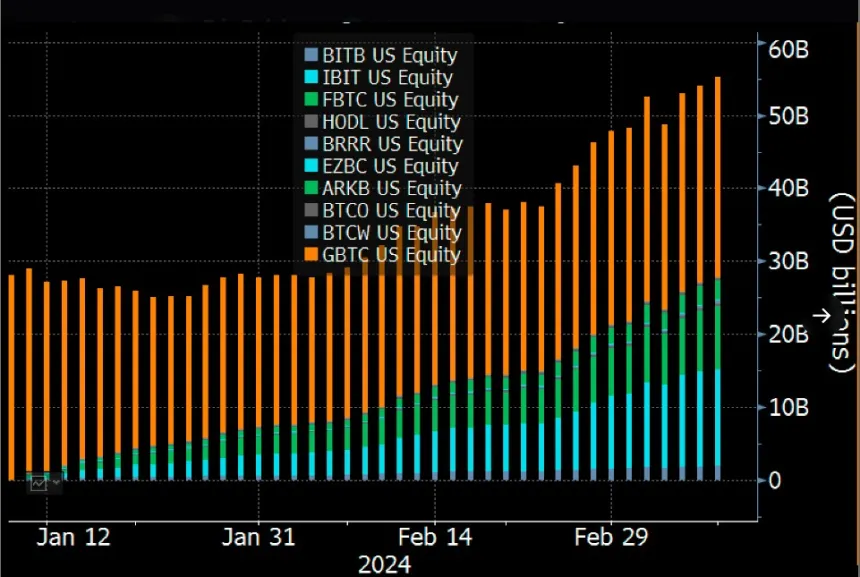

The meteoric rise of Bitcoin exchange-traded funds (ETFs) has exceeded even the most optimistic predictions. Bloomberg ETF expert Eric Balchunas highlighted the growth of these funds in a post on social media site X (formerly Twitter).

Experts note that assets under management (AUM) exceeded $55 billion and trading volume reached an impressive $110 billion.

The assets under management of 10 Bitcoin spot ETFs exceed US$55 billion | Source: Eric

Balchunas's X Tweets

Balchunas admits that achieving such figures in just two months is simply "ridiculous" and far exceeds what would normally only be considered a success at the end of a full year.

Additionally, in a surprising twist among ETF experts, Blackrock's IBIT ETF and Fidelity's FBTC have emerged as the leaders in year-to-date (YTD) flows among all ETFs as of mid-March. This unexpected achievement positions these Bitcoin ETF products as major players in the ETF market, attracting the attention and interest of investors seeking exposure to the digital asset.

Daily chart shows BTC price trending upward | Source: BTCUSD on TradingView.com

Currently, BTC continues its uptrend aiming to consolidate above $70,000, which would put the cryptocurrency in a good position to reach the $100,000 mark during the remainder of the year.

The above is the detailed content of MicroStrategy doubles down on Bitcoin bets, buys $822 million, adds 12,000 BTC to treasury. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- How to confirm if you own Bitcoin? A guide to all things Bitcoin

- Can I buy Bitcoin ETF? how to buy?

- How to buy and sell Bitcoin? Bitcoin Trading Tutorial

- Domestic formal virtual currency trading platform Top ten formal exchange apps ranking

- Which digital currency exchange platform is the safest? A formal and easy-to-use digital currency software app