A brief analysis of Karma Protocol: the first full-chain prediction market protocol driven by the Sui network community

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-03-13 10:52:11527browse

As of early 2024, we have witnessed the market size of Polymarket (prediction market platform) reaching an impressive figure of $5.7 million. In addition, during various popular events, fan tokens, which serve as an alternative form of asset for participating in event predictions, have a daily trading volume of more than US$2 billion during the peak period of the event. This phenomenon clearly shows that compared with the huge scale of event predictions mapped by Fan Token, the existing prediction market platform has not been able to fully meet the huge prediction needs of users. An example of Fan Token’s trading volume during a hot period, revealing the huge growth potential of prediction markets. Innovative solutions provide the opportunity to solve existing challenges, provide better solutions to improve the status quo, and better meet user interest in diverse prediction market needs.

Blockchain experts have also raised strong expectations for the prediction market

Binance announced the launch of Futures NEXT, providing users with a way to predict the launch of Binance contracts tokens to earn rewards. The NEXT Pool contains a curated collection of user-nominated tokens for potential listing. Futures NEXT operates independently of Binance’s traditional listing process and is focused on incentivizing accurate market predictions, Binance said. Rewards under the program include futures reward coupons for new traders, as well as futures trading fee rebate coupons for existing futures users. This initiative aims to promote user participation and drive the accuracy of market forecasts, providing users with more opportunities to participate and benefit.

Meanwhile, Vitalik Buterin described prediction markets as early as 2020: “I expect that prediction markets will become an increasingly important application technology for Ethereum in the next few years. The 2020 U.S. election is just Starting, the prediction market will attract more attention, covering not only elections, but also condition prediction, decision-making and other ecological applications."

Alliance DAO is one of the high-profile investment institutions in the blockchain field, In "Entrepreneurial Ideas," he explores three key issues in the prediction market space: discreteness, binary outcomes, and restricted discontinuity conditions. These problems are evident in current prediction market applications and affect the development and operation of the market.

Case Study on Polymarket and Fan Token

Although Polymarket is one of the leaders in the blockchain prediction market, it still faces some problems. These issues include challenges such as uneven distribution of topic traffic, inability to achieve liquidity interoperability between duplicate options, lack of diversity of predicted events, and insufficient community participation.

Similar problems arise in traditional prediction markets, where options are not interoperable on a different but related topic. This issue forces users to split their assets for collateral across various themes, affecting the liquidity of their assets. In addition, under the AMM model, centralized bookmakers, market makers and liquidity providers cannot avoid the risk of losses.

Although Fan Token is highly popular on various exchanges, especially during popular events, it also faces some obvious problems. These include: insufficient liquidity during non-event periods, resulting in unstable value; in addition, its usage restrictions are also a significant problem, limiting its use. These issues affect the development and circulation of Fan Token and may limit its performance in the cryptocurrency market. In order to solve these problems, more measures are needed to increase the liquidity of Fan Token, stabilize its value, and expand its wider

These challenges urgently require innovative solutions to integrate and enhance prediction markets and Fan Token functionality and effectiveness. After years of research on prediction markets, the KarmaPi team has a deep understanding of the huge potential in this field and the pressing problems that need to be solved. They are committed to developing better solutions for prediction markets.

The latest solution - Karma Protocol V3: the first full-chain prediction market protocol based on Sui network

KarmaPi team (https://karmapi.ai/) Launched the first full-chain prediction market protocol Karma Protocol based on the Sui network, aiming to stimulate the potential of the prediction market through community-driven power. They combined smart inscription technology with prediction market protocols to create a new solution that brings new opportunities to prediction markets. This innovative move is expected to bring more vitality and development space to the prediction market.

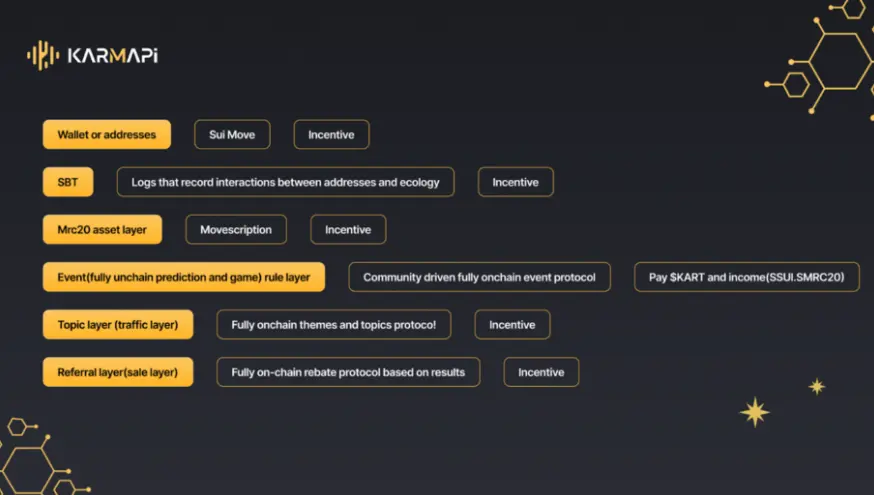

We have made the following detailed annotations for the new assets and logic generated in Karma Protocol,

- Predicted props: will come from smart inscriptions Movescription (Twitter: @MoveScriptions) on the Sui ecosystem (Twitter: @SuiNetwork) or smart inscriptions in Movescription format As a prediction prop on karma protocol. These props have unified fluidity, participate in various themes, and are applied in aggregate.

- Prediction event protocol on the whole chain: Prediction events are initiated and participated by the community and are completely driven by the community. Community-driven event initiation promotes diversity in the predicted event ecology. The combination of props layer and prediction event layer ensures that the entire prediction protocol is aggregated and not just affected by the binary outcome of a single prediction event.

- Traffic distribution based on the topic protocol on the whole chain: Distribute traffic by protocol through the model on the whole chain, promote traffic conversion and interoperability between various layers, expand and accommodate the whole chain Possibility of ecological asset participation.

- Protocol Token: $KART token is the core governance token of Karma Protocol and is used to initiate prediction topics and access other platform functions. Deployment of prediction problems requires $KART tokens. Currently $KART will be stored in Karscriptions, and the $KART corresponding to any deployment, participation and reward will be deducted and increased in Karscriptions.

- Prediction Result Liquidation Rules: After the prediction result is confirmed, all smart inscriptions from the losing party will be sent to the liquidation pool. 95% of the total liquidation pool will be allocated to the winners, 2.5% will be allocated to the creator of the prediction event, and another 2.5% will be allocated to the $KART Foundation (for burning, rewards, etc. purposes).

- The deployer can also destroy/burn the inscription assets of the losing party when deploying the topic. Then during liquidation, the equivalent $Sui generated after the destruction of the inscription assets will be directly divided.

-

The source of prediction result information and the ownership of liquidation rights currently support the customization of event liquidation rights Cap:

- The information can come from the creator of the prediction event and be determined by the creator liquidation.

- Multiple parties can provide information, and liquidation is carried out jointly by multiple parties.

- Oracle liquidation.

- Multi-oracle liquidation.

- Random number liquidation.

Partnership with MoveScriptions, First IDO Success

Karma Protocol has established a partnership with the MoveScriptions community. The MoveScriptions community will use Karma Protocol to create community prediction events to empower $MOVE and mrc assets and assist the development of Karma Protocol. This cooperation aims to enhance the diversity of predictive event protocols and smart inscriptions and promote the development of sui's entire chain community.

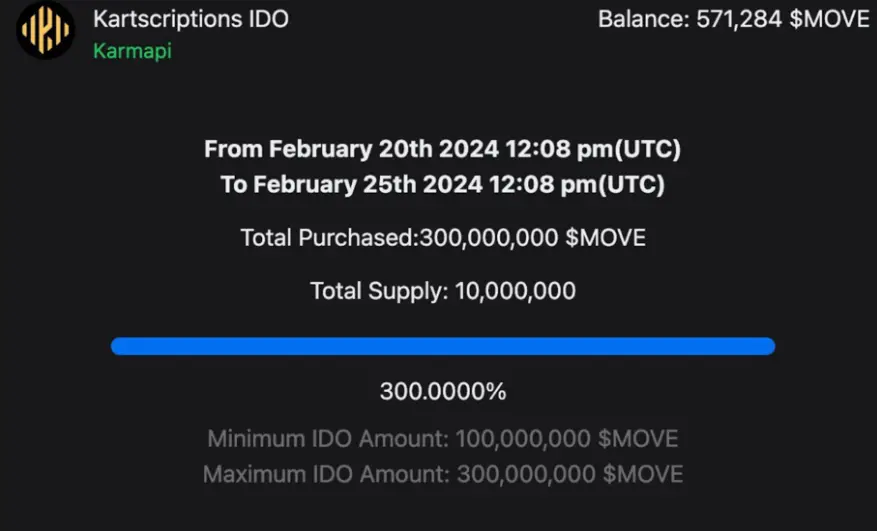

Recently, Kartscription completed its first IDO on MoveScription as the first token smart inscription asset to store $KART and jellypi (karma protocol mascot jellyfish). The IDO completed 200% of the fundraising within 60 seconds. , and completed 300% of the IDO in the next 6 hours, indicating the $MOVE community’s welcome to the karma protocol, a prediction market protocol on the entire chain

Karma protocol’s monetization mechanism

After the IDO process of Kartscriptions, Kartscriptions will have an initial price of 3,000 $MOVE (equivalent to 0.345 $SUI).

- $KART: As the main protocol token, it will not be independently unlockable for transactions in the early stages and will be stored within Kartscription. An equal amount of $KART will be deducted from Kartscription for each use.

- Kartscriptions: Smart inscriptions used to store and consume $KART and other KarmaPi ecological assets. It is also a dual-image inscription asset and the main medium in the interactive scenario of the entire Karma Protocol chain.

- Each prediction event deployed on Karma Protocol will consume 100 $KART, and the $KART consumed by these deployments will be used as a reward for staking Kartscriptions.

- After the prediction event is settled, participants in the prediction event will receive $KART rewards and be stored in the held Kartscriptions.

- Liquidation classification rules (refer to "Forecast result liquidation rules")

What is the governance equity asset veKS? How to get?

- Protocol protection: Users pledge the KartScriptions they hold to protect the protocol, and can obtain the corresponding veKartScriptions (hereinafter referred to as veKS) to obtain the corresponding protocol governance rights (Community Governance Right)

- Governance Right holders can participate in regular voting to determine the weight of rewards allocated among various incentive plan pools in the Karma Protocol ecosystem, thereby affecting how much $KART incentive plan rewards will be allocated to each incentive plan pool. This is also the most core of rights and interests.

- Choose the time to pledge KartScription (at least 1 KS), which determines the proportion of governance rights (Gov Power).

- Choose to pledge KS for 1 year and you can immediately receive 0.25% veKS. For example, if you pledge 100ks for a year, you can get 25 veKS

- Choose to pledge KS for 2 years and you can immediately receive 0.5% veKS

- Choose to pledge KS for 3 years and you can immediately receive 0.75% veKS

- Choose to pledge KS for 4 years and you can immediately receive 1 veKS

- Note, KS After the pledge is completed, the veKS obtained cannot be redeemed, transferred, or traded before expiration

Use and income scenarios of veKS

- Holders of veKS , will supervise and implement the decision-making voting results according to the proportion of governance rights (core contributors multi-sign based on the voting results)

- Incentive Plan (Incentive Plan) For proposals that can be submitted and voted on, it involves new Add incentive plans, parameter settings and modifications to the agreement, etc.

- Holding veKS can obtain transaction fees on the protocol or platform in proportion to the holding ratio. The fees come from the protocol's revenue pool (the revenue pool is 2.5% of the total predicted event liquidation pool, and the liquidation pool comes from user deployment The final settlement asset after predicting events and producing results).

- Hold veKS to obtain a share of the handling fees generated by ecological users’ transactions on the chain. This income segment comes from the transaction fee income share generated by FT Swap, SFT exchange, NFT Exchange, etc. (for example, the transaction fee of sKART in Cetus is 1%).

- veKS can only be redeemed after it is generated and expires. It cannot be redeemed before expiration (that is, the user cannot cancel the KS pledge). veKS cannot be transferred or traded and can only be used for governance and income.

Since then, Karma Protocol has evolved into a full-chain ecosystem built around positive externalities such as "business & incentives & governance" through assets and asset circulation.

We hope that the emergence of Karma Protocol can inject new vitality into the prediction market ecology and create more new possibilities with its full-chain, community-driven and other characteristics.

- Learn More

- Topic Deployment Website

- About Incentive Program

The above is the detailed content of A brief analysis of Karma Protocol: the first full-chain prediction market protocol driven by the Sui network community. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- What does java.lang.NullPointerException mean?

- Chain Argos reveals Polygon's improper allocation of MATIC, hinting at the possibility of market manipulation with Binance

- S&P Ratings: Ethereum spot ETF integration of pledges may lead to the risk of pledge concentration

- Grayscale launches crypto-staking dynamic income fund