Bitcoin once hit $70,000! Total ETF trading volume exceeds US$100 billion

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-03-10 09:04:02491browse

This site (120btC.coM): Bitcoin once again pushed to a historical high on the evening of the 8th, once reaching US$70,040, and then fell to a minimum of US$66,063 (-5.68%). It is currently around the $68,000 level (-3.1%).

Bitcoin experienced an even bigger drop (down 14.59%) after breaking above its previous high of $69,000, which resulted in nearly $1.2 billion in liquidations in the cryptocurrency market. This is the largest liquidation event since the collapse of the FTX exchange in November 2022.

The highest price of Ethereum reached $3,993.

The scale of the nine ETFs finally surpassed GBTC

GBTC had a net outflow of US$302.9 million on the evening of March 8, which made the asset size of the other nine ETFs (excluding Hashdex and GBTC) finally Beyond GBTC.

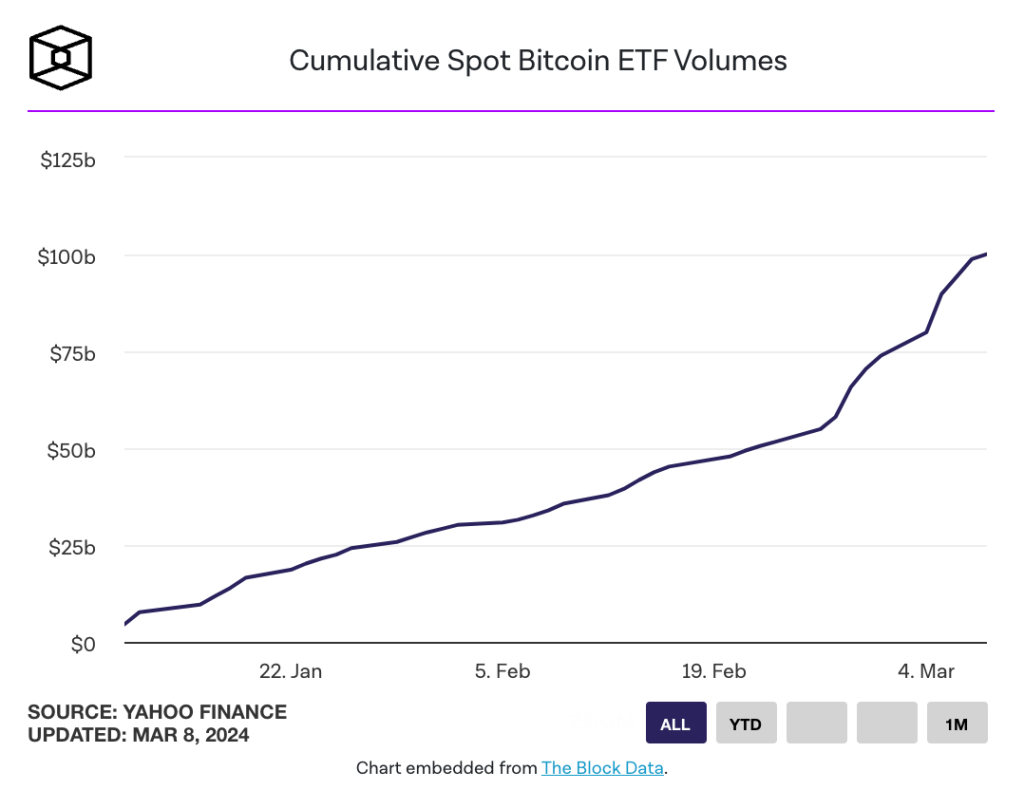

The total trading volume of Bitcoin ETF exceeds 100 billion US dollars

In addition, according to TheBlock, the momentum of Bitcoin spot ETF is becoming stronger and stronger. The initial $50 billion in transaction volume took more than a month to reach, and the subsequent $50 billion in transaction volume took just two weeks, bringing the total transaction volume to officially exceed $100 billion.

Bitcoin ETF total trading volume

Bloomberg ETF analyst Eric Balchunas also pointed out that the trading volume on March 8 took only 2 hours On par with the trading volume on the 7th and 6th, BlackRock IBIT alone had a trading volume of US$2.2 billion.

Eric Balchunas also mentioned the weekly trading volume of ETFs. The trading volume last week was 30 billion U.S. dollars. After confirming the trading volume on the evening of the 8th, he believed that the weekly trading volume may reach 36 billion U.S. dollars, setting another new record. new highs.

The above is the detailed content of Bitcoin once hit $70,000! Total ETF trading volume exceeds US$100 billion. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Cryptocurrency exchange rankings

- How long does it take to transfer coins from one exchange to another? (Including tutorials on transferring OYi coins to Binance)

- What are the platforms for buying Bitcoin? List of the top ten Bitcoin trading platforms!

- Atomic Coin is listed on the world's largest exchange. Is Atomic Coin listed?